Here is your Bonus Idea with links to the full Top Ten:

JP Morgan (N:JPM) stock had a good run higher to start the year. Moving from 54 to 70 by August, it was up almost 30%. But then the market fell off and JP Morgan fell with it. You can attribute the fall to the Fed not raising rates, or Chinese worries or US Economic worries. Whatever the case, it does not matter. The stock fell.

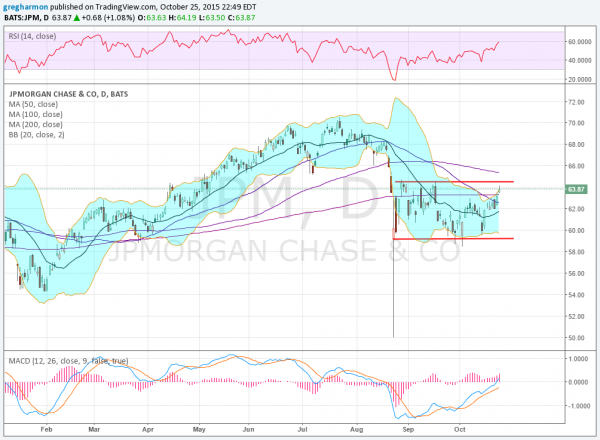

Since then it has moved in a consolidation channel between 59.25 and 64.50. Last week saw the stock rise to the top of the channel and over the flat 200 day SMA. Interestingly, the stock printed a Death Cross last week, with the 50 day SMA crossing down through the 200 day SMA. This is after the pullback and the consolidation. Death Crosses are a signal of more downside, but from my experience, often are printed after the fall is over.

And with the stock price rising and momentum supporting more, this may be the case this time. The RSI is moving into the bullish zone and the MACD is rising. The Bollinger Bands® are also opening to the upside. A break of the channel higher would look for a move of 5.25 to the upside, or to about 69.75, just below the prior top.

There is resistance higher at 64.50 and 65.75 followed by 67.35 and 68.30 before 69 and 70. Support lower stands at 62 and 59.25. Short interest is low at 1.1% and the company reported earnings just 2 weeks ago.

The options chains show open interest from 60 to 63 on the Put side this week and 62 to 65 on the Call side, favoring a bit of a downside move. November monthly options show extremely large volume at the 67.5 Call and then the 65 Call with some lower at the 60 Put as well. But upward favor longer term.

JP Morgan

Trade Idea 1: Buy the stock on a move over 64.50 with a stop at 63.

A straight stock trade.

Trade Idea 2: Buy the stock on a move over 64.50 and add a October 30 Expiry 64 Put (76 cents).

Married Puts, gives downside protection for just over 1% of cost.

Trade Idea 3: Buy the November 64 Bullish Risk Reversal (8 cent credit).

A leveraged long position, with risk of owning the stock on a close under 64 at Expiry.

Trade Idea 4: Buy a November 62/64/65 Call Spread Risk Reversal (free).

Also leveraged long, but with capped upside to give a lower risk point, at 62.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which, heading into the last week of October, sees the equity markets looking strong. Elsewhere look for gold to continue lower in its longer term downtrend, while crude oil heads lower in the short term. The US dollar index is breaking to the upside, while US Treasuries are marking time sideways. The Shanghai Composite and Emerging Markets are biased to the upside, with Emerging Markets at a major resistance level. Volatility looks to remain subdued, keeping the bias higher for the equity index ETFs N:SPY, N:IWM and O:QQQ. The SPY and QQQ had major moves and look set up to continue higher into next week with the IWM lagging and at resistance. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog. Please see my Disclaimer page for my full disclaimer.