Here are the Rest of the Top 10:

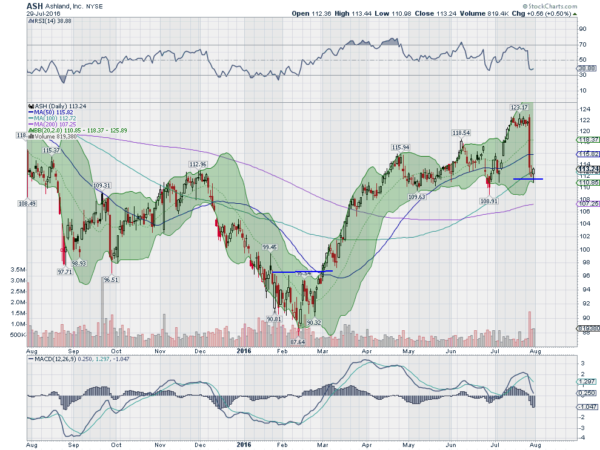

Ashland Inc (NYSE:ASH)

Ashland, ASH, was a Top 10 pick when it broke above the base in March. Since then it had a strong run higher to a new base. Last week it reported earnings and fell hard, to the bottom of the base it has jumped out of. But it ended the week with some bottoming action. The RSI is turning back up but the MACD remains in a downtrend. Look for a reversal higher to participate…..

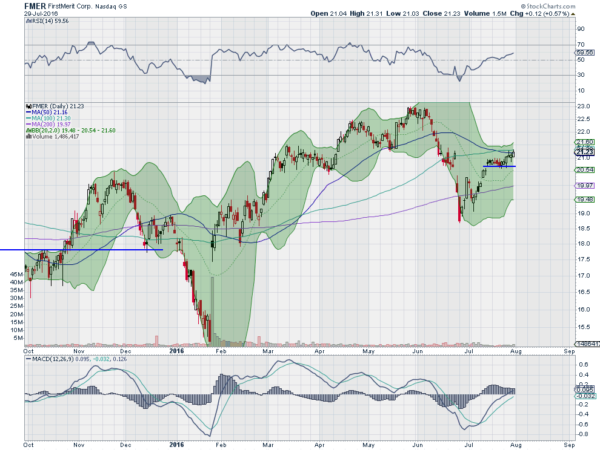

FirstMerit Corporation (NASDAQ:FMER)

FirstMerit, FMER, rose from the February low with a quick gap higher and then continued to a high in June. The pullback had found support until it moved lower following the Brexit vote. That made a new low under the 200 day SMA. After consolidation it moved back higher and stabilized. The end of last week saw the price lift out of that stability. The RSI is rising and bullish and the MACD is moving higher in the bullish zone. Look for continuation to participate to the upside…..

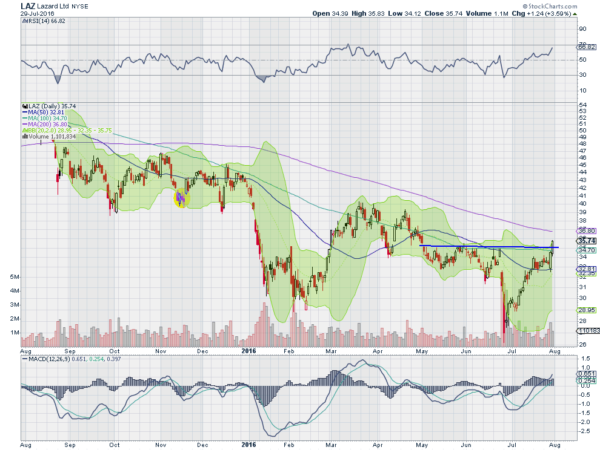

Lazard Ltd (NYSE:LAZ)

Lazard, LAZ, fell with the market to start 2016, making a bottom in February. A bounce in March met resistance and it started lower again, ended with a lower low in June. Since then it has moved higher and last week went through resistance Friday. The RSI is now in the bullish zone and the MACD is rising. Look for continuation to participate to the upside…..

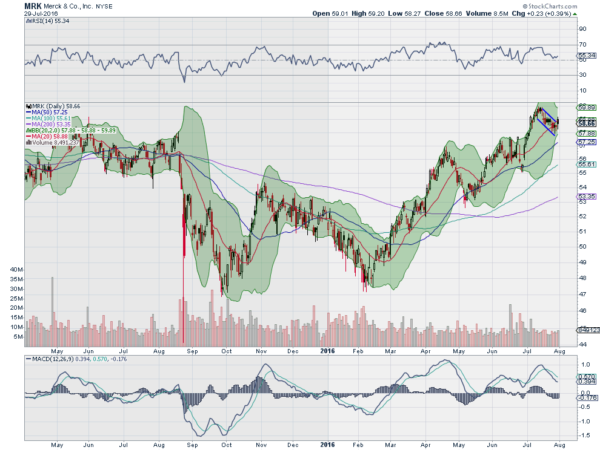

Merck (NYSE:MRK)

Merck, MRK, started higher off of a low in February and ran to the middle of April. A small pullback and it then made a higher high and consolidated before another run higher. The pullback from that was in a bull flag pattern and broke to the upside, out of the flag Friday, before pulling back. The RSI has held in the bullish zone and the MACD is falling but positive. Look for a move over Friday’s high to participate to the upside…..

Red Hat Inc (NYSE:RHT)

Red Hat, RHT, also moved up off of the February low and then consolidated under 76 for over 2 months. It broke that to the upside and successfully retested it before a push higher in June. That failed and it sold off to the prior channel low. Since then it has been slowly moving higher and is now back at resistance. The RSI is crossing the mid line as it moves higher and the MACD is rising and about to turn positive. Look for a push through resistance to participate to the upside..

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which heading into August sees the Equity markets still look strong but the smaller cap and technology laden indexes stronger than the large caps.

Elsewhere look for Gold to continue its uptrend while Crude Oil continues lower. The US Dollar Index looks better to the downside short term while US Treasuries are biased higher. The Shanghai Composite looks like it will continue to drift lower while Emerging Markets move higher.

Volatility looks to remain at abnormally low levels keeping the bias higher for the equity index ETF’s SPY (NYSE:SPY), IWM and QQQ. Their charts show real strength in the QQQ with the IWM ready to join it moving higher, while the SPY takes a pause. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.