5 Trade ideas excerpted from the detailed analysis and plan for premium subscribers

Here are the Rest of the Top 10:

Biogen (NASDAQ:BIIB)

Biogen, BIIB, reported earnings Thursday morning and after moved higher to resistance. Friday broke that to the upside making another higher high. This is the second higher high, but still takes place in the long downtrending channel. Positive but with some work left. As it moves up the RSI is in the bullish zone and rising while the MACD is moving higher supporting the upside. Look for continuation Monday to participate to the upside.

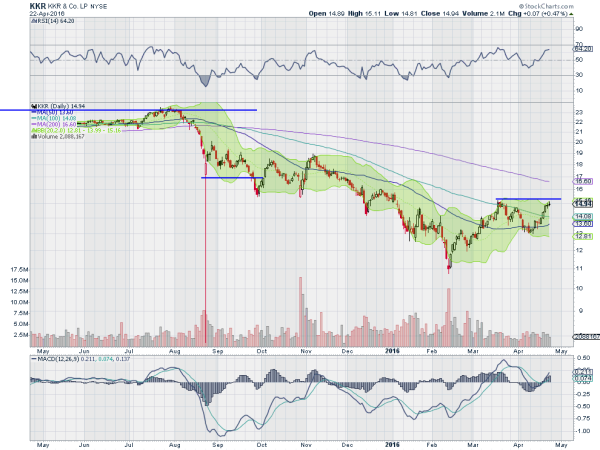

KKR & Co LP (NYSE:KKR)

KKR, will report earnings before the market opens Monday. Heading into that event the chart looks promising for a break out. it made a higher low and is approaching resistance. a move over that would make for a higher high and confirm a reversal. The RSI is bullish and rising while the MACD is crossed up and rising, also supporting more upside. Look for a positive reaction to participate to the upside.

ON Semiconductor Corporation (NASDAQ:ON)

ON Semiconductor, ON, made a bottom in February and has been moving higher since. the last two weeks it has rounded into consolidation and the Bollinger Bands® are squeezing. This is often a precursor to a move in price. The RSI is in the bullish zone and the MACD flattened after a fall and now approaching a positive cross. Look for a push over resistance to participate in the upside.

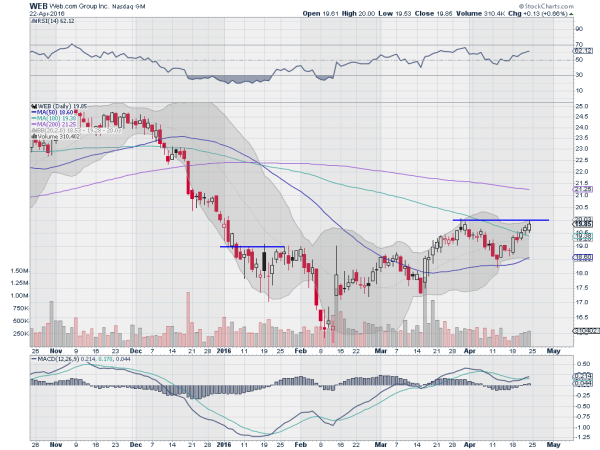

Web.com Group Inc (NASDAQ:WEB)

Web.com, WEB, is coming out of a bottoming pattern, having back to back higher highs and higher lows. Coming into the week it is at resistance, trying to make another higher high. The RSI is now in the bullish zone and rising with the MACD crossed up and rising. These support more upside.

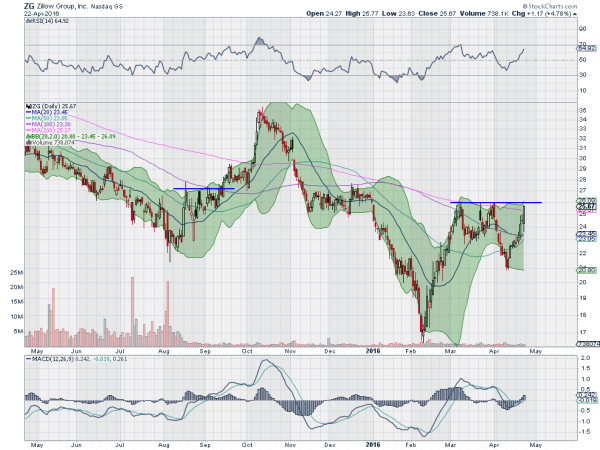

Zillow Group Inc (NASDAQ:ZG)

Zillow Group, ZG, bounced off of a bottom in February, making the familiar ‘V’ shaped recovery. It met resistance at the consolidation zone from November and December before a pullback to a shallower low. Another touch at resistance fell back farther but has also recovered to that resistance. The RSI is in the bullish zone and the MACD crossed and rising as it hits there again on a strong candle Friday. Look for a push through resistance to participate to the upside.

Up Next: Bonus Idea

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which heading into the last week of April the Equity indexes are showing signs of rotation out of the PowerShares QQQ Trust Series 1 (NASDAQ:QQQ) and SPDR S&P 500 (NYSE:SPY) and into the iShares Russell 2000 (NYSE:IWM).

Elsewhere look for Gold to consolidate in a $30 range while Crude Oil continues higher. The US Dollar Index continues to test the bottom of a wide consolidation range while US Treasuries are biased lower. The Shanghai Composite and Emerging Markets are biased to the downside with risk of the Emerging Market longer term uptrend re-exerting itself. Volatility looks to remain subdued and with a bias lower keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ, despite the moves last week.

Their charts are mixed with the IWM just strong all around and the SPY strong on the weekly timeframe but with cracks on the daily. The QQQ is the weakest on the daily and shows consolidation on the weekly. Perhaps next week rotates back into the QQQ. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.