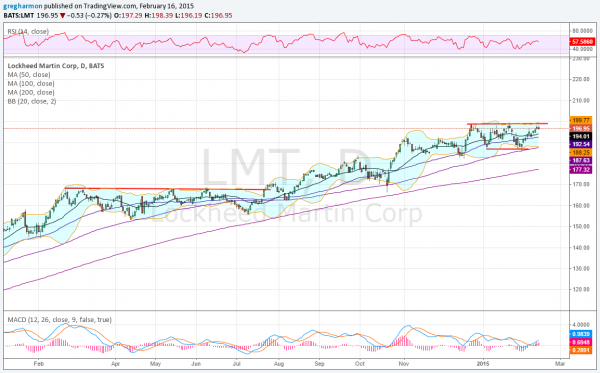

Lockheed Martin (NYSE:LMT), has been in a strong trend higher for quite some time. Since late December though it has been consolidating in a channel between 187 and 199. Unable to reach 200. The SMA’s show the trend higher and notice that the last bottom in the channel touched the 100 day SMA before moving up.

It now rests at the top of the channel. As it sits there the Bollinger Bands® are opening higher to allow a move. Also the RSI is trending higher with a MACD crossed up and rising. These support more upside price action.

When the stock has moved up it has tended to be in $15 to $20 runs. That could move it to 215 to 220 on a break over 200. That is interesting. There is no resistance above the channel and support lower may come at 192.50 and 187. Short interest is low at about 1%. The company does not report earnings again until April 28th.

The February options chain shows large open interest st both the 195 and 200 Strike Calls, with 200 the biggest. These both are at least double the open interest of any strike on the put side. They could act as a containment zone this week. With the larger open interest at 200 it could also start a break out of the channel on a pin at 200. March open interest shows large size at the 200 Strike Call as well but also at the 170 Strike Put.

Lockheed Martin, (NYSE:LMT)

Trade Idea 1: Buy the stock on a move over 199 with a stop at 193.

A straight stock trade.

Trade Idea 2: Buy the March 200 Calls for $2.20.

A cheaper, defined risk way to participate in a move higher in the stock.

Trade Idea 3: Sell the February 195 Straddle for a $3.65 credit.

This trade looks for the range to continue this week and large open interest to stay in control of price. It also offers the possibility of owning the stock at 191.35 at the end of the week.

Trade Idea 4: Buy the February/March 200 Call Calendar for $1.90.

This trade looks to own those March 200 Calls cheaper, using the large open interest at 200 in February as a speed brake.

Trade Idea 5: Buy the February 195/June 210 Call Diagonal for 50 cents.

This is a longer term trade and designed to call the stock at the end of the week, or roll up the February Calls to March Calls.

Elsewhere look for Gold to lower in the short term in the longer consolidation while Crude Oil consolidates, and may be ready to reverse higher. The US Dollar Index looks to continue in a consolidation range while US Treasuries are biased lower. The Shanghai Composite looks to continue to pullback in the uptrend and Emerging Markets look to hold in the bear flag, and might prove it a reversal higher.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Original post