Here is your Bonus Idea with links to the full Top Ten:

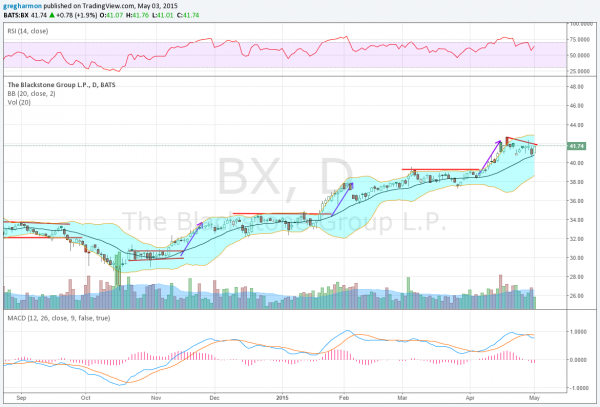

Blackstone (NYSE:BX), has moved higher in a stair step fashion since bottoming with the market in October. The steps up have been equal in length as shown by the purple arrows. They have been typically followed by a slight pullback and then a run to a new high and consolidation. Each time the 20 day SMA has played a role as both support and a launching spot.

Heading into the week the price has visited the 20 day SMA again after a slight pullback. This makes for a possible low risk entry point. It has room to move higher within the Bollinger Bands® and the RSI is in the bullish zone. The MACD has pulled back but it has been so shallow and a flat angle that a break higher could change that quite quickly. There is no resistance above the April 20th high at 42.75 and support lower may come at 40.75 and 39.30 before 37.50.

The stock has weekly options and the May 8 Expiry shows open interest clustered from 41.50 to 42.50 on the call side but lower from 39 to 41 on the put side. There is a similar view on the May monthly options but at much bigger size. Finally June open interest pushes a little further to the upside from 40 through 44 and is focused at 36 on the put side. The company is not due to report earnings next until July 15th and it pays a fat dividend of nearly 8%. It has short interest of 2.3%, pretty low.

The Blackstone Group LP (NYSE:BX)

Trade Idea 1: Buy the stock with a stop at 40.25, under the 20 day SMA. A straight stock but.

Trade Idea 2: Buy the May 42 Calls (offered at 70 cents late Friday). A defined risk way to trade the stock.

Trade Idea 3: Buy the June 42 Calls ($1.14). Also defined risk but with more time.

Trade Idea 4: Buy the June 38/42 bullish Risk Reversal (88 cents). Adding leverage with protection to the last consolidation area.

Trade Idea 5: Buy the June 38/42/44 Call Spread Risk Reversal (52 cents). Capping the upside in the prior trade but giving a possible 4:1 reward to risk ratio.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which, heading into May sees the equity markets continuing to look better on the longer timeframe but a bit shakier on the shorter timeframe.

Elsewhere look for Goldto consolidate with a downward bias while Crude Oil continues higher. The US Dollar Index has pulled back to a critical level where a reversal could be expected but more downside a character change while US Treasuries continue to be biased lower. The Shanghai Composite may finally be consolidating in its uptrend while Emerging Markets are showing some downside risk due to a wider consolidation.

Volatility looks to remain subdued keeping the bias higher for the equity index ETF’s SPDR S&P 500 (ARCA:SPY), iShares Russell 2000 (ARCA:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). Their charts look a bit vulnerable in the short term despite the support and moves higher Friday, with the IWM the weakest and the SPY and QQQ in consolidation zones. The QQQ chart looks the best on the longer timeframe. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.