Here are the Rest of the Top 10:

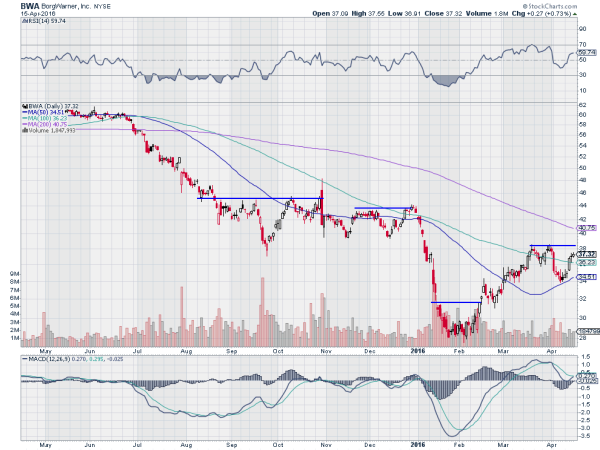

BorgWarner (NYSE:BWA)

BorgWarner, BWA, fell from a plateau at 60 finding some support along the way at 43 before bottoming in January. The move off the low found resistance and created a higher low to start April, and is now moving higher again. The RSI is also rising and in the bullish zone and the MACD is about to cross up. A higher high would be a buy signal.

Cerner Corporation (NASDAQ:CERN)

Cerner, CERN, has had a long run lower since peaking a year ago. It appears to have made a double bottom in February though and is heading higher. The RSI is bullish and rising while the MACD is rising too. Look at using the recent low as a stop and follow it higher. The higher low solidifies a trend reversal to the upside. A move over the falling trend resistance would add weight to that case.

International Paper Company (NYSE:IP)

International Paper, IP, began a pullback in February 2015. That seems to have ended with a bottoming formation in in late January into February. The price came back to a resistance zone in mid March and retrenched slightly. Now it is testing that high again. The RSI is bullish and rising with the MACD about to cross up. Look for a new higher high to participate in the upside.

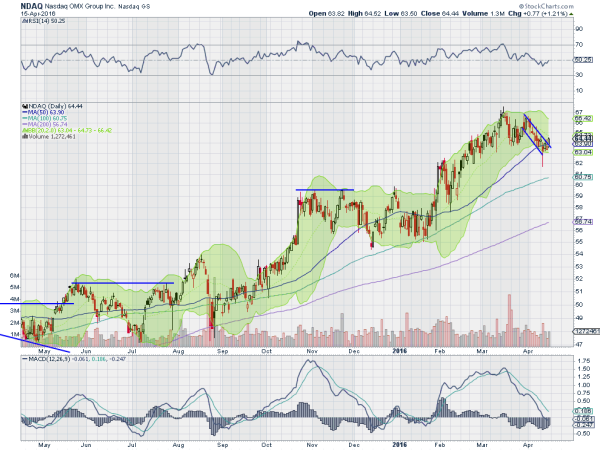

Nasdaq Inc (NASDAQ:NDAQ)

Nasdaq, NDAQ, has been moving higher in steps since September 2015. The last leg up, after break the consolidation zone in February, took the stock to a new all-time high. Since then it has pulled back, digesting the move, finding support at the 50 day SMA and bouncing. Friday saw it move out of the falling channel to the upside. The RSI is holding in the bullish zone while the MACD is starting to curl up towards a cross. Look for continuation to the upside to participate.

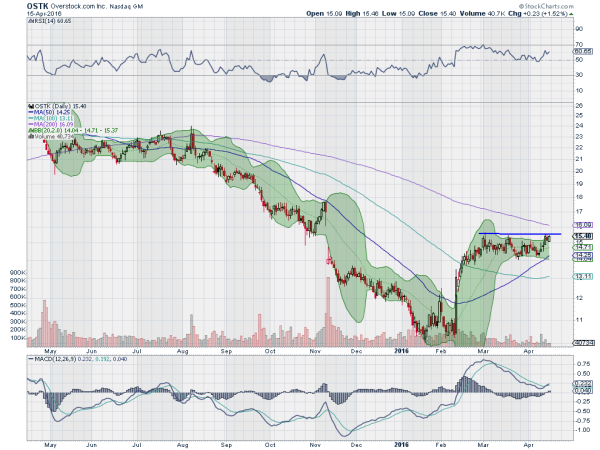

Overstockcom Inc (NASDAQ:OSTK)

Overstock, OSTK, rolled lower from a plateau at 22 starting in August last year. That continued until finding a bottom over the last part of January into February. Since then it jumped and has consolidated. The RSI is pushing back higher now and into the bullish zone while the MACD is crossing up. These support more upside as the price is at the top of the consolidation. Look for a move over that top to participate to the upside.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which with April Expiry behind sees the Equity markets held strong and look to have started back higher.

Elsewhere look for Gold to consolidate while Crude Oil consolidates but with a bias to the upside. The US Dollar Index is testing the bottom of the consolidation range while US Treasuries look to move higher. The Shanghai Composite and Emerging Markets look strong and ready to go higher the with risk of Emerging Markets running in place a bit longer.

Volatility looks to remain subdued keeping the bias higher for the equity index ETF’s SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). Their charts also look better to the upside now with the weekly charts looking strong. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.