Here is your Bonus Idea with links to the full Top Ten:

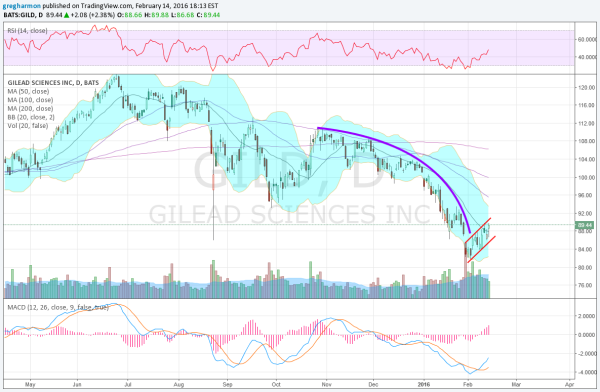

Gilead Sciences (O:GILD) accelerated lower from a lower high in October. It finally bounced at the end of January, and has been rising in a channel since. This leaves the question: Will this be a bear flag or a reversal?

The chart shows the momentum rising off of oversold conditions and making a higher high as it approaches the mid line. The MACD is crossed up and rising. These support continued upside, but falls short of strong support. The stock sits over the 20 day SMA for the first time in a couple of months, but all of the SMA are falling.

There is resistance above at 89.50 and 92.50 followed by 96.25 and 97.75 before 100. Support lower comes at 86.15 and 84 followed by 82.25. Short interest low at only 1.5%.

Looking at the options open interest shows weekly options, with the February monthly expiring this week. There is extremely high open interest at 92.5 and 93 this week, with large size at 89 as well on the call side. March monthly options show open interest spread from 85 to 110 on the call side and biggest at 85 and 80 on the put side.

Gilead Sciences

Trade Idea 1: Buy the stock on a move over 90 with a stop at 87.25.

Trade Idea 2: Buy the stock with a March 87.5/80 Put Spread ($2.00) and selling an April 100 Call (96 cents).

Trade Idea 3: Buy the February/March 90 Call Calendar ($2.00).

Trade Idea 4: Sell the stock short on a move under 86 with a stop at 90.

Trade Idea 5: Buy the March 11 Expiry 89 Puts for $3.05.

Trade Idea 6: Buy the March 11 expiry 89/85 Put Spread for $1.55.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday. Heading into the February Operations Expiration Week, the equity markets started with a weak move lower and then consolidation with a promise Friday.

Elsewhere gold looks overdone to the upside and ready for a pullback while crude oil bounces in the downtrend. The US Dollar Index has short term strength in the downturn while US Treasuries may also be overdone to the upside and ready to pullback. The Shanghai Composite comes back after a week off looking to consolidate while Emerging Markets consolidate in their downtrend.

Volatility looks to remain elevated keeping the bias lower for the equity index ETFs N:SPY, N:IWM and O:QQQ. Their charts show possible reversals higher in the downtrend in the short run, but intermediate weakness remains. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog. Please see my Disclaimer page for my full disclaimer.