Here are the Rest of the Top 10:

Agilent Technologies (N:A)

Agilent Technologies pulled back from a high in April in a couple of steps, culminating in a bottom with the market in August and into September. Since then it has risen in a couple of steps as well and is now looking to start a third. The RSI is in the bullish zone and rising, while the MACD is about to cross up, bullish signals. Look for continuation to participate.

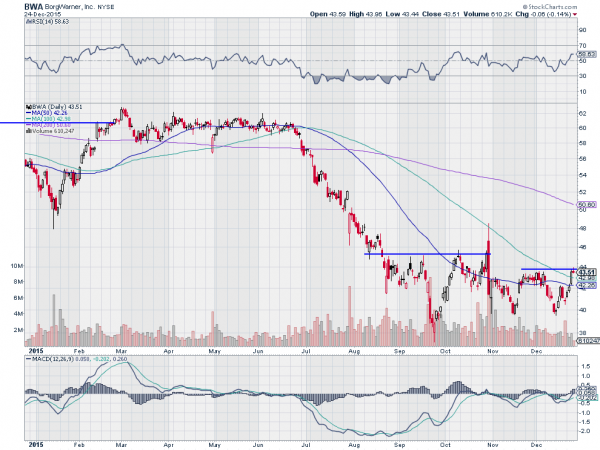

BorgWarner (N:BWA)

BorgWarner had a steady falling trend out of consolidation from July to a bottom in September. Since then it has consolidated again and is pressing towards a possible reversal higher. The RSI is pushing against the bullish zone while the MACD is rising. Look for a break of resistance to participate.

Charles River Laboratories (N:CRL)

Charles River Laboratories had a series of cascading steps lower from April to October. But since that bottom, it has done nothing but go up. It starts the week back at prior resistance. The RSI is in the bullish zone while the MACD is turning back up, both supporting a continued push higher. Look for a break over resistance to participate.

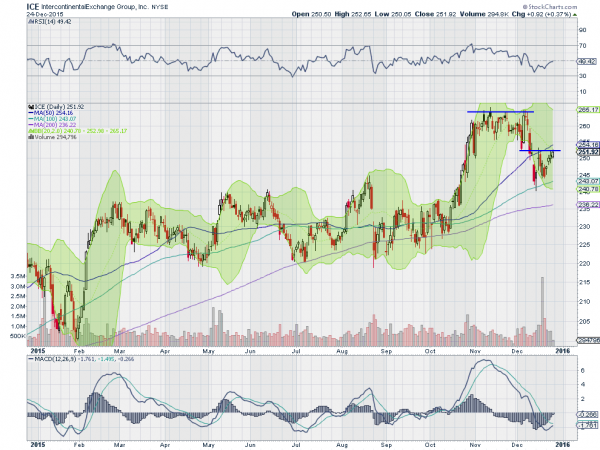

Intercontinental Exchange (N:ICE)

Intercontinental Exchange broke above a consolidation zone in October, rising to 265 and consolidated again. The pullback from there has seen a bounce and testing of resistance again as it rises. The RSI is moving back above the mid line while the MACD is about to cross up. Look for a move over the short term resistance to participate.

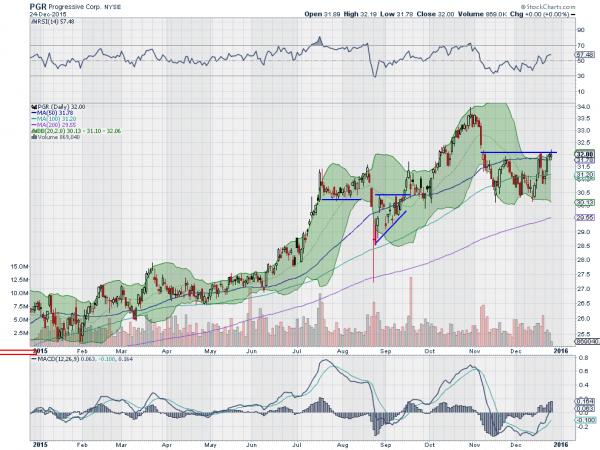

Progressive (N:PGR)

Progressive spiked down with the market in August but trended higher, quickly erasing that pullback and making a new high in October. The Evening star pattern then sent it back lower into a consolidation zone. The RSI continues to rise and the MACD is rising, diverging or perhaps leading price. The Bollinger Bands® also appear to be opening higher. Look for a move over resistance to participate.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which, heading into another holiday shortened week, and one that should prove to be very light on everything, sees the equity markets have rebounded but are still looking vulnerable, especially the N:SPY.

Elsewhere look for gold to consolidate in its downtrend while crude oil continues a bounce in its downtrend. The US dollar index looks to be weaker short term in consolidation while US Treasuries consolidate. The Shanghai Composite looks to continue consolidation with an upward bias while Emerging Markets bounce in their consolidation of the downward move.

Volatility looks to remain subdued, keeping the bias higher for the equity index ETFs SPY, N:IWM and O:QQQ. Their charts agree with that in the short term with the IWM looking the strongest. In the intermediate term, the SPY looks weakest while the IWM and QQQ continue the sideways churn. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog. Please see my Disclaimer page for my full disclaimer.