Here is your Bonus Idea with links to the full Top Ten:

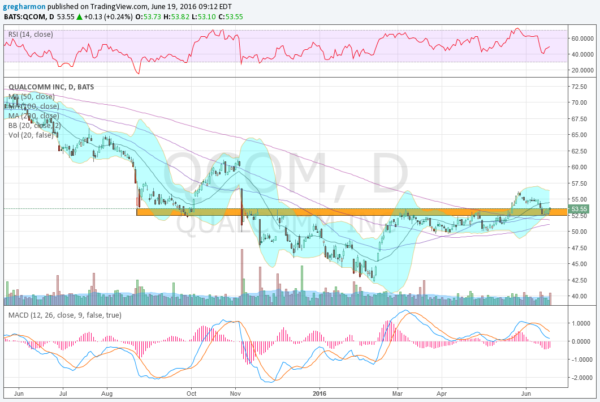

Qualcomm (NASDAQ:QCOM), peaked in mid 2014 at just under $82. From that point it trended lower, slow and steady to a bottom in February under $43. It was nearly cut in half. The chart below shows the price action over the last 12 months and there are some interesting features.

The price area between 52.50 and 53.50 has proven to be very significant for this stock over the last year. First it acted as support from August through September of 2015. Then from March 2016 through to May it acted as resistance. The break over the range in late May was short lived as it pulled back. It retested the range and held last week, rounding up and peeking over the top on Friday.

Momentum started to turn higher Friday as well. The RSI bounced off of the bottom of the bullish range. The MACD has yet to turn, but is slowing its descent as it approaches zero. The price stopped falling and started the bounce last week as it touched the lower Bollinger Band®, and now the Bollinger Bands are getting tight. This is often the precursor to a big move.

There is resistance above at 55 and 56.50, with a gap to fill to 60 and then 61 and 65. Support lower comes at 52.50 and 50. Short interest is low at 1.5% and the stock is expected to report earnings next July 20th.

The June 24 Expiry options chain shows biggest open interest at the 54 Strike on the Call side with smaller open interest from 54.5 to 56.5. The Puts at this Expiry are biggest at 52.5 but spread from 51 to 53.5. There is no real edge this week. The July monthly options favor the Call side. The biggest open interest is at the 52.5 and 55 Strikes with some size at 57.5 also. The Put side is smaller but biggest at 52.5. This suggests a range from 52.5 to 55 as most likely.

The July 22 Expiry, the first after the earnings report, shows smaller size but the biggest open interest at 55 on both side. Finally, the August monthly Expiry favors the upside with large open interest at 57.5, dwarfing the size at any other strike on both sides by a factor of 10.

Qualcomm, Ticker: QCOM

Trade Idea 1: Buy the stock now (over 53.50) with a stop at 52.50.

Trade Idea 2: Buy the stock now 9over 53.50) and add a July 22 Expiry 53.50/50 Put Spread ($1.17) and also sell a August 57.5 Call (60 cent credit).

Trade Idea 3: Buy the July monthly 53.5 Calls (about $1.25).

Trade Idea 4: Buy the July monthly 53.5/55 Call Spread (70 cents) and sell the July monthly 52.5 Put (79 cents) for a free Call Spread Risk Reversal.

Trade Idea 5: Buy the August 52.5/July 55 Call Diagonal ($2.30).

Trade 1 is a straight stock buy while Trade 2 adds a collar for protection through the earnings event through the range projected by the options. Trade 3 offers a defined risk method to participate in a run up to earnings. Trade 4 looks for that run up with a capped and levered trade. Trade 5 looks longer term with open interest in July to hold it below 55 but open interest in August to draw it to 57.50.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which saw following the June FOMC meeting and Options Expiration, the market got a shock to the downside, but not deep. Now it can look forward to the Brexit vote and then summer.

Elsewhere look for Gold to consolidate with an upward bias while Crude Oil moves higher after a digestive pullback. The US Dollar Index looks to consolidate sideways at the bottom of the range while US Treasuries are biased higher. The Shanghai Composite and Emerging Markets are running in place with the Chinese market biased to lean lower and Emerging Markets higher.

Volatility looks to remain near the top of the lower range keeping the bias lower for the equity index ETF’s SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ), mildly. Their charts suggest intermediate term consolidation with a short term downward bias for the SPY and QQQ, but the IWM looking a bit stronger. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.