Here are the Rest of the Top 10:

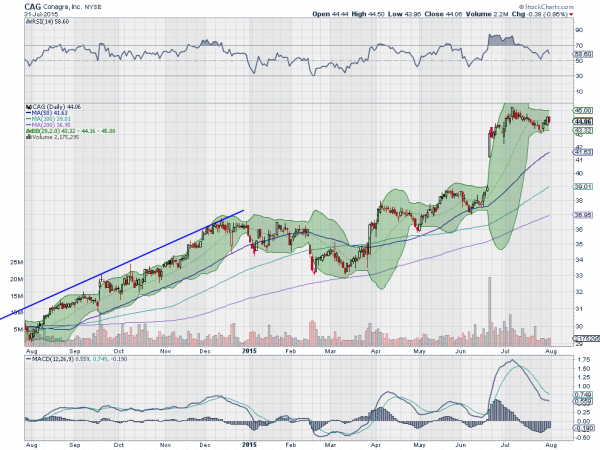

ConAgra Foods (NYSE:CAG)

ConAgra Foods had been trending higher through 2014 and took a break in 2015. Then it got an activist investor involved and gapped higher in June. Since then, it has consolidated with the Bollinger Bands® tightening, often a precursor to a move. The MACD has slowed its decent and is turning as the RSI falls, but in the bullish zone. Watch for a break of the consolidation either way.

Foot Locker (NYSE:FL)

Foot Locker is one way to avoid a decision between Nike (NYSE:NKE) and Under Armour (NYSE:UA) altogether. It has been moving higher in long steps for quite some time. Now it sits under resistance at 71 with tightening Bollinger Bands. The RSI is bullish and rising while the MACD has been pulling back, but is stabilizing. Watch for a break over 71 to enter.

FirstMerit (NASDAQ:FMER)

First Merit stock fell hard following its earnings report last week. But notice that the level it is holding has been an important one in the past, as both support in the second quarter and resistance at the end of 2014. It is also holding at the 200 day SMA. The RSI is oversold and kinking back higher, but the MACD is falling. Look for a potential bounce in this stock.

Packaging Corporation of America (NYSE:PKG)

Packaging Corporation of America had a strong move up off of the October 2014 bottom in the market to a peak in February. Since then, though, it pulled back, making a low as a double bottom in July. Now it is rising again and testing resistance at the gap down from April. It has support for a move higher from the rising and bullish RSI and MACD.

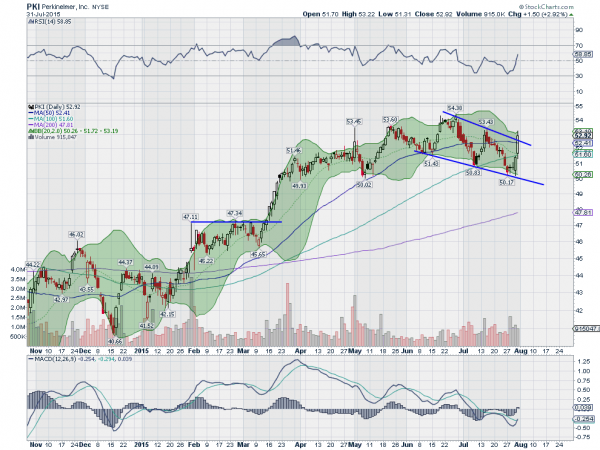

PerkinElmer (NYSE:PKI)

PerkinElmer has been a strong stock, rising through most of 2015 until the June and July pullback. There are signs that the pullback is over though and the stock is ready to reverse back higher. The RSI moved up off of the oversold level again and is making a higher high into the bullish zone. The MACD is turned and crossing up as well. Finally, the price is breaking above a falling wedge and pushing the Bollinger Bands higher.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which, heading into the dog days of August, sees the Equity markets having weathered another storm, but not showing strength to push higher yet.

Elsewhere, look for gold to consolidate or continue lower, while crude oil moves to the downside. The US dollar index looks to move sideways with an upward bias, while US Treasuries are biased to continue higher. The Shanghai Composite and Emerging Markets both are biased to the downside, but trying to consolidate.

Volatility looks to remain subdued keeping the bias higher for the equity index ETF’s ARCA:SPY, ARCA:IWM and NASDAQ:QQQ. Their charts suggest that there is potential for some weakness in the current move short term though. On the longer timeframe, the QQQ looks strong and may be ready for new all time highs, while the SPY is on consolidation and the IWM a retrenching consolidation. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog. Please see my Disclaimer page for my full disclaimer.