Here is your Bonus Idea with links to the full Top Ten:

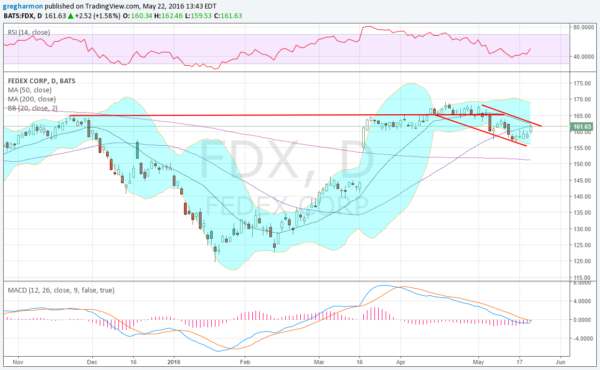

FedEx (NYSE:FDX), drove lower from a high last June, the final step a move from the December bounce to a low in January. Since then it reversed higher, driving back to that December high. This delivered a 40% return. But after consolidating for 6 weeks, it started to pull back again. Is it ready for more downside?

There are signals that it may actually be ready for another leg higher instead. The move back to December resistance and then short pullback sets up a Cup and Handle pattern. This pattern gives a target to 214 if it triggers.

The move in the stock price Friday took it back to the top of the falling channel and the 50 day SMA. Momentum indicators are supportive of a break higher out of the Handle. The RSI is moving higher after bottoming at the lower bound of the bullish zone, and the MACD is about to cross up, its own buy signal.

A move out of the channel, over 163 for Monday, would trigger the pattern. Then there would be resistance above at 168 and 172 followed by 179 and 183 before the all-time high at 185.19. Support lower stands at 161 and 157.50 followed by 155 and then a gap to fill to 145. Short interest is non-existent, and the company is due to report earnings next after the close June 21st.

Looking at the options chains, the biggest open interest this week is at the 162.5 Strike Call, 3 times the 165 Call and 8 times anything on the Put side. June monthly options show high open interest at the 165 and 170 Call Strikes as well as the 155 Put. The June 24 Expiry chain, just past earnings is biggest at the 170 Call, but has not had long to build. The July chain is largest at the 165 Call. An upward bias.

FedEx, Ticker: FDX

Trade Idea 1: Buy the stock on a move over 163 with a stop at 157.

Trade Idea 2: Buy the stock on a move over 163 and buying a June 24 Expiry 162.5/157.5 Put Spread selling the July 170 Calls. 30 cents for the collar protection through earnings.

Trade Idea 3: Buy the June 165/170 Call Spread and sell the June 155 Put for a 10 cent credit.

Trade Idea 4: Buy a May 27 Expiry/June Call Calendar for $1.50. Sell next week calls when May expires, and repeat weekly.

Trade Idea 5: Buy a May 27 Expiry/June Call Calendar and sell a May 27 Expiry 157.5 Put for $1.10. Sell next week calls when May expires, and repeat weekly.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which with Options Expiration behind and heading into the last week before the unofficial start of summer, sees equity markets treading water.

Elsewhere look for Gold to consolidate in its uptrend while Crude Oil continues higher, perhaps with a short term pause. The US Dollar Index looks to continue higher while US Treasuries consolidate broadly in their uptrend. The Shanghai Composite looks to continue to consolidate with a downward bias and Emerging Markets look to head lower.

Volatility looks to remain subdued keeping the bias higher for the equity index ETF’s SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). Their charts show continued short term confusion, with the SPY extending a long bull flag maybe too long, and the IWM and QQQ looking more like they could start a reversal higher. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.