Here is your Bonus Idea with links to the full Top Ten:

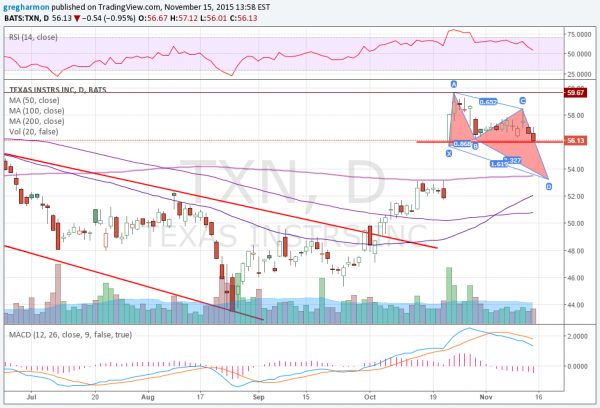

Texas Instruments (O:TXN), broke a falling expanding wedge to by moving higher to start October. It consolidated briefly under the 200 day SMA before gapping higher to the prior high from March. It has consolidated since then.

The price action in consolidation is a bullish Deep Crab harmonic. That is good news for long holders. But the pattern looks for a reversal higher, after attaining the Potential Reversal Zone (PRZ) at 53.18 below. This would close the gap as well.

The momentum indicators are supporting a continued move lower, lining up with this view. The RSI is running down and into the mid line with the MACD is falling. There is support lower at 56 and then at 53 followed by 51.80 and 51.15. Resistance higher comes at 57.75 and 59.65. Short interest is low at 2.3%.

Looking at the options chain this week shows large open interest at 60 and 60.5 above on the call side. There is also big open interest at 57 above on the put side. These could influence it higher by the end of the week. In the December chain the open interest is large at 50 on the put side and 60 on the call side. January options see open interest spread but mostly to the downside.

Texas Instruments, Ticker: TXN

Trade Idea 1: Sell the stock short on a move under 56 with a stop at 57.

A straight stock trade.

Trade Idea 2: Buy the November 27 Expiry 56/53 Put Spread (offered at 80 cents late Friday).

Looking for down side with defined risk.

Trade Idea 3: Buy the December 4 Expiry 56/ December 11 Expiry 53.5 1×2 Put Diagonal (free).

Looking for downside with a possible entry at 51 in mid December.

Trade Idea 4: Buy the November 27 Expiry/December 57.5 Call Calendar (54 cents).

Looking for upside but for the longer term.

Trade Idea 5: Buy the November 27 Expiry/December 57.5 Call Calendar and sell the December 50 Puts (30 cents).

Adding leverage to the longer term upside.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which, heading into November Options Expiration and the last week before the shortened Thanksgiving holiday, sees the Equity markets have again shown an inability to make new highs, without giving up the positive longer term perspective.

Elsewhere look for Gold to continue its downtrend, but with a possible short term reversal while Crude Oil works lower. The US Dollar Index looks to continue higher while US Treasuries are biased lower, but also may see a short term reversal. The Shanghai Composite is building energy for another leg higher while Emerging Markets are biased to the downside again.

Volatility looks to remain above the lower range, making things difficult for equities, but looking for a pullback after the spike in short order. The equity index ETF’s N:SPY, N:IWM and O:QQQ, all look better to the downside this week. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.