Here are the Rest of the Top 10:

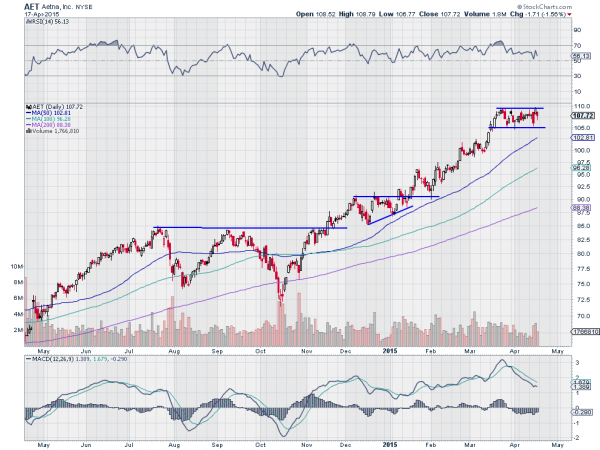

Aetna (NYSE:AET)

Aetna, AET, moved out of a ‘W’ like consolidation in November and has just kept going. Currently it is taking a breather, as it consolidates between 105 and 110. While the MACD is resetting lower during the consolidation the RSI is holding in the bullish zone. Look for a break of the zone for the next leg higher or a retrace below 100.

Jd.Com Inc Adr (NASDAQ:JD)

JD.com, JD, rose out of its IPO to a peak in September. Since then it has pulled back and then reversed in a rounded pattern, a Cup. Currently it is consolidating over the prior high. As it does so, the RSI is working off a technically overbought condition while the MACD is starting to roll over. The Handle may be forming in this consolidation or it may pullback to form it. The move higher out of it is what will make it interesting.

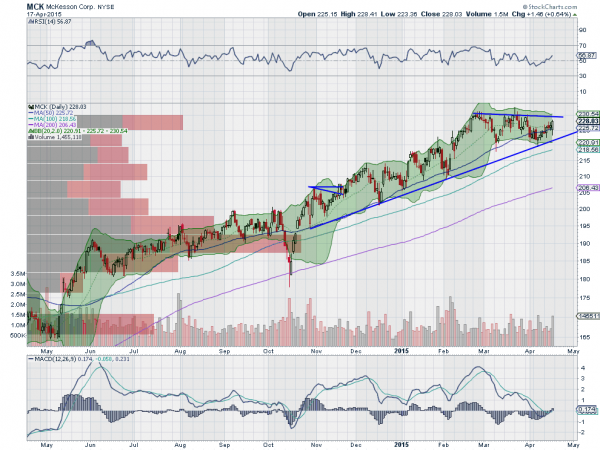

McKesson (NYSE:MCK)

McKesson, MCK, has been trending higher since the October pullback with the market. What makes it interesting now is that the recent price action since late February shows consolidation of that move and a touch back at the rising trend support line. The RSI is now moving back higher, after holding in the bullish zone on the pullback, and the MACD crossed up last week, giving a buy signal.

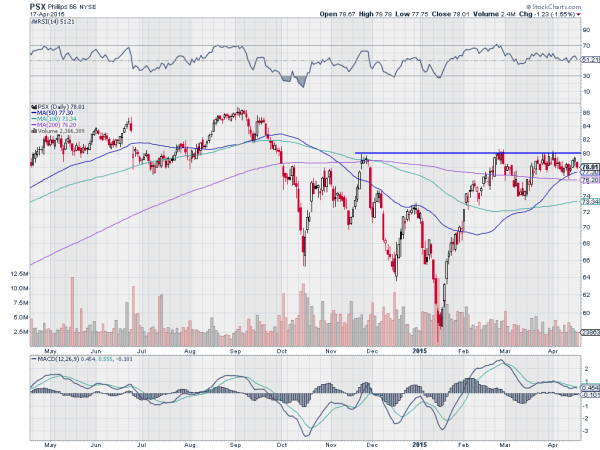

Phillips 66 (NYSE:PSX)

Phillips 66, PSX, had a choppy pullback over the back half of 2014. But since the bottom in January it has recovered and is bouncing off of resistance at 80. The higher lows show some strength as it tightens against resistance. The RSI has held bullish and over the mid line during the consolidation while the MACD rest lower and is now flirting with a bullish cross.

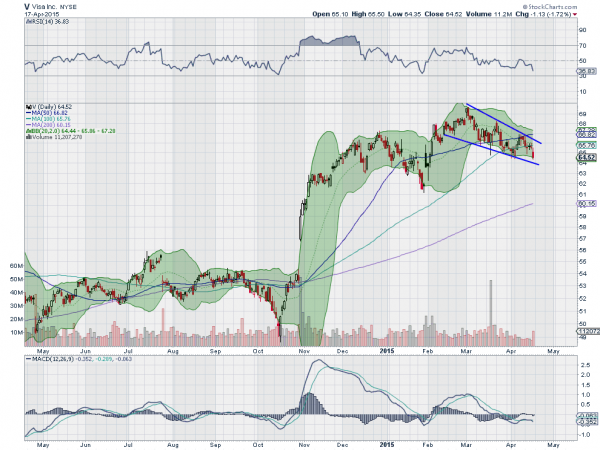

Visa Inc (NYSE:V)

Visa, V, is moving in a falling wedge as it pulls back from a top in early March. This is often a bullish pattern on the break of the wedge. As it moves lower the RSI is nearing the oversold region while the MACD has reset to levels where price has reversed in the past.

If you like what you see sign up for more ideas and deeper analysis using the Get Premium button above.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which, heading into next week sees the equity markets remaining positive in the longer run but mixed with a bit of trepidation in the short term.

Elsewhere look for Gold to continue to hold around 1200 while Crude Oil continues its short term bounce. The US Dollar Index looks to continue to consolidate sideways while US Treasuries are biased higher if they break their consolidation range. The Shanghai Composite is on fire and frothy but who know when it will stop while Emerging Markets consolidate their recent move higher.

Volatility looks to remain subdued keeping the bias higher for the equity index ETF’s ARCA:SPY, ARCA:IWM and NASDAQ:QQQ. Their charts suggest that the longer term view remains stronger while in the short term the IWM continues to be the strongest but with some short term trepidation and the SPY and QQQ with a decent possibility to start the week lower. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.