After reviewing over 1,000 charts, I have found some good setups for the week. This week’s list contains the first five below to get you started early. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which, with the calendar turning from 2016 to 2017 sees the equity markets retrenching in their uptrends.

Elsewhere look for Gold to continue its bounce in its downtrend while Crude Oil continues higher. The US Dollar Index looks to continue consolidation of the break out move while US Treasuries may have bottomed in their downtrend. The Shanghai Composite looks to continue to consolidate in the uptrend and Emerging Markets are consolidating the bounce in the downtrend.

Volatility looks to remain low but out of abnormally low levels keeping the bias higher for the equity index ETF’s SPY (NYSE:SPY), IWM and QQQ. Their charts show short term pullbacks likely to continue within the long term uptrends. Use this information as you prepare for the coming week and trad’em well.

Here are the first 5 ideas for the week, to get you started:

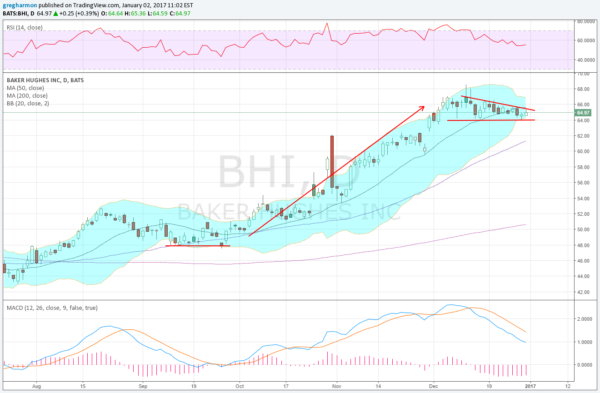

Baker Hughes Incorporated (NYSE:BHI)

Baker Hughes, came off of a base in September to run higher to a top in early December. Since then it has been consolidating against support at a higher base at 64. The range has been tightening in a descending triangle. A break of that triangle would look for a $3 move. The broader target on a break to the upside would be a Measured Move to 83. The RSI is stalling in its pullback, holding in the bullish zone but the MACD is still falling. The Bollinger Bands® are squeezing, often a precursor to a move. There is resistance at 66.40 and 68 before 69.30 (the April 2015 high) and 74.60. For the longer term trader there is also a Cup and Handle back to that April 2015 high that gives a target to 98. Support lower comes at 64 and 62.30. Short interest is low at 2.5%. Enter long on a move over 65.75 with a stop at 64. As it moves over 66.75 move the stop to break even and then to a $1.50 trailing stop over 67.25. Take off 1/3 on a stall at 74.60 or higher. As an options trade consider the January 65 Calls (offered at $2.02 late Friday) and trade them like the stock trade (using the stock price as a trigger, stop and target).

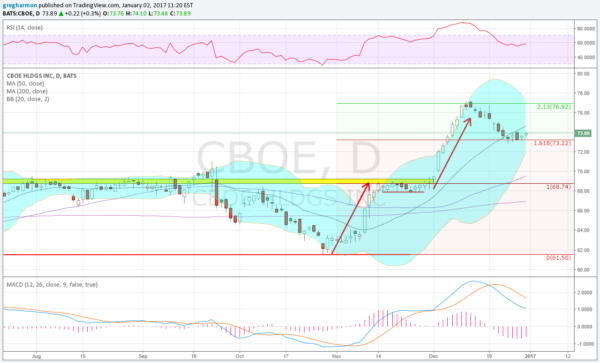

CBOE Holdings Inc (NASDAQ:CBOE)

CBOE, started higher off of a pullback kin October to find resistance at a significantly important level in November. It settled there for two weeks and then moved higher in a second leg, a 213% extension of the first move. From there it pulled back to the 161.8% extension and is consolidating as the Bollinger Bands squeeze. A slight lift Friday combined with the RSI strengthening in the bullish zone suggest a reversal and third leg higher may come soon. The MACD remains heading lower though. The 3rd leg would look for a move to 82.50, to complete a 3 Drives pattern. Support lower comes at 73.25 and 70.25 followed by 68.65. Resistance comes at 74.20 and 77.25. Short interest is elevated at 8.6%. Enter long on a move over 74.20 with a stop at 73.20. As it moves over 74.50 move the stop to a $1.30 trailing stop and take off 1/3 on a stall at 82.50 or higher. As an options trade consider the January 72.50 Calls ($2.20) and trade them like the stock trade.

