Here are the Rest of the Top 10:

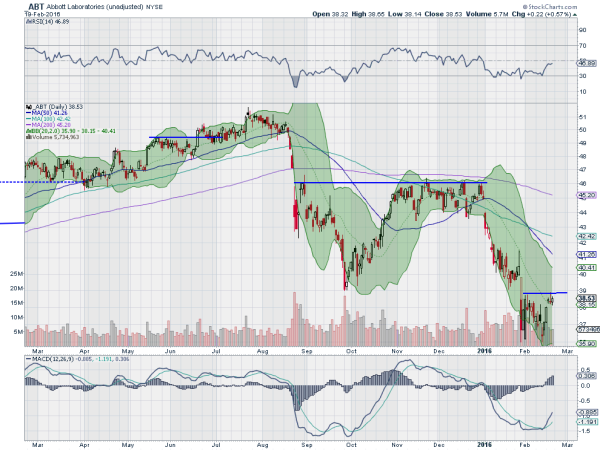

Abbott Laboratories (N:ABT)

Abbott Laboratories, $ABT, went through a long consolidation after it fell with the market in August and September. As 2016 started it resumed that move lower finding some support at 36 at the end of January and consolidating. Last week it pushed back to resistance and over the 20 day SMA for the first time this year. The RSI is rising near the mid line and the MACD is running higher. Look for a move over resistance to participate to the upside.

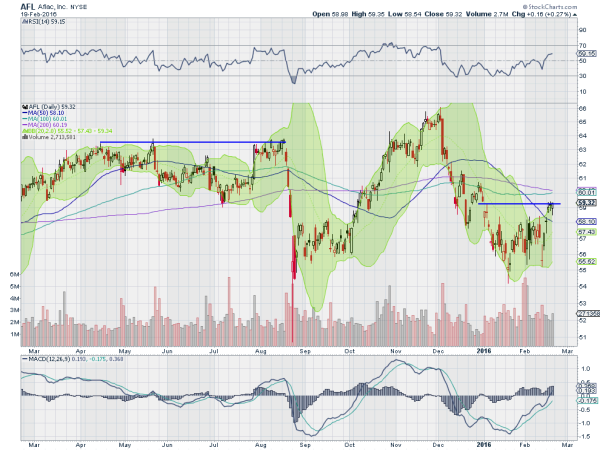

Aflac Incorporated (N:AFL)

Aflac, $AFL, fell from a high at 66 to start December finding support in mid January. This made for a higher low following a higher high. But wow what a range. Now the price is consolidating at a prior gap and has support from the rising RSI and MACD to a push higher. Look for a break of consolidation to the upside to participate.

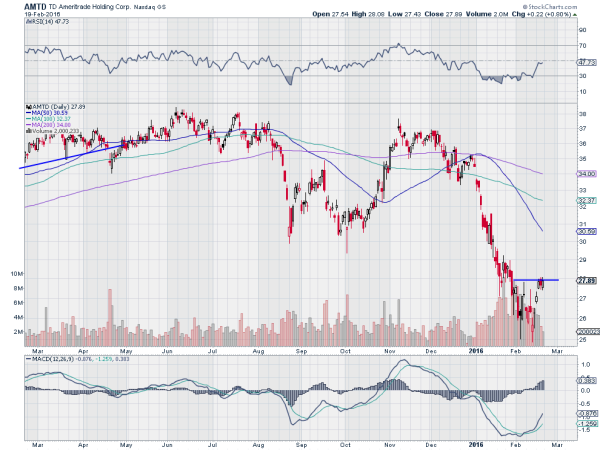

TD Ameritrade Holding Corporation (O:AMTD)

TD Ameritrade, $AMTD, fell from a high near 38 in November without finding support until the beginning of February. It lost nearly 35% of its market cap before it was over. Now it has been consolidating and last week pushed higher. The week ended in a short term consolidation under 28 but over the 20 day SMA for the first time this year. Look for a break of consolidation to the upside to participate higher.

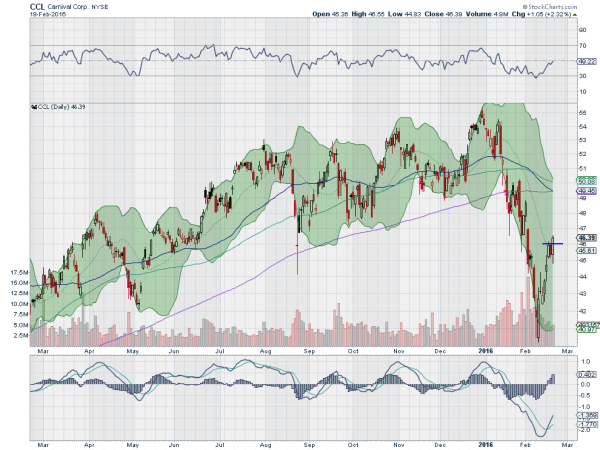

Carnival PLC (N:CCL)

Carnival, $CCL, started the year at 55 and then lost 25% before finding a bottom in early February. Since then it has been moving higher and Friday also crossed its 20 day SMA for the first time since January 12th. The RSI is rising at about to cross the mid line with the MACD crossed up and rising, both supporting more upside price action. Use the break of the recent short term consolidation as your signal to enter.

Estee Lauder Companies Inc (N:EL)

Estee Lauder, $EL, made a strong run higher from a low in August only to get knocked back at the start of the year. Finding support near 82 it then consolidated and started back higher again in February. The price is now above the December high, making a higher high following a higher low, and at the August, pre-fall level. Look for a new high to participate to the upside.

Up Next: Bonus Idea

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which sees moving past February Options Expiration that the equity markets showed some strength in the week but also a need for more upside before starting to talk about a reversal.

Elsewhere look for Gold to consolidate in its recent uptrend while Crude Oil turns lower in the consolidation zone in its downtrend. The US Dollar Index looks better to the downside in its broad consolidation while US Treasuries are biased lower short term in the uptrend. The Shanghai Composite looks to continue the slow move higher in the downtrend and Emerging Markets look to consolidate their move up in their downtrend.

Volatility looks to remain elevated but biased to the downside starting to ease the bias lower for the equity index ETF’s SPDR S&P 500 (N:SPY), iShares Russell 2000 (N:IWM) and PowerShares QQQ Trust Series 1 (O:QQQ). Their charts all show short term digestion of the large moves higher and possible exhaustion short term, which could resume the downward path. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.