Here are the Rest of the Top 10:

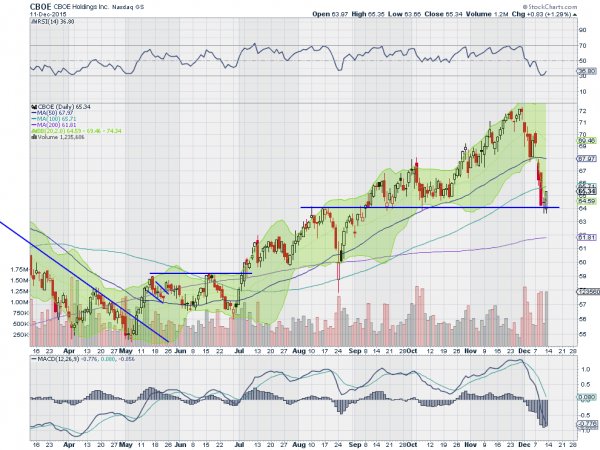

CBOE (O:CBOE)

CBOE trended higher from May to the peak to start December at 72. Since then it fell hard, back to the resistance level preceding the August dip. The RSI hit the oversold level there and the price bounced Friday. The MACD continues lower though. Follow through Monday can be bought.

DineEquity (N:DIN)

DineEquity started trending lower in early August and lost 25% before it bottomed in mid-November. A bounce found resistance at the upper Bollinger Band® and it pulled back in a bull flag. The RSI is holding at the mid line while the MACD is flat but avoiding a cross. The movement Friday is pushing out of that flag and continuation can be bought.

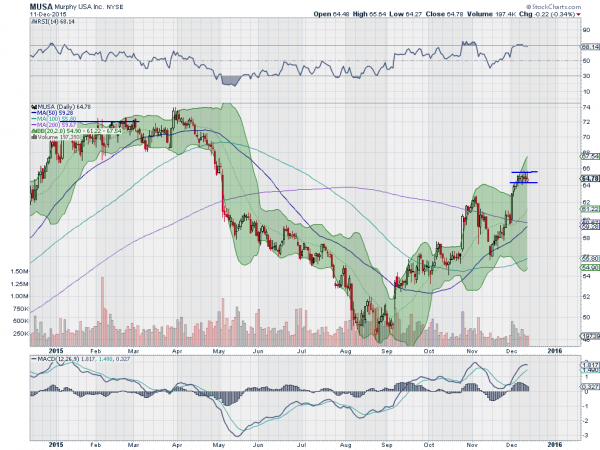

Murphy USA (N:MUSA)

Murphy USA has been trending higher off of the bottom made with the market in August. The pullback in November reset the momentum indicators and it has risen again since. Last week, it found resistance and consolidated. The small body candles with upper shadows suggest it may be topping. But the consolidation could break either way. Follow the break.

Palo Alto Networks (N:PANW)

Palo Alto Networks pulled back in August with the market then bounced to a lower high in September. From there another pullback made for a higher low. A possible tightening consolidation. But a move to a higher high added more confusion. Friday’s move lower suggests another leg to the downside. The RSI is falling, but it remains bullish, while the MACD is about to cross down. Follow through Monday would confirm lower.

PC Connection (O:PCCC)

PC Connection made a double top at 27 in June before starting lower. After losing almost 30% of its value, it found support in September and consolidated for 2 months. November saw a spike higher to the 200 day SMA and then consolidation between that and the 100 day SMA. You can participate on a move over resistance.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which, heading into Options Expiration Week, the last full week before Christmas and the FOMC meeting sees the equity markets looking weak in the short run and all but the O:QQQ tired or weak on the intermediate term.

Elsewhere, look for gold to consolidate in it downtrend while crude oil runs lower. The US dollar index is back into consolidation with a short term downward bias while US Treasuries are biased higher in consolidation. The Shanghai Composite looks better to the downside short term in its bounce, and Emerging Markets flat out broken and falling, but oversold.

Volatility looks to remain elevated keeping the bias lower for the equity index ETFs N:SPY, N:IWM and QQQ. Their charts look weak in the short term as well. In the intermediate term, the IWM is nearing key support, and the SPY testing a shift to a downside bias while the QQQ is still the strongest. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog. Please see my Disclaimer page for my full disclaimer.