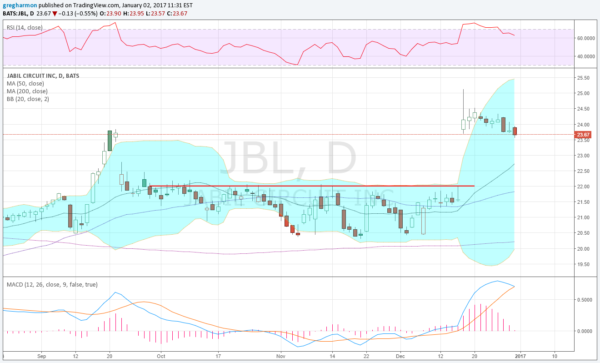

Jabil Circuit (NYSE:JBL)

Jabil Circuit,, gapped higher after earnings out of a consolidation that had lasted 3 months. The gap opened at a very significant price level. The thin line shows the 23.65 price that has significance back to 2012. After the gap it has now pulled back to that level. A hold and reversal here would be a strong buy signal. But the RSI is pulling back and the MACD about to cross down. This suggests to watch for a break down and gap fill. There is support at 23.65 and then 22.50 and 22 before 21.25 and 20.50. Resistance above stands at 24 and 24.50 followed by 25.10. Short interest is moderate at 5.2%. Enter short on a move under 23.50 with a stop at 24. As it moves under 23.25 move the stop to a 50 cent trailing stop and take off 1/3 on a stall at 22 or lower. As an options trade consider the January 24 Puts (80 cents) and trade them like the stock trade. There is big open interest at the 22 Put strike which could also pull it lower. If you are comfortable owning this stock at 22 then a January 23/22 1×2 Put Spread (20 cents) is a cheap way to add some downside participation on the way there.

JetBlue Airways Corporation (NASDAQ:JBLU)

JetBlue, has been rounding out of a bottom for the past year. This seems to be firmly in place since November. As it continues higher it will set up a series of Cup and Handle patterns with increasing target prices. Over the last 2 weeks it has consolidated in a descending triangle, retesting the 20 day SMA. This give a Cup and Handle target of 29 on a break higher. The RSI is in the bullish zone and turning back higher while the MACD is resetting lower. There is support at 22 and 21 followed by 20. Resistance above stands at 23 and 23.60 followed by 24.65 and 26.50 before 27. Short interest is low at 3.0%. Enter long on a move over 22.75 with a stop at 22. As it moves over 23.20 move the stop to break even and then to a 60 cent trailing stop over 23.35. Take off 1/3 on a stall at 27 or higher and by 29. As an options trade consider the January 22 Calls ($1.00) and trade them like the stock trade.

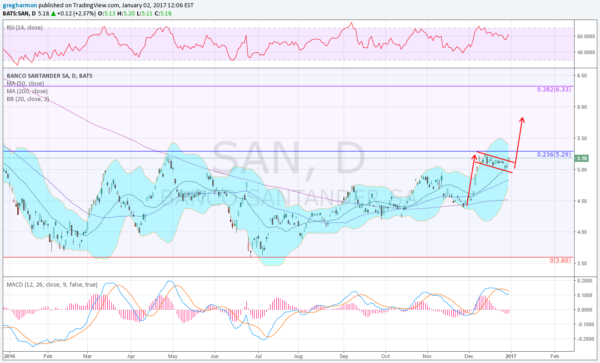

Banco Santander (MC:SAN)

Banco Santander, made a double top in July 2015 and started lower. It found support in February and bounced, but it could not get over its 200 day SMA or a 23.6% retracement of the down leg. In October it managed to move above the 200 day and set a higher high before a pullback. The pullback retested the 200 day SMA at a higher low and then it jumped higher to another higher high near the 23.6% retracement. Since early December it has moved in a bull flag and looks to be ready to break that to the upside into the New Year. That would give a Measured Move to 5.85. The RSI is bullish and rising while the MACD is also turning back higher. There is resistance at 5.25 and 5.55 followed by 5.80 and 6.05. Support lower comes at 5.00. Short interest is low at less than 1%. Enter long now (over 5.10) with a stop at 5. As it moves over 5.30 move the stop to break even and then to a 20 cent trailing stop over 5.35. Take off 1/3 on a stall at 6.05 or higher. As an options trade consider the January 5 Calls (25 cents) and trade them like the stock trade.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.