Here are the Rest of the Top 10:

Choice Hotels (NYSE:CHH)

Choice Hotels had been falling along trend support since the beginning of March. Last Monday, it broke that support and was bought , printing a Hollow Red Candle, showing the intraday strength. It then rose the rest of the week closing over resistance, and making a higher high. The RSI is moving up through the mid line as the MACD climbs, both supporting more upside.

Dril-Quip (NYSE:DRQ)

Dril-Quip had fallen along with oil, with trend resistance driving it down. August accelerated that culminating in a bottom last Monday. Since then the price has been rising back through resistance and over the 50 day SMA. With a rising RSI, now in the bullish zone, and rising MACD, look for more upside.

Fiserv (NASDAQ:FISV)

Fiserv has been moving higher along a rising channel since October 2014. A great long term stock. It spent most of the time in the top half of the channel, with only the 2 sell offs in October 2014 and last week driving toward the bottom. Despite the drop and recovery last week, the SMA’s continue to show a smooth rise higher. The RSI is back at the mid line and rising with the MACD turning up , moving towards a bullish cross. And there is room to the top of the channel for a good short term profit.

Infosys (INYSE:INFY)

Infosys had been moving in a very broad channel until pulling back. The bottom last Monday closed a gap from mid July and the recover closed smaller gaps higher. The last 3 days have exhibited a bullish 3 Advancing White Soldiers pattern, calling for more upside price movement. The bullish and rising RSI and the MACD turning back higher both support that case too.

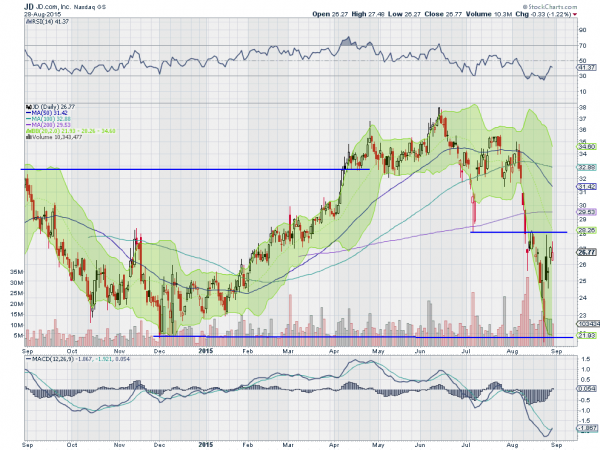

JD.com (NASDAQ:JD)

JD.com had built a Cup and Handle pattern over the last year. But that pattern failed when the price broke below 28 three weeks ago. The stock then retraces the entire leg higher from December with the low last Monday and finally bounced. The stock is now building energy as it consolidates under resistance. The RSI is moving back higher and the MACD is crossing up. Both would support a move higher, but wait for a break of price over the resistance line.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which, heading into the unofficial last week of summer sees the equity markets have dodged a bullet, but still need to prove they have the strength to continue and not get pulled lower.

Elsewhere look for gold to continue to bounce in its downtrend, while crude oil continues higher. The US dollar index is biased to the upside in consolidation while US Treasuries are biased lower. The Shanghai Composite and Emerging Markets both look to continue their bounce in the downtrends, and may turn into reversals.

Volatility looks to remain elevated keeping the bias lower for the equity index ETF’s NYSE:SPY, NYSE:IWM and NASDAQ:QQQ, despite their rebounds higher. Their charts all show signs of both promise to the upside, but further risk or another turn lower. Best to keep all long trades on a tight leash. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog. Please see my Disclaimer page for my full disclaimer.