Here are the Rest of the Top 10:

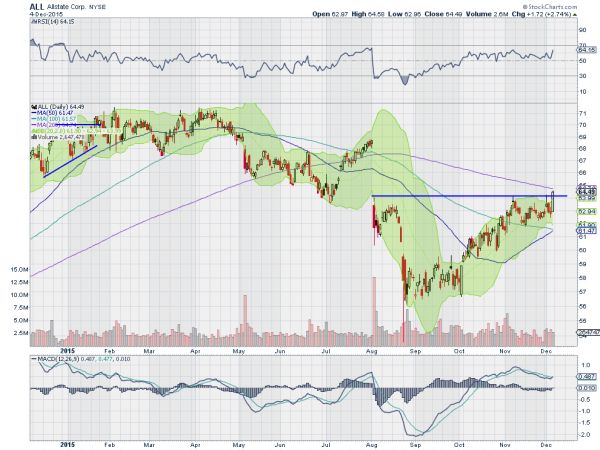

Allstate (N:ALL)

Allstate started moving lower in May, culminating in a bottom with the broad market in late August. Since then it has had a strong trend higher. That trend met initial resistance in early November and pulled back slightly to the 100 day SMA. Finding support there, it bounced and is back at resistance. The RSI is in the bullish zone and the MACD is crossing up after a mild pullback. Both support a further push higher.

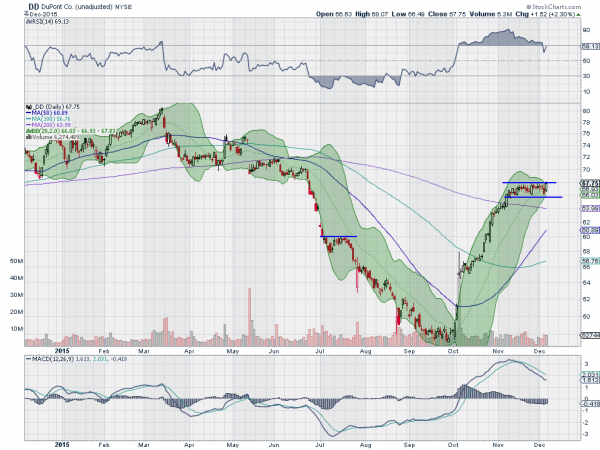

DuPont (N:DD)

DuPont broke through support heading lower in June and keep on going. It did not find a bottom until late September. But when it did, it moved higher quickly. Since early November, it has been consolidating in a tight range though. The RSI is bullish and has worked off an overbought condition while the MACD is falling. A mixed story. Look for the break of the channel in either direction to participate.

Intercontinental Exchange (N:ICE)

Intercontinental Exchange moved higher off of a tight flat SMA combination in October. It met resistance in early November and has been consolidating under it since then. Friday saw the price push back to resistance with the RSI jumping higher off of the mid line. The MACD has not turned yet though. Look for a break of resistance to participate in the upside.

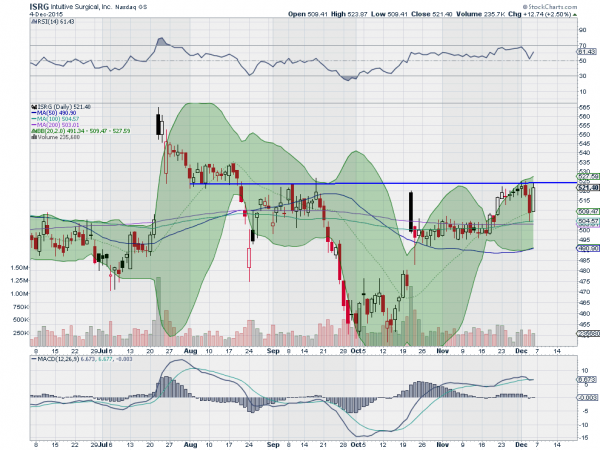

Intuitive Surgical (O:ISRG)

Intuitive Surgical jumped to a high near 565 in July only to trickle lower to a low to start October. From that point it made a Double Bottom and pushed back higher. A quick spike to near the September resistance was pushed back and then after some consolidation, it moved back to that same resistance. Friday saw a strong candle push higher to that level again. The RSI is bullish and moving higher while the MACD is turning up towards a cross. Look to participate in upside on a break over that resistance.

Illinois Tool Works (N:ITW)

Illinois Tool Works hit 100 in February, March and April, and then started a move lower. Who says a there is no such thing as a triple top? That move found support in a double bottom at 80 and started higher. Last week the price failed at prior resistance, printing a Shooting star reversal candle. After 2 days though it found support and moved higher in a strong Marubozu candle to end the week at resistance again. The RSI is bullish and the MACD is flat after a pullback. Look for a break of resistance to participate in the upside.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which, heading into next week sees the equity markets looking mixed in the short run and at resistance, while better in the intermediate term.

Elsewhere look for gold to continue the bounce in its downtrend while crude oil continues lower. The US dollar index is biased lower in the short term in its uptrend while US Treasuries look lower in the broad consolidation.

The Shanghai Composite looks better to the upside, but with resistance nearby while Emerging Markets are biased to the downside. Volatility looks to remain subdued, keeping the bias higher for the equity index ETFs N:SPY, N:IWM and O:QQQ. Short term the QQQ looks best and ready to challenge the all-time high, while the SPY and IWM lag. Longer term they are all at prior consolidation areas and need a catalyst.

After a week where the ECB disappointed, the FOMC is pushing hard with rhetoric it will tighten, that they equity indexes did not crater can also be viewed as strength. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog. Please see my Disclaimer page for my full disclaimer.