Here are the Rest of the Top 10:

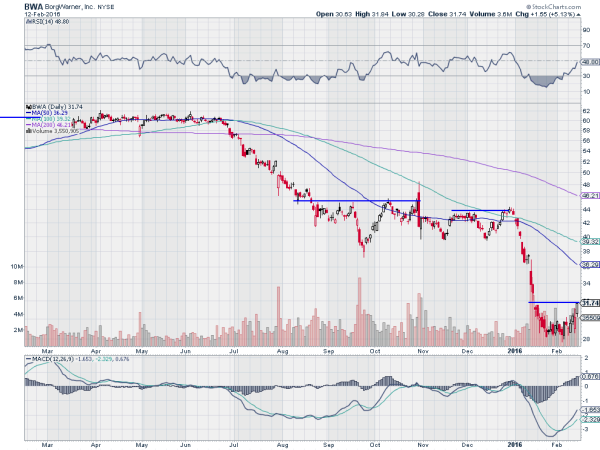

BorgWarner (N:BWA)

BorgWarner, $BWA, is a bottoming and reversal play. The stock fell from a consolidation in July and then based again for 5 months. It started 2016 with a second move lower to the current base. The RSI is turning up and the MACD crossed and is rising. With the tight Bollinger Bands® a move may be imminent. Look for a move over resistance to participate.

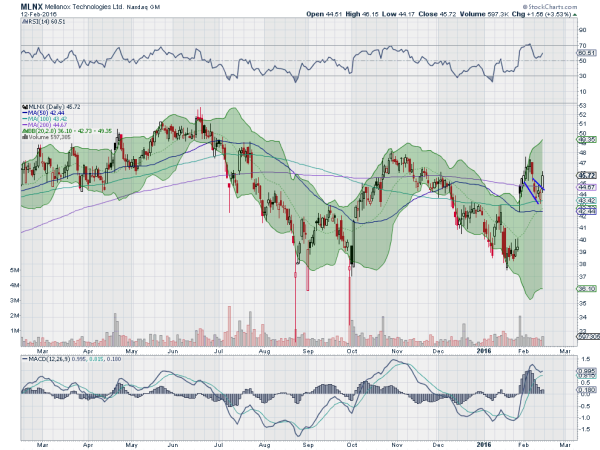

Mellanox Technologies Ltd (O:MLNX)

Mellanox Technologies, $MLNX, pulled back from June through to a double bottom in September 2015. The bounce higher made for a lower high and it pulled back again, but to a higher low. Since that bottom in January the stock came near a retest of the October high and pulled back, but to a higher low this time. With that pullback the RSI held in the bullish zone and the MACD avoided a cross down, kissing the signal line and turning. The move Friday started the next leg higher.

MGIC Investment Corporation (N:MTG)

MGIC Investment, $MTG, had a slow roll lower starting in July that accelerated lower into 2016. Since then it has been consolidating in a ascending triangle. The RSI is rising and near the mid line as the MACD moves higher. Look for a break of resistance to participate to the upside.

PC Connection Inc (O:PCCC)

PC Connection, $PCCC, moved lower through the back half of 2015 to a base around $20. The jump up in November and then consolidation teased of a move higher but failed, falling back to support to start 2016. The gap up in mid January retested the prior high and it is now consolidating. The RSI is in the bullish zone and turning up as the MACD rises, both supporting a push higher. Look for a break above resistance to participate in the upside.

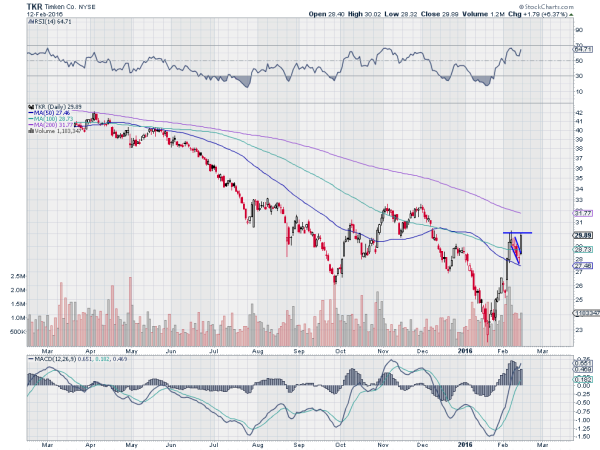

Timken Company (N:TKR)

Timken, $TKR, fell from a consolidation in March. It seemed to have found some support after making a low in September. But December started a new move lower to a ‘V’ bottom in January. For the last month it has been rising. Friday broke a bull flag to the upside to resistance. The RSI is bullish and rising while the MACD is rising. A push over resistance is a signal to participate to the upside.

Up Next: Bonus Idea

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday. Heading into the February Operations Expiration Week, the equity markets started with a weak move lower and then consolidation with a promise Friday.

Elsewhere Gold looks overdone to the upside and ready for a pullback while Crude Oil bounces in the downtrend. The US Dollar Index has short term strength in the downturn while US Treasuries may also be overdone to the upside and ready to pullback. The Shanghai Composite comes back after a week off looking to consolidate while Emerging Markets consolidate in their downtrend.

Volatility looks to remain elevated keeping the bias lower for the equity index ETF’s SPDR S&P 500 (N:SPY), iShares Russell 2000 (N:IWM) and PowerShares QQQ Trust Series 1 (O:QQQ). Their charts show possible reversals higher in the downtrend in the short run, but intermediate weakness remains. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.