Goldman Sachs (NYSE:GS) GS has been at the top of the investment banking world for over 30 years. Their alumni hold prestigious posts in government, advise countries and run some of the biggest hedge funds in the world. The days of white gloved servants delivering lunch may be over but the prestige is still there.

Their stock has been caught up in the debate on interest rates. Will they rise soon and benefit banks or is the economy about to revert and require additional accommodative policy. Part a bank, part a fee machine, it makes a lot of money.

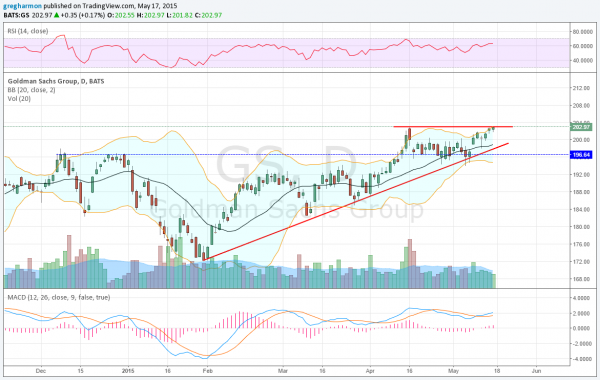

And the stock has been trending in the right direction lately. Higher. It closed at an all-time high on Friday. The chart suggests there may be more in the offing. There has been rising trend support since the beginning of February with the price connecting there just over a week ago before the latest leg up. The move to resistance then at 203 creates an ascending triangle that would target a move to 220 should it break higher.

The Bollinger Bands® are opening to allow a continued move higher. The RSI is in the bullish zone and the MACD is crossed up and rising. There is support lower at 199 and 196.60 that has held during this latest consolidation. Below that 193 and 186 may give support.

Options open interest this week shows a bell curve around 200 to 202.50 on the call side, but very large open interest at the 180 strike below. This can sometimes be a magnet but so far away unlikely to draw it this week unless there is a catalyst. As you move further out the expiry chain the highest put side open interest rises as does the call open interest, a positive influence.

Short interest is low at 1.3% and the company is expected to report earnings next July 14th before the open. The stock also goes ex-dividend on May 28, so there is a reason to own the common in the short run.

Goldman Sachs: (NYSE:GS)

Trade Idea 1: Buy the stock on a move over 203 with a stop at 199.

Trade Idea 2: Buy the May 22 Expiry 202.5 Calls (offered at $2.04 late Friday).

Trade Idea 3: Buy the June 202.5/May 22 Expiry 205 Call Diagonal ($3.25).

Trade Idea 4: Buy the June 202.5/May 22 Expiry 205 Call Diagonal and sell the May 29 Expiry 195 Puts ($2.70).

Trade Idea 5: Buy the stock on a move over 203 with a May 29 Expiry 200/195 Put Spread/June 210 Call Collar (15 cents for collar).

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which, heading into the Memorial Day Weekend sees the equity markets looking healthy but remaining short of break out levels.

Elsewhere look for gold to continue to consolidate with a short term upward bias while crude oil consolidated in its uptrend. The US Dollar Index looks to continue to pullback while US Treasuries bounce in their downtrend. The Shanghai Composite is in broad consolidation mode while Emerging Markets consolidate with an upward bias in their uptrend.

Volatility looks to remain subdued with a bias lower keeping the bias higher for the equity index ETF’s SPDR S&P 500 (ARCA:SPY), iShares Russell 2000 (ARCA:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). Their charts are all still more positive on the longer timeframe, but with the SPY and QQQ looking stronger than the IWM. This might yield an opportunity in the IWM on a catch up. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.