Here are the Rest of the Top 10:

ASML (O:ASML)

ASML, fell hard out of a consolidation zone at the end of the year. It made a bottom in the middle of January and then bounced. that was followed by a short consolidation and then a bullish Marubozu candle Friday to resistance. The RSI is moving into the bullish zone and the MACD is rising and bullish. Look for follow through Monday to participate.

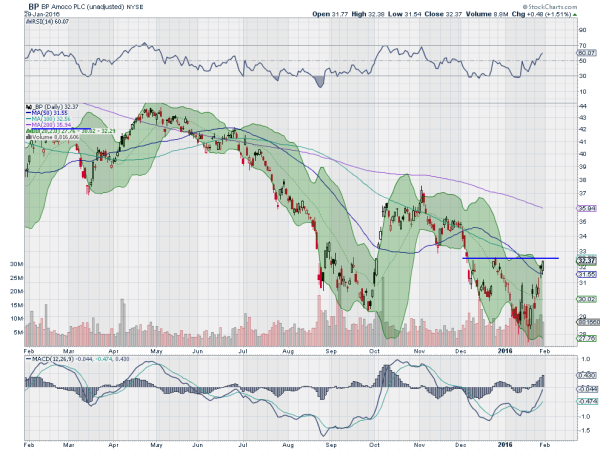

BP (L:BP)

BP staged a rally in October that fizzled out before the 200 day SMA. It then pulled back and bottomed again, at a lower low in January before the latest leg higher. Friday it ended at resistance again, but with a rising RSI and MACD. Look for follow through Monday to participate.

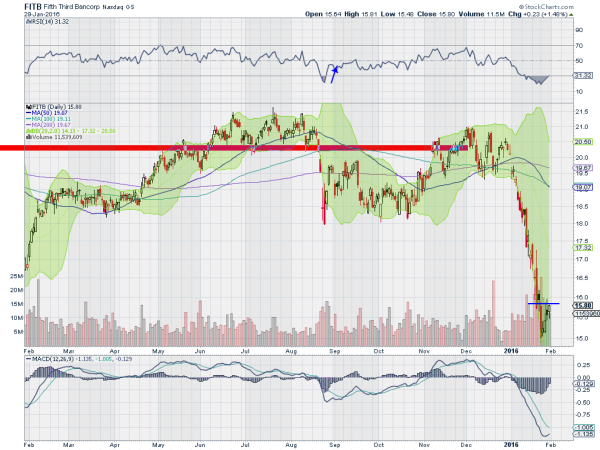

Fifth Third Bancorp (O:FITB)

Fifth Third Bancorp flirted around 21, an important level for a long time, all of 2015. Some times a bit below and sometimes a bit above. But that changed when the calendar turned to 2016 and the stock started a nosedive, losing 25% in 3 weeks. That resulted in an oversold condition on the RSI and MACD. Now it is consolidating as the RSI and MACD turn back up. Look for a move over the consolidation to participate for a move higher.

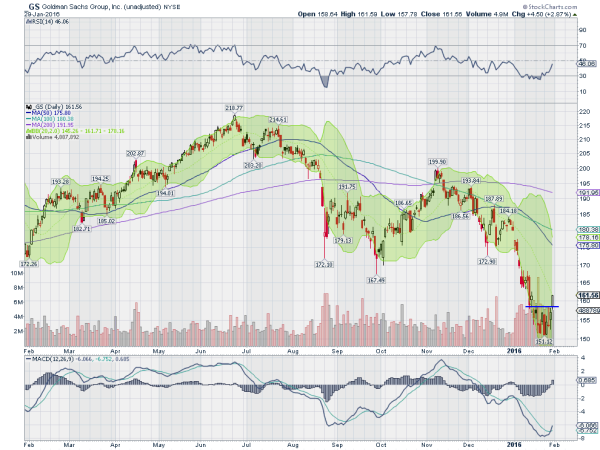

Goldman Sachs (N:GS)

Goldman Sachs is a bottoming and reversal trade as well. This one has already stated higher and has a MACD that is crossed up with an RSI that is climbing near the mid line. The bullish candle Friday finishing near the high supports more upside. Look for follow through to participate.

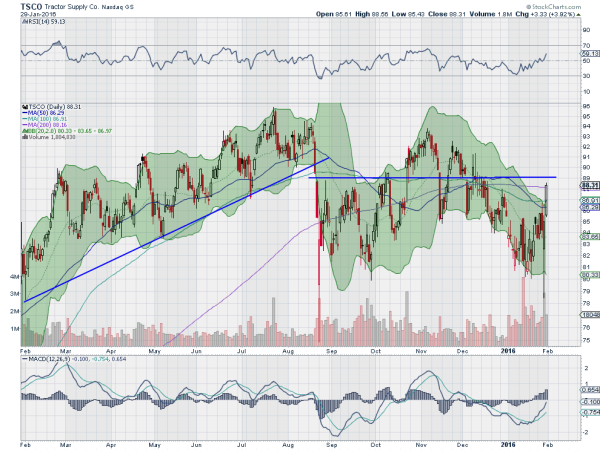

Tractor Supply (O:TSCO)

Tractor Supply fell out of a rising trend in August with the market. From there it consolidated before a failed break to the upside and return under resistance. Now a possible double bottom has formed and the stock is back at resistance with a rising RSI and MACD. Look for a move higher to participate.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which, after completing a horrible January at least saw it end on a good note in the equity markets.

On to February and look for gold to continue higher in the short run while crude oil maintains a short run bias higher in the downtrend. The US Dollar Index continues to look ready to explode higher while US Treasuries may be ready to consolidate in the uptrend. The Shanghai Composite still looks like it is headed lower while Emerging Markets are biased to the upside in their downtrend.

Volatility is drifting lower towards normal levels relieving some of the pressure on the equity index ETFs N:SPY, N:IWM and O:QQQ. Their charts all had great moves higher Friday and look to continue in the short term, while the weekly charts showed strong signals of reversals higher. The QQQ is the only short term chart that did not break resistance. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog. Please see my Disclaimer page for my full disclaimer.