Here are the Rest of the Top 10:

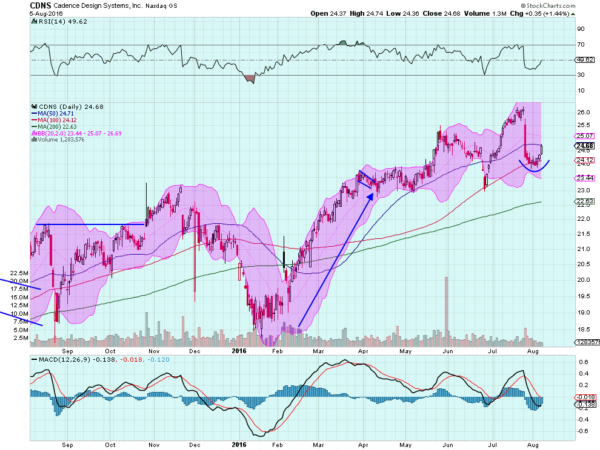

Cadence Design Systems Inc (NASDAQ:CDNS)

Cadence Design Systems, had a steady run higher from the January low until it consolidated in April. In May it broke that consolidation to the upside. The pullback through June made for a higher low and then it reversed to a higher high in July. The end of July brought another drop lower and a rounding bottom at a higher low. A new uptrend has formed, just not as neat as the last one. The RSI has turned back higher and the MACD is leveling. Look for continuation higher to participate…..

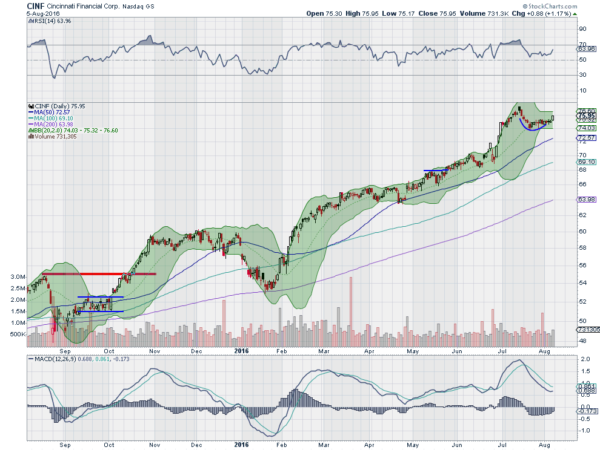

Cincinnati Financial (NASDAQ:CINF),

Cincinnati Financial, moved higher off of a low in January and then consolidated through March and April. It started higher again in May and found resistance in July, leading to a shallow pullback. The price is rising out of that pullback now and has support for more upside from a rising and bullish RSI and a MACD starting to turn up towards a bullish cross. Look for continuation higher to participate…..

PacWest Bancorp (NASDAQ:PACW)

PacWest Bancorp rose from its February low to consolidate under a high in late May. Friday it passed through that high on the third touch and closed at the high of the day. The RSI is in the bullish zone and rising while the MACD is crossing up. Look for continuation Monday to participate in the upside…..

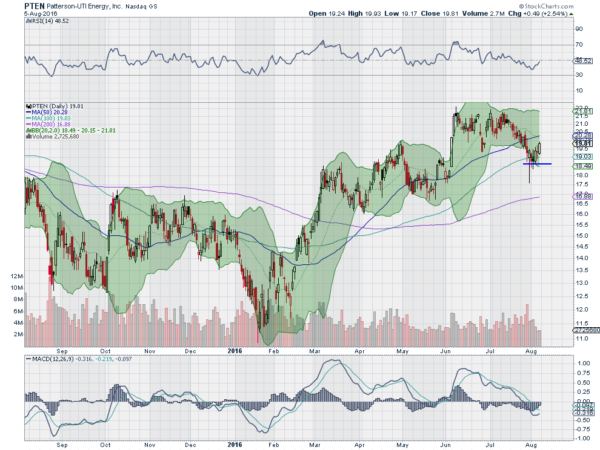

Patterson-UTI Energy Inc (NASDAQ:PTEN)

Patterson-UTI Energy, moved higher from the February low to consolidation over March and April. It moved to a higher high from there followed by a higher low in May. Another move higher to a higher high in June and then the recent pullback to a higher low at the end of July. This defines an uptrend. The RSI is running higher again after holding in the bullish zone while the MACD is about to cross up. Look for continuation of the nascent move higher to participate…..

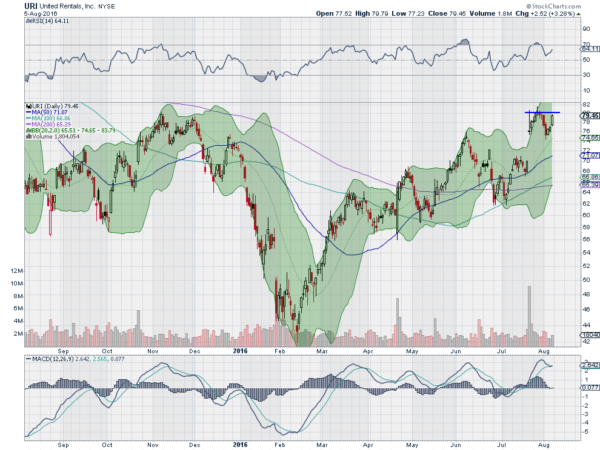

United Rentals Inc (NYSE:URI)

United Rentals moved higher from its February low to a peak in March. From there is saw a series of higher highs and higher lows over the next 4 months. In mid July it gapped higher and has consolidated in a tighter range since. The RSI is moving back higher and the MACD is avoiding a cross down. Look for a push through consolidation to participate to the upside…..

Up Next: Bonus Idea

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which heading into the dog days of August sees the equity markets looking strong.

Elsewhere look for Gold to continue lower short term in the uptrend while Crude Oil bounces in the downtrend. The US Dollar Index looks to continue higher in the broad consolidation while US Treasuries are biased lower. The Shanghai Composite looks to continue to move sideways in a narrow range while Emerging Markets continue higher.

Volatility looks to remain at extremely low levels keeping the bias higher for the equity index ETF’s SPY (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ) . Their charts agree on both the daily and weekly timeframe. If you ranked them the QQQ might be the most ready for a pause or retrench, possibly handing the baton to the IWM. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.