Here are the Rest of the Top 10:

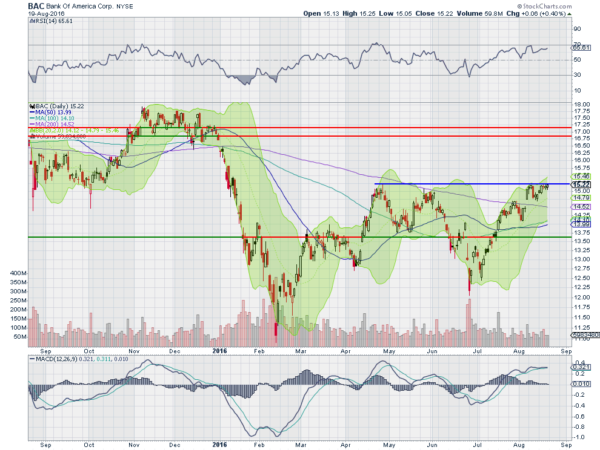

Bank of America (NYSE:BAC)

Bank of America, BAC, made a low in February and then started higher. It found resistance in April and pulled back over the next 2 months to a higher low. Now it is back at the April high and consolidating.

The RSI is bullish and rising and the MACD is flat, but positive, with the Bollinger Bands® shifting higher. Look for a break above resistance to participate to the upside…..

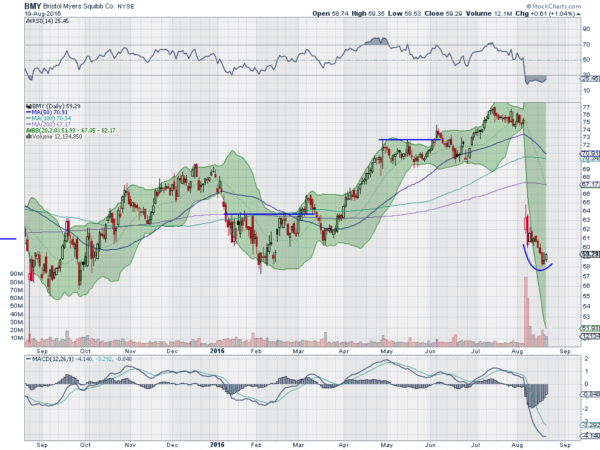

Bristol-Myers Squibb Company (NYSE:BMY)

Bristol-Myers Squibb, BMY, had been trending higher from a low in February until it got bad news in early August. The price dropped over 16% in one day and it has drifted lower since. Last week saw a possible bottom as the price rose Friday for a second up day.

The RSI is oversold but not falling anymore while the MACD is leveling. Look for a continued move higher Monday to participate in the reversal…..

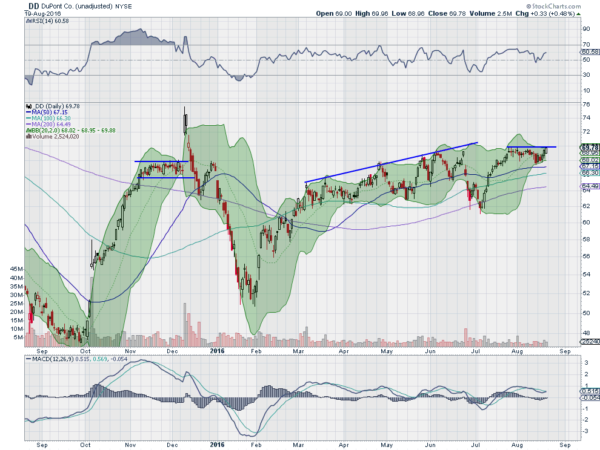

DuPont (NYSE:DD)

DuPont, DD, was trending higher all Spring before a set back at the end of June. After building a ‘W’ recovery it has moved sideways in consolidation. Last week saw a push to the top of consolidation, ending the week at resistance.

The RSI is bullish and rising now while the MACD is about to cross up. Look for a break of resistance to participate to the upside…..

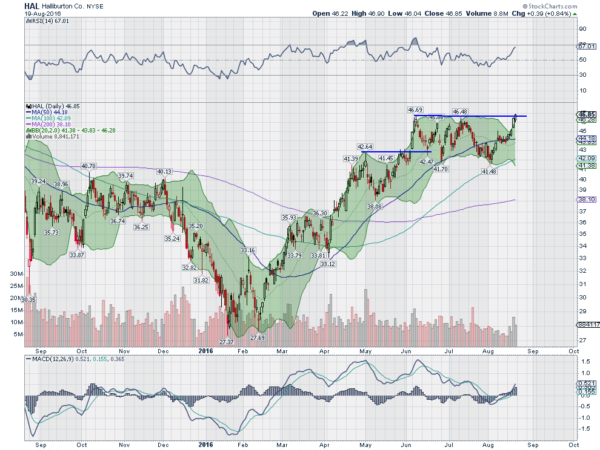

Halliburton (NYSE:HAL),

Halliburton, HAL, rose from a low in February in a few steps up to a plateau in June. It knocked against that resistance again in July. Then last week it ran up to it again and peeked over the top Friday. The RSI is bullish and rising with the MACD rising too. Look for continued upside Monday to participate…..

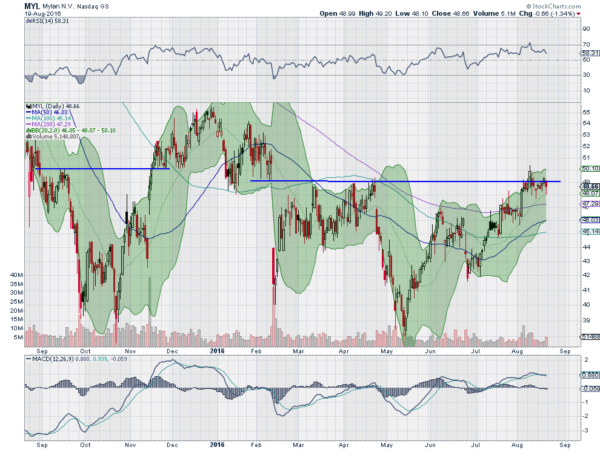

Mylan (NASDAQ:MYL)

Mylan, MYL, shot lower in February and then slowly recovered to fill the gap in late April. But it could not hold there and started another fast move lower to a bottom in May, near the October bottom.

The bounce from there initially made for a lower high with a shallow pullback but the second leg is now back at the April high. As it sits there the RSI is bullish but stalling while the MACD stalls. Look for a push through resistance to participate to the upside…..

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which with August Options Expiration in the rear view mirror, sees the equity markets are looking settled and stable, digesting their moves higher.

Elsewhere look for Gold to consolidate with an upward bias in its uptrend while Crude Oil continues to pump higher. The US Dollar Index looks to continue lower in its broad consolidation while US Treasuries are biased lower in their short term consolidation. The Shanghai Composite looks to continue higher but Emerging Markets look ready to consolidate or pullback short term in their uptrend.

Volatility looks to remain at abnormally low levels keeping the bias higher for the equity index ETF’s SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). Their charts suggest more sideways motion in the short term with the possible exception of the IWM which is drifting higher. Longer term, the topping candles suggest a pause or pullback may be in order soon. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.