Here is your Bonus Idea with links to the full Top Ten:

HollyFrontier Corporation (NYSE:HFC), refines petroleum and distributes the products including gasoline lubricants and waxes. The company is based in Dallas, Texas and is the result of a merger of Holly Corporation and Frontier Oil in 2011.

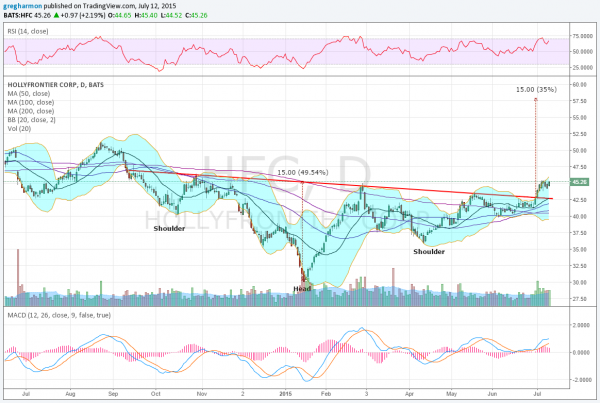

The stock got beaten down over the last half of 2014 along with the drop in oil prices. It made a bottom in January and rose through to the end of February. Since then it has moved sideways in a range, with a top where it ended Friday at 45.25.

The chart shows an Inverse Head and Shoulders pattern that triggered two weeks ago. That carries a price objective to at least 57.50. The initial move out is consolidating and a break higher would carry a Measured Move on the next leg to 49. If you look left on the chart the current level is also resistance from October.

There is further resistance above at 46.50 and 51 with the all-time high at 51.36. Support may come at 44.25 and 43.25 followed by 41.40 and 40 before 38.60 and 37.85. The Inverse Head and Shoulders would be violated on a move below the right Shoulder at 35.89.

The momentum indicators are positive. The RSI is deep in the bullish range and rising, while the MACD is rising too. Short interest is moderate to elevated at 6% and the company is expected to report earnings next on August 5th before the market opens.

Shifting to the options chains, the July open interest shows much more on the Put side than on the Call side, and almost all of the open interest on both sides below the current price. This would suggest a downward bias this week. It has weekly options as well with light open interest out to the August monthly Expiry, but again all to the downside.

Holly Frontier, Ticker: HFC

Trade Idea 1: Buy the stock on a move over 45.25 with a stop at 44.

A straight stock trade.

Trade Idea 2: Buy the stock and an August 7 Expiry 45/42.5 Put Spread (offered at 95 cents late Friday) and sell an August 47 Covered Call ($1.05 credit).

Stock with a collar through the earnings dater for protection to 42.50.

Trade Idea 3: Buy the August 45 Calls ($2.15).

A defined risk method to participate in the upside of the stock.

Trade Idea 4: Buy the August 45 Calls and sell the July 46.5 Calls ($1.75) for a Call Diagonal. Look to sell weekly calls each week as the previous week short calls expire. A strategy to own longer calls and sell premium from shorter calls to pay for it.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which, heading into July Options Expiration week sees the equity markets still looking vulnerable short term in their longer term uptrends.

Elsewhere look for gold continue to test the downside while crude oil also turns lower. The US Dollar Index seems ready to move higher in its consolidation while US Treasuries are biased lower in their consolidation. The Shanghai Composite and Emerging Markets are both bouncing and need to be watched carefully to see if the moves are real.

Volatility looks to remain in the elevated range of this low level, continuing to lessen the tail wind for the equity index ETF’s ARCA:SPY, ARCA:IWM and NASDAQ:QQQ. Their charts show the IWM looking the best short term as they all try to hold and reverse higher, while the QQQ and IWM look good longer term as the SPY is weakest. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.