Here is your Bonus Idea with links to the full Top Ten:

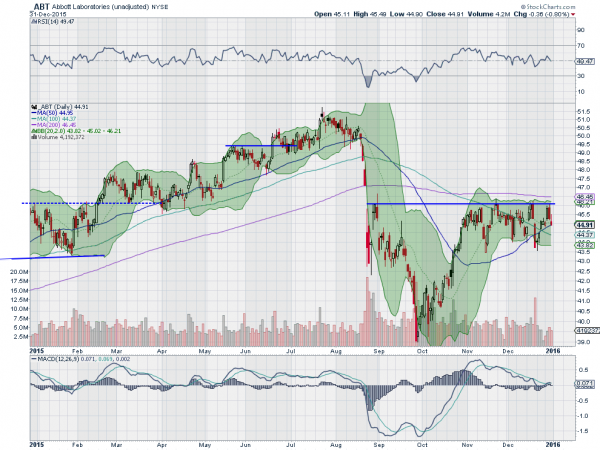

Abbott Laboratories (N:ABT), had a 17 month run higher before the pullback in the market in August 2015. It took a large hit them and then suffered another body blow when Hillary Clinton declared war on drug pricing in September. It has since recovered the ground lost on the second point and been consolidating around resistance at 46.

The stock moved back over the 50 day SMA in lat October and retested that two weeks ago. Since it has been acting as support, tightening against the resistance at 46. The RSI remains in the bullish zone, drifting near 50 after a move over 60. The MACD is trending lower but crossed up as it hit the zero level last week.

There is resistance at 46 and a move over that would trigger a target to 53, a new high, on a Cup and Handle break out. Or you could call it an AB=CD or Measured Move too, all point to 53. Support lower comes at 44.75 and 43.50 with a break under that targeting the prior low at 39 as a start. Short interest is low at 1.1% and the company is expected to report earnings next on January 27th.

Checking the options activity the January chain shows large open interest on the call side to the upside from 45 to 50 and then it tails off a bit but continues higher. The put side has high open interest at 45 and then the biggest at 40 below. Moving out to February, beyond earnings, sees a possible buffer at 43 in the put open interest with the call side showing volume from 44 to 50 above.

Abbott Labs, Ticker: ABT

Trade Idea 1: Buy the stock on a move over 46 with a stop at 45.

A straight stock trade.

Trade Idea 2: Buy the January 46 Calls (offered at 23 cents late Friday) on the same trigger.

Using defined risk to gain the upside.

Trade Idea 3: Buy the January 40/46 bullish Risk Reversal (17 cents).

A leveraged trade for upside participation.

Trade Idea 4: Buy the February 48 Calls and sell the February 43/42 Put Spread (10 cents).

A levered trade with defined risk and more time.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Thursday which, as the books closed on 2015 and we started prep for 2016 saw the equity markets showing a lack of strength at best and some weakness short term.

Elsewhere look for consolidation to rule the short term. In Gold look for consolidation in the downtrend with Crude Oil also consolidating its move lower. The US Dollar Index looks to consolidate in the uptrend while US Treasuries just continue broad consolidation sideways marking time. The Shanghai Composite looks to continue its sideways motion while Emerging Markets are biased to the downside in consolidation.

Volatility looks to remain subdued keeping the bias higher for the equity index ETF’s N:SPY, N:IWM and O:QQQ. Their charts look to move into the New Year showing further consolidation in the long run but with some weakness in the short run, especially in the SPY. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.