Here are the Rest of the Top 10:

Baker Hughes (NYSE:BHI),

Baker Hughes, BHI, was the subject of a longer write up April 1st and it broke higher triggering April 6th. The initial move is consolidating now in a triangle with a base at 67. The RSI remains bullish as the price action is tightening and the MACD is at the trigger line. Watch for a break of the triangle.

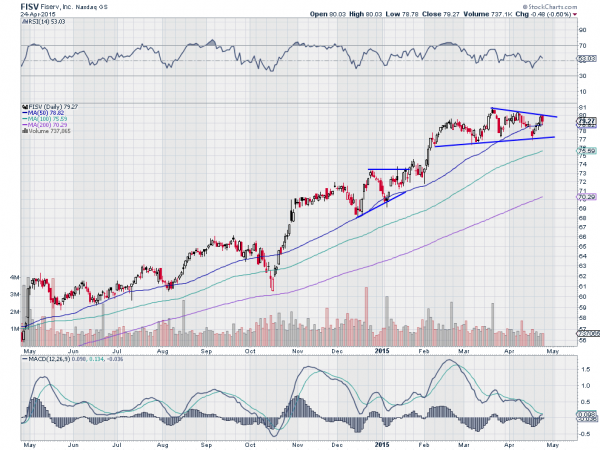

Fiserv (NASDAQ:FISV)

Fiserv, FISV, has been a strong stock, moving higher since May last year. Since February though it has consolidated in a symmetrical triangle pattern centered around 79. The price recently fell through the 50 day SMA and has since recovered. Other touches and recoveries at that measure have yielded substantial moves higher. The RSI has held in the bullish range thus far and is pointing higher, while the MACD is about to cross up.

Interactive Brokers Group Inc (NASDAQ:IBKR)

Interactive Brokers, IBKR, moved higher out of consolidation in September with a couple of stair steps of consolidation recently. The latest pulled back through the 50 day SMA, a catalyst in the past for this name as well. Now it is at resistance and has support for a break higher from the RSI which is rising and has remained in the bullish zone, and the MACD which crossed up on Friday.

Jazz Pharmaceuticals Plc (NASDAQ:JAZZ)

Jazz Pharmaceuticals, JAZZ, broke above resistance after a long consolidation but then meandered. It is now consolidating again under resistance with rising trend support still in play. The RSI remains in the bullish zone and the MACD is rising. Watch for a break higher.

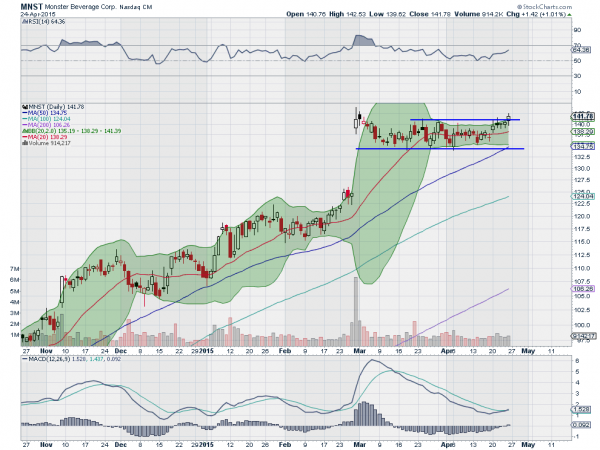

Monster Beverage (NASDAQ:MNST)

Monster Beverage, MNST, had a monster gap higher following its earnings report, but has consolidated that move since in a tight range. Friday saw a peek above the range, suggesting a break out is happening. The rising RSI, in the bullish zone, and MACD about to cross up, concur and support it continuing. Notice that the Bollinger Bands® are also opening higher.

Up Next: Bonus Idea

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which, heading into the last week of April, sees the equity indexes looking strong on the weekly timeframes and a bit mixed on the short term view.

Elsewhere look for Gold to continue lower while Crude Oil rises towards a major character change area. The US Dollar Index looks to continue to consolidate the large move higher while US Treasuries are biased lower in the short term in their uptrend. The Shanghai Composite and Emerging Markets are biased to the upside with risk of the Chinese market becoming overheated at any point.

Volatility looks to remain subdued keeping the bias higher for the equity index ETF’s ARCA:SPY, ARCA:IWM and NASDAQ:QQQ. Their charts all look higher ion the weekly timeframe but on the daily timeframe the QQQ may be a bit stretched while the IWM and SPY test resistance but with some strength. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.