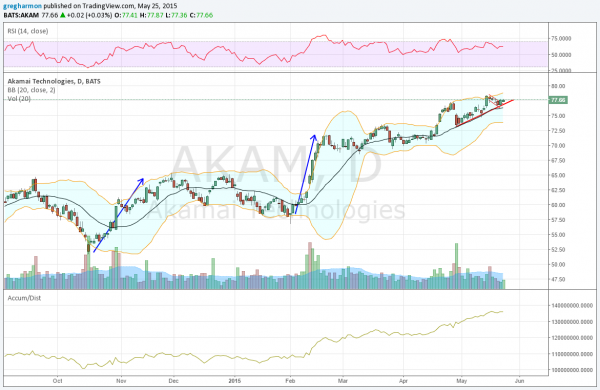

Akamai Technologies (NASDAQ:AKAM), provides cloud based computing services and content delivery. The cloud has been the place to be in technology recently and their stock has benefited from that over the last 6 months. Rising from a pullback with the market in October 2014, it plateaued in December. It then retraced 50% of that move before moving higher again. It was nearly a perfect Measured Move higher to 70 before consolidating.

Another break higher in April then retraced 61.8% of that before the shift to the current rising trend along the 20 day SMA. Tighter in the last week saw a bull flag and then a break to the upside. This gives a short term target to 81.70. But this stock looks strong.

The RSI is holding high in the bullish zone while the MACD (not shown) moves sideways, without a pullback. The accumulation/distribution statistic sees continued buying. Short interest is moderate at 3%. The next earnings report from the company is expected July 29th.

Looking at the options chains the May 29 Expiry weekly options sees very high open interest at the 81 Strike on the Call side. Further out in June open interest on the Call side far outweighs the Put side with large size in the 75, 80 and 85 Strikes. July open interest is still light.

Akamai Technologies

Trade Idea 1: Buy the stock now or on a move over 78.40, with a stop at 76.

A straight stock buy.

Trade Idea 2: Buy the May 29 Expiry 78 Calls (offered at 62 cents late Friday).

Defined risk for a short term trade.

Trade Idea 3: Buy the June 75/77.5 bull Risk Reversal ($1.20).

A leveraged trade for upside participation, with risk below 75.

Trade Idea 4: Buy the June 77.5/80 Call Spread Risk Reversal selling the June 75 Put (40 cents).

Lowers cost of trade #3 but caps the upside. Still better than 6:1 reward to risk ratio.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which, heading into the unofficial start of summer sees the equity markets looking positive and better in the longer timeframe than the shorter one.

Elsewhere look for gold to continue to hold near 1200 while crude oil consolidates with an upward bias. The US dollar Index is biased to the upside but it is still too soon to declare a reversal higher while US Treasuries are biased lower but showing signs of consolidation. The Shanghai Composite is moving higher in renewed strength and Emerging Markets are biased to the downside in the uptrend, debating whether it is a bull flag or a reversal.

Volatility looks to remain subdued keeping the bias higher for the equity index ETF’s SPDR S&P 500 (ARCA:SPY), iShares Russell 2000 (ARCA:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ) . Their charts agree with that on the weekly timeframe, but show better strength on the SPY and QQQ on the daily timeframe than in the IWM. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.