Here are the Rest of the Top 10:

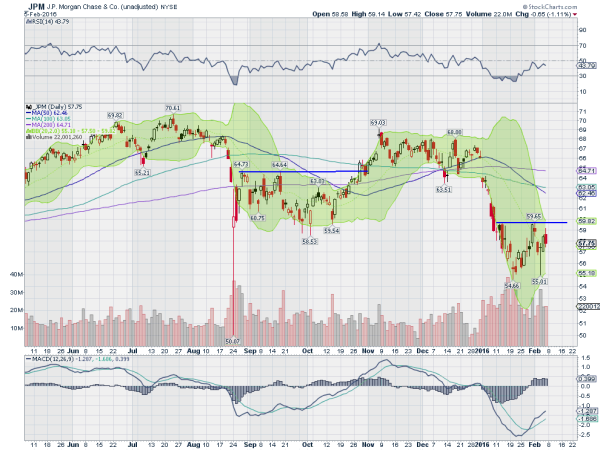

JP Morgan (N:JPM)

JP Morgan took a hard fall to start the year, dropping nearly 20%. Since then it found some support in mid January and has consolidated under the prior support area from September and October. As it consolidated the Bollinger Bands® are squeezing, often a precursor to a move, and the RSI is tapping against the mid line with a rising MACD. Look for a break over the January resistance to participate on the upside.

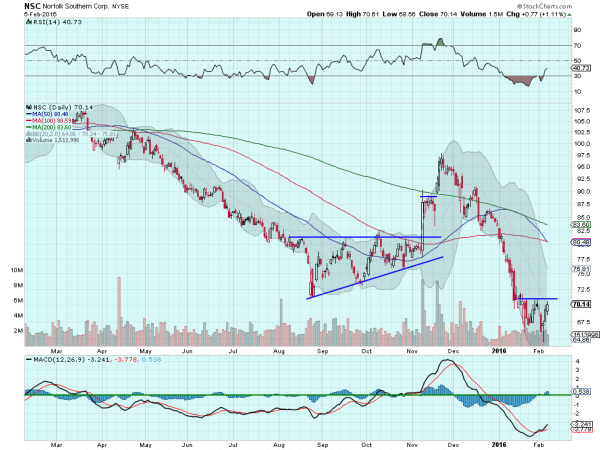

Norfolk Southern (N:NSC)

Norfolk Southern jumped out of an ascending triangle in November. It exceeded the target move at 95 on a possible deal and the started back lower. Two weeks ago that trend down turned into a consolidation and is showing signs of a possible reversal now. The RSI is moving higher and the MACD is crossed up and rising. A positive momentum divergence. Look for price to follow, over resistance, to participate to the upside.

Procter & Gamble (N:PG)

Procter & Gamble broke above resistance in December. That break out failed at the July high and it pulled back. But in mid January it started moving higher again, clearing that December high last week. As it consolidates the RSI is bullish and the MACD is rising. Both support more upside. Look for a break of the consolidation to participate.

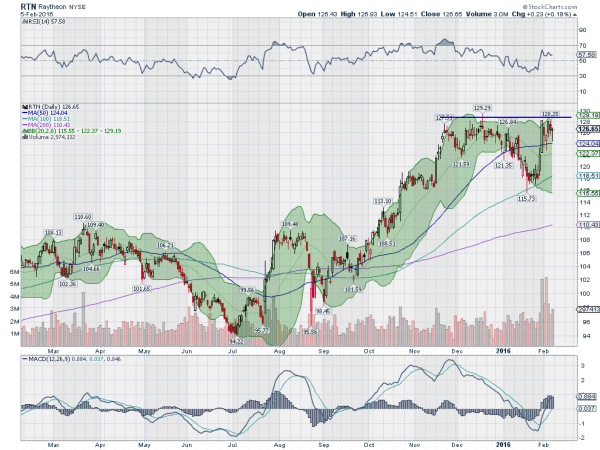

Raytheon (N:RTN)

Raytheon had a strong trend higher begin in September. By late November it had stalled and started to consolidate. That turned into a pullback to the 100 day SMA before reversing back higher. Now it is back at the all-time high and has support to push for more from a bullish RSI and a rising MACD. Look for a new high to participate to the upside.

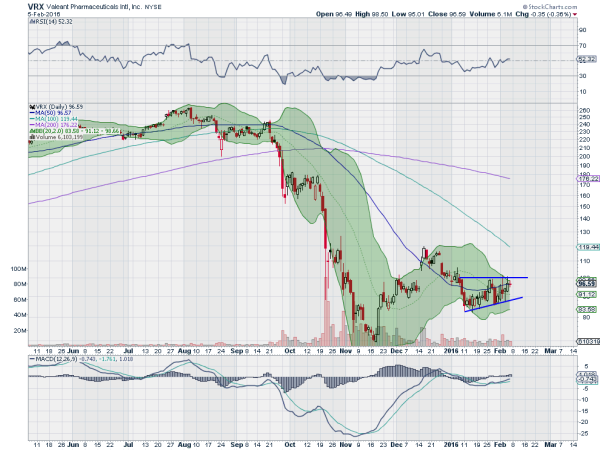

Valeant Pharmaceuticals (N:VRX)

Valeant Pharmaceuticals fell nearly 75% from its August high over 260 to the low near 69. Since then it has steadied and now made a higher low. The last month has seen tight consolidation as the Bollinger Bands® squeeze in. With the RSI pressing up through the mid line and the MACD, look for that break to happen to the upside. Join on a move over resistance.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday. The groundhog did not see his shadow, so an early Spring is on the way, but it does not seem like winter is over for equity markets. Heading into the second week of February equity markets are weak and looking to get worse.

Elsewhere look for gold to continue in its uptrend while crude oil consolidates broadly in the downtrend. The US Dollar Index looks better to the downside in consolidation in the short run while US Treasuries are continue higher. The Shanghai Composite and Emerging Markets look to continue their consolidation in their downtrends net week.

Volatility looks to remain elevated keeping the bias lower for the equity index ETFs N:SPY, N:IWM and O:QQQ. The indexes themselves all look weak and ready for more downside with the strongest, the SPY, trying to consolidate in its downtrend. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog. Please see my Disclaimer page for my full disclaimer.