Here are the Rest of the Top 10:

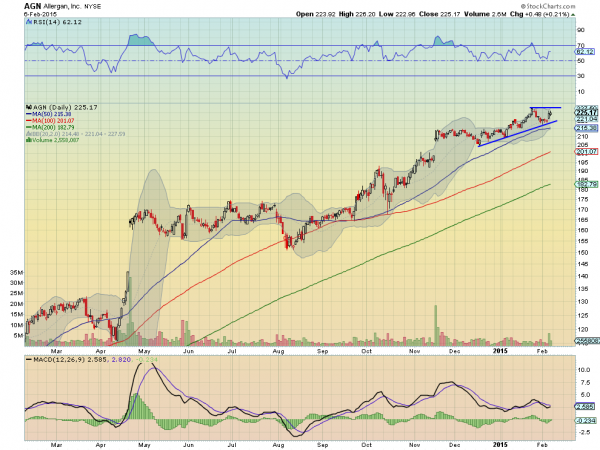

Allergan, (NYSE:AGN)

Allergan, has trended higher since moving out of a base in late September. The past month or so it has formed an ascending triangle against resistance, and is threatening the top heading into the week. The RSI has held in the bullish zone during the consolidation and the MACD is about to cross up, signaling a buy.

Hanesbrands, (NYSE:HBI)

Hanesbrands, had a long trend higher before the consolidation that began in December. It has support to push higher from a bullish RSI that is starting back higher and a MACD that is rising, along with Bollinger Bands® that are opening above.

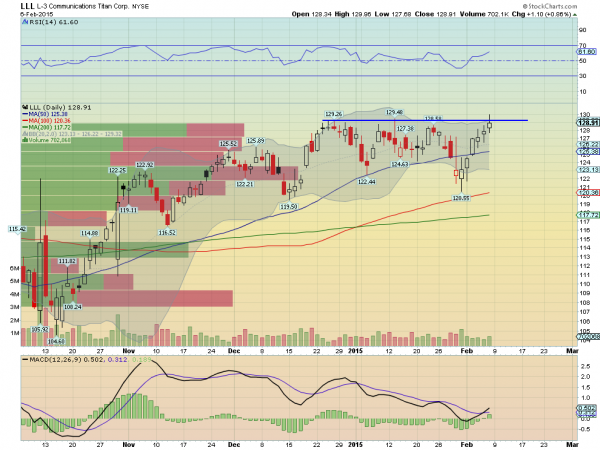

L-3 Communications, (NYSE:LLL)

L-3 Communications, is another one that is holding against resistance on a move higher last week. The 4th time there, it has a rising RSI, back above 60. it also has a MACD that has just crossed up and rising, giving a buy signal.

Linear Technology, (NASDAQ:LLTC)

Linear Technology, moved higher off of the October low and back over the SMA’s in December. But since then it has consolidated at the July and August top. The consolidation has allowed the RSI to reset lower, while it maintained in the bullish zone, while the MACD has bottomed and is starting back higher.

3M, (NYSE:MMM)

3M, is consolidating after at move higher out of a megaphone, or expanding wedge pattern and meeting the target move. After a touch at the 50 day SMA it is moving higher to resistance with momentum on its side to push through. The RSI is in the bull;ish zone and the MACD has crossed up and is rising.

Up Next: Bonus Idea

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which, heading into next week the equity markets are coming off of a good rebound higher but showed signs of exhaustion Friday.

Elsewhere gold looks to continue to pullback while Crude Oil tries to move higher off of a bottom. The US dollar Index may continue to consolidate the rise, pulling back mildly, while US Treasuries are biased lower in their uptrend. The Shanghai Composite looks to continue its pullback from a major run higher and Emerging Markets continue to consolidate in a bear flag in their downtrend.

Volatility looks to remain low but slowly rising slowing the wind be=hind equities to move higher. The equity index ETF’s SPY,IWM and QQQ, are all in a consolidation pattern in the intermediate term, despite the moves higher last week. The IWM looks the strongest and may test the all-time highs this coming week while the SPY is close behind but the QQQ a bit weaker. Use this information as you prepare for the coming week and trad’em well.

Disclaimer:The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.