Here are the Rest of the Top 10:

ConAgra Foods (N:CAG)

ConAgra Foods made a high in August and then started a pullback. Since September it has found support at 39 several times, bouncing and then falling back. Friday ended at that level again, with a RSI falling and in the bearish zone and the MACD falling. Watch for either a bounce or continuation.

Express Scripts (O:ESRX)

Express Scripts fell back from a peak at 94 in July culminating with the August low under 80, where it had found support several times prior. Since then it has drifted higher, but mainly under the 200 day SMA, until the wild ride last week. That left the stock with an RSI in the oversold range and a falling MACD. Time for a bounce?

Hasbro (O:HAS)

Hasbro pulled back to a low just before Christmas, but has been rising since. Last week saw it cross above resistance to end Friday. The RSI and MACD are rising in support of more upside. Look for a higher open to participate in more upside.

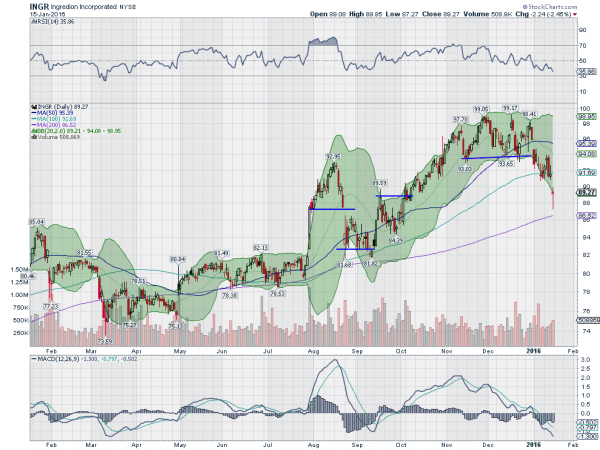

Ingredion (N:INGR)

Ingredion had a strong move higher to a peak just under 100 into December. It has pulled back in the new year though falling hard Friday. The RSI is now in the bearish zone and the MACD is falling. Watch Tuesday to either confirm more downside or a reversal.

Syntel (O:SYNT)

Syntel rose up to prior resistance in December and then started the recent move lower. The initial thrust lower into mid-December was quick and since it has had a series of smaller bounces. The RSI is in the bearish zone now and the MACD is flat. Look for a break of support to participate lower.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which, closed the January options expiration and the worst two week start to a year ever, yet with equity markets looking like they are not done falling yet.

Elsewhere gold is biased higher in its downtrend while crude oil consolidates in its downtrend. The US Dollar Index continues to move sideways but with an upward bias while US Treasuries are biased higher. The Shanghai Composite and Emerging Markets are biased to the downside with the Chinese market possibly ready to consolidate.

Volatility looks to remain elevated and with an upward bias keeping the bias lower for the equity index ETFs N:SPY, N:IWM and O:QQQ. Their charts agree and look better to the downside on both the daily and weekly timeframes. The IWM crossed into a bear market and looks the worst. The QQQ is down over 15% but still holding best over the August and September lows, while the SPY has held the closest to its all-time high but is precariously perched heading into the week. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog. Please see my Disclaimer page for my full disclaimer.