Here is your Bonus Idea with links to the full Top Ten:

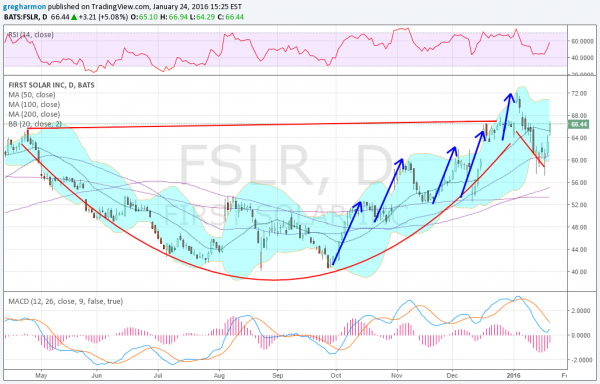

First Solar (O:FSLR) went through a long rounding pullback in 2015. As it started to come out the other side in October, breaking the 200 day SMA, it stair stepped higher. That stair stepping has continued making a series of higher highs and higher lows.

The price action can also be seen as a Cup and handle pattern, that would give a target to 92. The RSI has gone through the rise and pullback phases as well, holding in the bullish zone each time over 40. And currently it is rising along with the MACD which is about to cross up, a buy signal.

There is resistance above at 67.30 and 72 followed by 74.50. Above that and there is little prior history from the fall from the 170’s until 88 followed by 104 and 115.50. These are shown in the weekly chart. Short interest is moderate at 4.9% and the company is expected to report earnings February 23rd.

The options chains show weekly options and the January 29 Expiry with light open interest but biggest at 67.5 on the call side above. February options show biggest open interest in the call side as well and at the 70 and 75 strike, with smaller size spread from 55 to 62.5 on the put side. And the February 26 Expiry options, just beyond the earnings report, show little activity as yet but an expected price envelope of 57.40 to 75.40 by expiry.

First Solar, Daily

Trade Idea 1: Buy the stock now (over 64) with a stop at 60.

A straight stock trade.

Trade Idea 2: Buy the stock with a February 26 Expiry 64/60 Put Spread 70 Covered Call Collar (collar is free).

The collar adds protection through earnings.

Trade Idea 3: Buy the January 29 Expiry 66.5 Calls ($1.90).

A defined risk entry for a quick trade.

Trade Idea 4: Buy the February 66.5/70 Call Spread ($1.65).

Capping the upside but giving more time with defined risk.

Trade Idea 5: Buy the February 66.5/70.5 1×2 Call Spread for free.

Adds margin usage and looks for large open interest at 70 to stall the stock. Profitable between 66.50 and 74.5 at expiry.

Trade Idea 6: Buy the February 66.5/70.5/74.5 Call Butterfly (80 cents).

Similar to #5 but takes away the margin usage, and tightens profit range to between 67.30 and 73.70 at expiry.

First Solar, Weekly

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which, heading into the last week of January saw equity markets which seemed to have found some footing but still having to prove themselves.

Elsewhere looked for gold to move higher in its downtrend while crude oil bounced and will show us if it wants a reversal. The US dollar index was on the edge of a break out higher while US Treasuries were biased lower short term in the move higher. The Shanghai Composite was consolidating in the downtrend while Emerging Markets paused in their move lower.

Volatility looked to remain elevated but drifting lower keeping the bias lower for the equity index ETFs N:SPY, N:IWM and O:QQQ, but loosening the vice grip. The ETFs themselves all looked to continue the bounce in their downtrends with some work left to show that the worst is over. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog. Please see my Disclaimer page for my full disclaimer.