Here is your Bonus Idea with links to the full Top Ten:

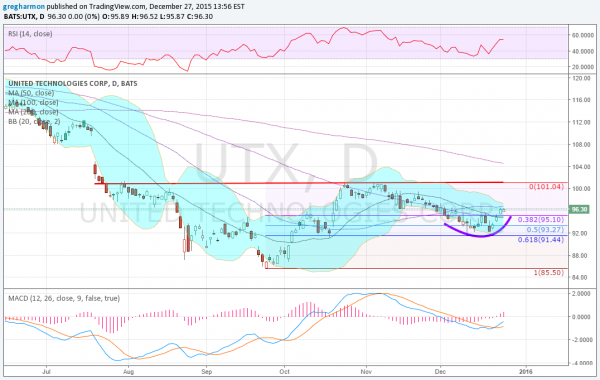

United Technologies (N:UTX), has its hands in many complex systems and companies in the aerospace industry. It makes things that fly but its stock certainly has not been doing that lately. Since June it had lost nearly 30% of its value before bouncing in October. That bounce found resistance just above the round number 100 at 101 and pulled back again.

The last pullback retraced 61.8% of the bounce and then turned back higher last week. This formed a higher low. A positive for the stock. The rounded bottom on the pullback is also a good signal. The stock has support for a move higher from the positive and bullish momentum indicators. The RSI is moving into the bullish zone as it rises while the MACD is crossed up and rising.

There is resistance above at 98.40 and 101 followed by 104.40 and a gap to fill to 109.40. Support lower comes at 92.30 and 90.90. Short interest is moderate at 6.1% and the company is expected to report earnings next on January 27th.

Checking the options chains reveals weekly chains. The December 31st Expiry has the highest open interest at the 95 and 100 strikes on the call side. The January monthly options show very large open interest at the 85 put strike and then similar but smaller by a factor of 2 size at each of the 90, 95, 97.5, 100 and 105 strikes. Moving to the January 29th expiry, beyond earnings, sees little open interest at this point. Finally in February monthly options the open interest is much large on the call side and from 95 to 105.

United Technologies, Ticker: UTX

Trade Idea 1: Buy the stock now (over 95) with a stop at 92.

A straight stock trade.

Trade Idea 2: Buy the stock now with a January 29 Expiry 94/88 Put Spread, 100 Covered Call Collar (38 cents).

Adding protection through earnings with a collar to the stock trade.

Trade Idea 3: Buy the January 96.5/100 Call Spread ($1.10).

A defined risk way to participate in upside.

Trade Idea 4: Buy the January 96.5/97.5 Call Spread (57 cents) and sell the January 94 Put (62 cents) for a 5 cent credit.

A short term leveraged trade for those comfortable owning the stock at 94.

Trade Idea 5: Buy the January/January 29 Expiry 97.5 Call Calendar (69 cents).

A trade for upside on earnings but not before January monthly expiry.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which, heading into another holiday shortened week, and one that should prove to be very light on everything, sees the equity markets have rebounded but are still looking vulnerable, especially the SPY.

Elsewhere look for Gold to consolidate in its downtrend while Crude Oil continues a bounce in its downtrend. The US Dollar Index looks to be weaker short term in consolidation while US Treasuries consolidate. The Shanghai Composite looks to continue consolidation with an upward bias while Emerging Markets bounce in their consolidation of the downward move.

Volatility looks to remain Subdued keeping the bias higher for the equity index ETF’s N:SPY, N:IWM and O:QQQ. Their charts agree with that in the short term with the IWM looking the strongest. In the intermediate term the SPY looks weakest while the IWM and QQQ continue the sideways churn. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.