Here are the Rest of the Top 10:

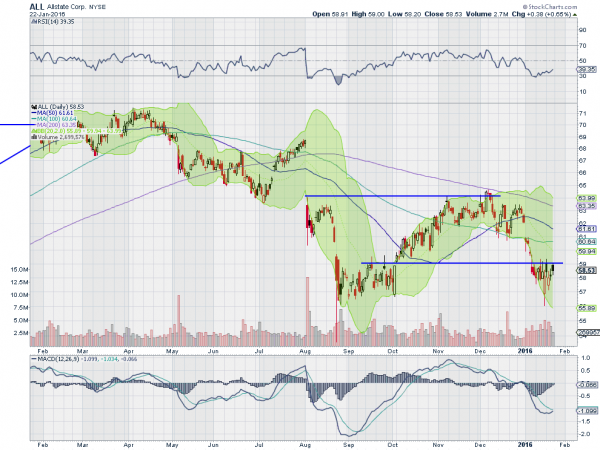

Allstate (N:ALL)

Allstate moved lower sharply in August 2015, losing 20% of its value in about 3 weeks. It recovered and moved to the August 4th gap down but could not break through and ended up falling back lower. With the consolidation last week, there is a possible double bottom forming, as it presses against prior resistance. Look for a move above to follow……

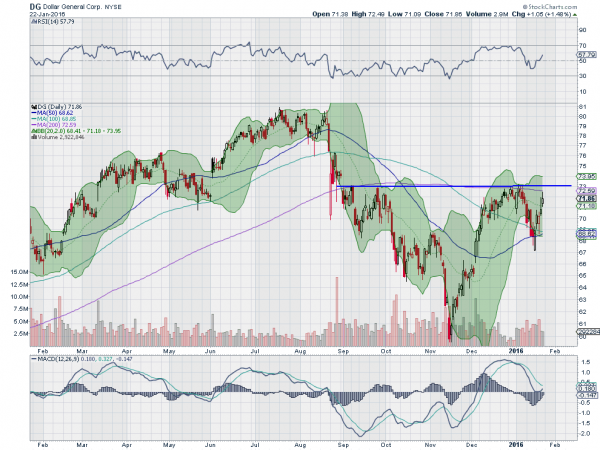

Dollar General (N:DG)

Dollar General had a long trend lower that started with the market sell off in August. That made a bottom in November is bounced. It met resistance at prior bounce highs and near the 200 day SMA and pulled back, but in a shallower move. Now it is back at resistance again with the RSI remaining in the bullish zone and rising and the MACD about to cross up. Look for a break higher to follow……

Fiserv (O:FISV)

Fiserv has had a long trend higher over the past 4 years. Along the way it has pulled back to the 200 day SMA and bounced several times, something it did again last week. The RSI has quickly pushed to the upside and over the mid line while the MACD has crossed up. This leaves a trade opportunity on many timescales…..

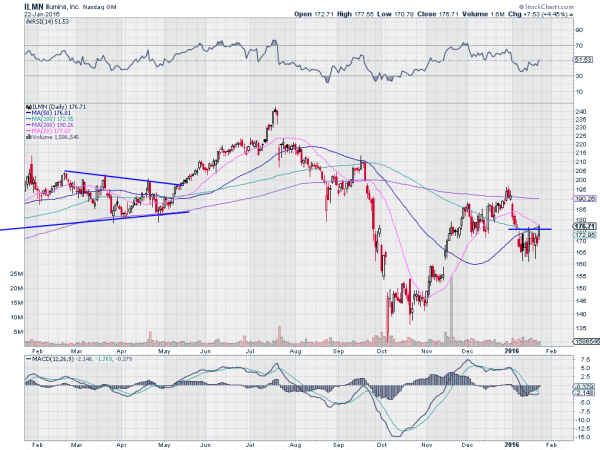

Illumina (O:ILMN)

Illumina has pulled back from a high in July, finding a bottom 50% lower in October. Since then it recovered in a steady climb into the end of 2015. It pulled back then from a lower high but quickly found support at a higher low. Friday it started a push up from consolidation and has support for more upside from a rising RSI and MACD about to cross up…..

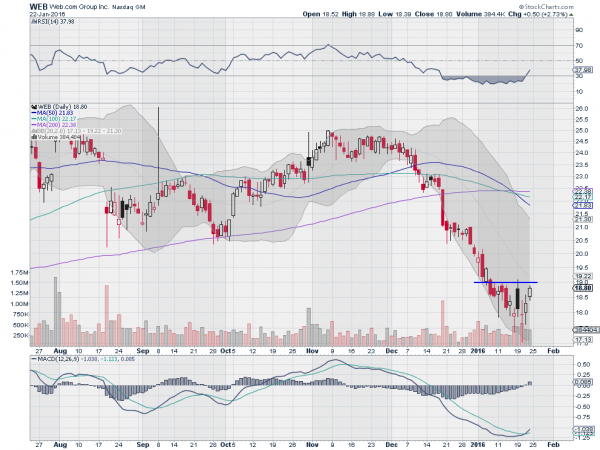

Web.com (O:WEB)

Web.com fell in a steady trend lower from the beginning of December. Two weeks ago it started printing some bottoming candles, with long lower shadows and added a Long Legged Spinning Top Doji Wednesday. It was confirmed higher to resistance the next two days. The RSI is also moving up off of oversold territory while the MACD is about to cross up. Look for a break of resistance to follow…….

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which, heading into the last week of January saw equity markets which seemed to have found some footing but still having to prove themselves.

Elsewhere looked for gold to move higher in its downtrend while crude oil bounced and will show us if it wants a reversal. The US Dollar Index was on the edge of a break out higher while US Treasuries were biased lower short term in the move higher. The Shanghai Composite was consolidating in the downtrend while Emerging Markets paused in their move lower.

Volatility looked to remain elevated but drifting lower keeping the bias lower for the equity index ETFs N:SPY, N:IWM and O:QQQ, but loosening the vice grip. The ETFs themselves all looked to continue the bounce in their downtrends with some work left to show that the worst is over. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog. Please see my Disclaimer page for my full disclaimer.