Dow Chemical, NYSE:DOW, is a $60 billion chemical maker headquartered in Michigan. They are huge. And their product reach touches several industries. The Blue Chip for Blue chips. But what makes it interesting is not what they make or what they do. Instead it is that their stock price is moving.

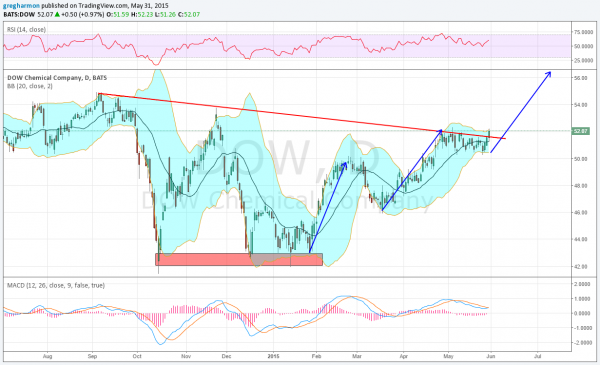

The chart below shows several positive factors. The first is that the price is rising. After making a bottom near 43 to end 2104 and start 2015, it rose to a peak at 50 in February. After a small pullback it rose again to 52 in April. Now it has consolidated for a month and last Friday started higher again. The two blue arrows denoting the previous moves higher would suggest a third to come to complete a three Drives pattern at 56.50. The price also broke above a falling trend resistance, another positive.

The momentum indicators look good as well. The RSI is holding in the bullish zone while the MACD is about to cross up, giving a bullish signal. The Bollinger Bands® which had turned lower in the latest consolidation, are now opening to the upside as well. These all support what the price action is showing.

On the options front the contracts expiring this week see large open interest at the 52 Strike, but then most other open interest below. Moving out to the monthly June Expiry, where activity is much larger, shows the 52.5 Strike as the largest open interest. Finally out in the July contracts the largest open interest is at 55. There is a trend higher.

The stock goes ex-dividend June 26th, and at a 3.2% rate will likely trigger some dividend trading in the options if it stays at this level. The company is expected to report earnings next on July 23rd before the market opens. Short interest in this behemoth is less than 1%.

Dow Chemical, Ticker: DOW

Trade Idea 1: Buy the stock (as long as it is over 51.50) with a stop at 50.

A straight stock trade.

Trade Idea 2: Buy the June 52 Calls (offered at 92 cents late Friday).

A defined risk, low cost way to participate.

Trade Idea 3: Buy the June 52/June 5 Expiry 53 Call Diagonal (78 cents, buy June, sell June 5).

A short term low cost method to participate expecting a slow price rise.

Trade Idea 4: Buy the July 52.5/June 53 Call Diagonal (60 cents).

A longer term low cost method to participate expecting a slow price rise.

Trade Idea 5: Buy the stock and add a June 26 Expiry 52/50.50 Put Spread (71 cents) September 57.5 Covered Call (41 cents) collar.

A method of owning the stock and protecting the downside through the dividend.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which, heading into June sees the equity markets as mixed, with the NASDAQ:QQQ strong but the ARCA:SPY and ARCA:IWM showing some short term weakness.

Elsewhere look for gold to continue to hold between 1180 and 1200 while crude oil consolidates with an upward bias. The US Dollar Index looks to continue higher while US Treasuries also are looking stronger, possibly breaking their downtrend. The Shanghai Composite is in pullback mode in the uptrend but at a good support level, while Emerging Markets are falling and look weak.

Volatility looks to remain subdued keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts are a bit mixed, with all better on the weekly timeframe than the daily, and the QQQ’s the strongest short term while the SPY and IWM may pullback. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.