Here is your Bonus Idea with links to the full Top Ten:

It is well known in financial circles that Warren Buffett is a big fan of Cherry Coke. Coca-Cola Company (NYSE:KO), is one of his core holdings in Berkshire Hathaway (NYSE:BRKa) as well. Not an exciting momentum stock, at least most of the time. But it is a solid performer up 200% since the 2009 low. And it pays a 3% dividend. What is not to like.

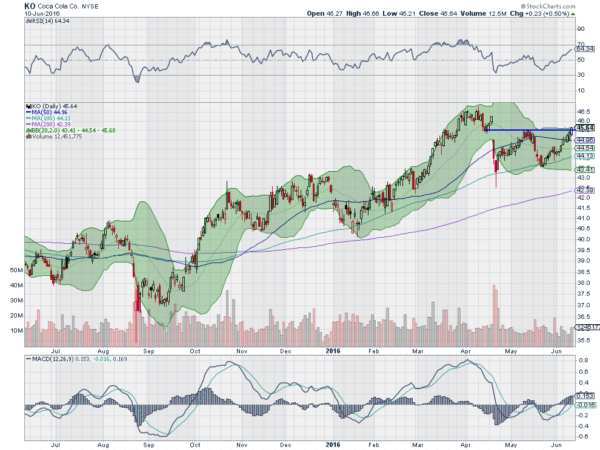

Right now the chart also looks good for a quick move higher. After a long consolidation from October 2015 until March this year, it broke to the upside. The stock ran to $47 but then quickly retraced back to the top of the consolidation box. Since then it has created another consolidation zone, with resistance at 45.75 above and rising support.

This has created two technical formations to watch. The first is the horizontal resistance (blue) at 45.75. It broke above this Friday on a strong candle finishing at the high. This confirms a reversal higher. The second is a symmetrical triangle (red). The break of this triangle gives a target to 49.15. Momentum supports this move up with the RSI in the bullish zone and rising and the MACD moving higher too.

There is resistance at 46.60 and 46.90 along the way. Support lower comes at 45.75 and 45.30 followed by 45 and 44.45 then 43.95. Short interest is low under 1%. The company is expected to report earnings July 19th, and the stock goes ex-dividend Monday. With a 35 cent dividend you may get a retest of the break out at the open.

In the options chains the biggest open interest this week is at the 46 strike on the call side, with size down to 45 as well on both sides. In July monthly options the 46 strike stands out as well, with size at 48 above too then smaller at 45. July 22 Expiry, just beyond the earnings report shows the at the money straddles pricing a $1.75 move by then, but open interest is not sizable at this point. In the August options there is big size above at 46 through 48. But the 45 strike is the biggest open interest.

Coca Cola

Trade Idea 1: Buy the stock now (over 45.75) with a stop at 45.

Trade Idea 2: Buy the stock now and add a collar, buying the July 22 Expiry 45.5/43.5 Put Spread and selling the August 47 Call (3 cents).

Trade Idea 3: Buy the July 46 Calls (56 cents).

Trade Idea 4: Buy the July 44/46 bullish Risk Reversal (31 cents).

Trade Idea 5: Buy the July 22 Expiry 45.5/44.5-44 1×2 Put Spread (free).

Trade Idea 1 is a straight stock buy while Trade Idea 2 adds protection through earnings down to 43.5 while allowing upward price action to 47 without adjusting. Trade Idea 3 gives the upside with controlled risk. Trade Idea 4 gives the upside with leverage and a possible entry at 44.31 at July Expiry if it closes under 44. Trade Idea 5 is an earnings trade for a pullback giving a possible entry in the middle of the consolidation box.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which heading into June Options Expiration week and the FOMC meeting sees the equity indexes taking a little breather to the downside, after big moves. It would be troublesome if it turns into more.

Elsewhere look for Gold to continue higher in the short term while Crude Oil continues its trend higher. The US Dollar Index continues to trend lower in the short term in broad consolidation while US Treasuries are breaking out higher. The Shanghai Composite continues to hold steady in the downtrend and Emerging Markets are biased to the downside short term in their broad consolidation.

Volatility looks to remain low but may creep up a bit keeping the bias higher for the equity index ETF’s SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ), but with less support that previously. Their charts are set to continue to digest the recent moves higher, with the QQQ weakest and then the IWM and the SPY holding well on the longer term charts. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.