Here are the Rest of the Top 10:

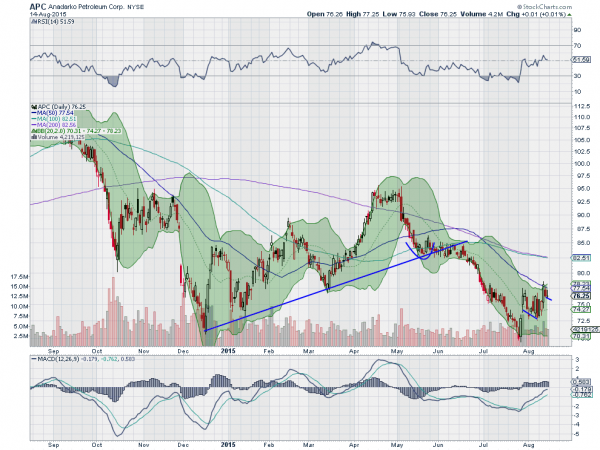

Anadarko Petroleum (NYSE:APC)

Anadarko Petroleum, APC, fell hard with oil over the back half of 2014. It rose then along trend support to test the October 2014 highs before starting back lower. July found another support zone, a possible double bottom, and the price has been rising since. The action recently has been in bull flags following moves higher. Friday saw another building with the RSI holding over the mid line and the MACD rising in support of the upside plan. A move over the 50 day SMA would trigger a buy.

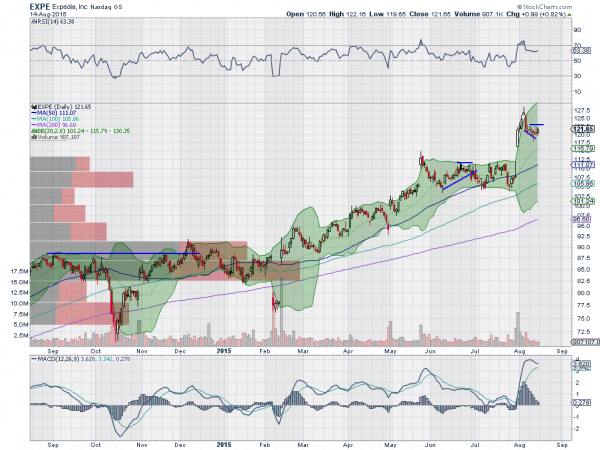

Expedia (NASDAQ:EXPE)

Expedia, EXPE, has been moving higher all year. After a consolidation through June and July, it jumped higher following its earnings report and ran to a Shooting Star top two weeks ago. It is now consolidating that move after a short pullback. Into the week, the RSI has just started to turn back up and the MACD looks to be leveling. The volume pattern looks like a classic Bull Flag.

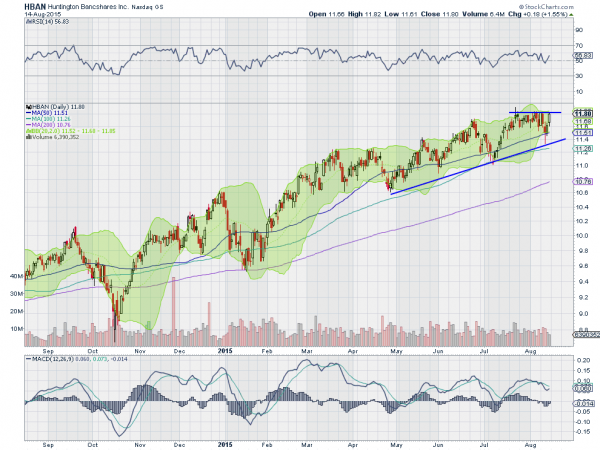

Huntington Bancshares (NASDAQ:HBAN)

Huntington Bancshares, HBAN, has been rising with the financial sector since the October 2014 market low. Since May, rising trend support has been in place, and in mid-July, it met up with resistance, forming an ascending triangle. Friday found the price back at that resistance following two strong up days. The RSI is bullish and rising and the MACD is turning up, with a positive cross this week sealing the deal for more upside.

Old Dominion Freight Line (NASDAQ:ODFL)

Old Dominion Freight Line, ODFL, made a double top over 80 before pulling back through the end of July. Since touching the lower Bollinger Band®, it rose sharply, and has consolidated that move over last week, finding support. The RSI is bullish and started back higher Friday and the MACD is looking at avoiding a cross down. A great set up for the next leg higher.

Perrigo (NYSE:PRGO)

Perrigo, PRGO, had a steep rise off of a low in February that included a large jump in April on news of an FDA approval of new drug application. Since then, though, it has consolidated and is tracing out an Adam and Eve bottoming pattern. The RSI remains in the bullish zone, while the MACD moves sideways in the consolidation. A break over the current resistance looks like a good place to buy for continuation.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which, heading into August Options Expiration week, sees the equity markets looking to consolidate in the short term and looking better long term.

Elsewhere, look for gold to continue the bounce in its downtrend while crude oil just continues lower. The US dollar index seems content to move sideways, but with a short term downward bias, while US Treasuries are biased higher. The Shanghai Composite looks to continue to consolidate in the longer uptrend, while Emerging Markets look ugly with more downside to come.

Volatility looks to remain subdued, keeping the bias higher for the equity index ETF’s ARCA:SPY, ARCA:IWM and NASDAQ:QQQ, despite their failure to move higher last week. Their charts show weakness continuing in the IWM and consolidation in the SPY and in QQQ short term. All look better longer term, with the QQQ strongest followed by IWM and then SPY. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog. Please see my Disclaimer page for my full disclaimer.