Here is your Bonus Idea with links to the full Top Ten:

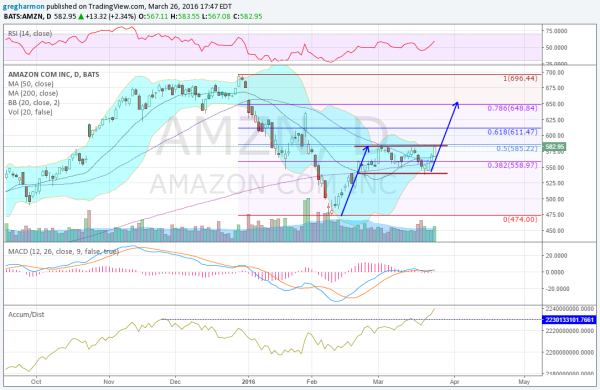

Amazon (NASDAQ:AMZN), had a strong fall of 2015, rising from consolidation to a high near 700 at year end. But that entire move was wiped out in the first 6 weeks of 2016. Touching a low of $474 in February it bounced. The Straight run higher paused at the 38.2% retracement of the move lower and then met resistance at the 50% retracement. Since then it has moved sideways in a channel between 540 and 585.

Thursday saw the stock jump to the top of the range on a strong Marubozu candle, climbing higher all day. A break of the range would give a Measured Move to 652.50 as a target. That would be about at the 78.6% retracement of the down leg and the bottom of the gap down at the start of the year.

Momentum is looking supportive for a move higher. The RSI is rising and crossing into the bullish zone while the MACD is flat but also crossing up. The Bollinger Bands® are opening to the upside after a squeeze as well. The accumulation/distribution statistic shows accumulation since mid February and is now making new highs.

There is resistance at 585 and 605 followed by 637 and 656 before the gap to fill to 675 and then 696. Support lower may be found at 565 and 540 followed by 520. Short interest is low under 2%. The company is expected to report earnings next April 21st.

Options chains show open interest this week spread from below 540 to 570 on the put side but small compared to the larger open interest at 570, 580 and 590 and then especially large at 600 on the call side. April monthly calls show largest open interest at 550 on the put side with smaller amounts at 540, 560 and 600, and then again much bigger at 575 and especially 600 on the call side. Looking beyond the earnings report, the April 22 Expiry options show small open interest relatively. The May monthly are also much lighter than April monthly.

Amazon, Ticker: $AMZN

Trade Idea 1: Buy the stock on a move over 585 with a stop at 570.

Trade Idea 2: Buy the stock on a move over 585 with a April 29 Expiry 585/545 Put Spread ($17) and selling a May 650 Covered Call ($13).

Trade Idea 3: Buy the April 22 Expiry 540/585/597.5 Call Spread Risk Reversal (40 cents) for a run up into earnings.

Trade Idea 4: Buy the April/June 600 Call Calendar ($23.45) and sell the April 22 Expiry 540 Puts ($6.80). Continue to sell weekly puts to collect back premium as the April 22 Expiry come to expiration.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which heading into the end of the first Quarter sees the run up in equities may have exhausted, at least in the short term.

Elsewhere look for Gold to continue to pullback in its uptrend while Crude Oil does the same, but with a possible bounce. The US Dollar Index continues higher in the consolidation range while US Treasuries may be breaking their downtrend to the upside. The Shanghai Composite looks better to the upside in the downtrend while Emerging Markets are biased to the downside in their uptrend.

Volatility looks to remain low keeping the bias higher for the equity index ETF’s SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). Their charts suggest the recent uptrend may be exhausting though with the SPY lading to the downside followed by the QQQ and the IWM consolidating. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.