Fifth Harmony has nothing to do with Fifth Third Bancorp (NASDAQ:FITB), but if they were smart they would find a way to work the girl group into their plan. They are an interesting company as they have bought up almost every derivation of 5-and-3 websites to direct traffic to their site.

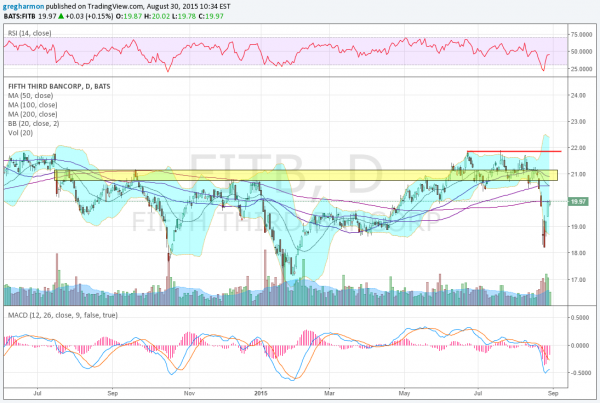

The stock had a good run higher in 2015 until reaching a consolidation zone in June. The market sell off hit it hard, dropping the price over 10% before a bounce late last week. Through that it made a higher low to go with the higher high near 22. On a Measured Move that would project to a high at 22.85.

The RSI is climbing again too. In fact on a broad scale there is now a Positive RSI Reversal in play against that January low that reinforces the 22.85 target. The MACD also turned back high off the low and is losing in on a positive cross. The stock sits at the 200 day SMA going into the week and in the lower half of the Bollinger Bands®. And it has short interest under 2%.

Looking at the options chains the September Expiry has large open interest on the Put side above at 21 and the Call Side at 22. These could draw the stock higher into expiration. In October contracts are just starting to build with the preference being the 18 Strike Put, possibly as protection and the 20 Strike Call. The October Strike expires the day after the expected earnings report on the 15th.

Fifth Third Bancorp (NASDAQ:FITB)

Trade Idea 1: Buy the stock with a stop at 19.30.

A straight stock trade.

Trade Idea 2: Buy the September 20 Calls (58 cents).

A defined risk method to participate in an upward move.

Trade Idea 3: Buy the September 20 bullish Risk Reversal (2 cents).

Adds leverage and risk of ownership at 20.

Trade Idea 4: Buy the stock with a October 18/21 Collar (3 cent credit).

An entry to the stock with protection for earnings.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed, Friday which, heading into the unofficial last week of Summer sees the equity markets have dodged a bullet, but still need to prove they have the strength to continue and not get pulled lower.

Elsewhere look for gold to continue to bounce in its downtrend while crude oil continues higher. The US Dollar Index is biased to the upside in consolidation while US Treasuries are biased lower. The Shanghai Composite and Emerging Markets both look to continue their bounce in the downtrends, and may turn into reversals.

Volatility looks to remain elevated keeping the bias lower for the equity index ETF’s (NYSE:SPY), (NYSE:IWM) and (NASDAQ:QQQ), despite their rebounds higher. Their charts all show signs of both promise to the upside but further risk or another turn lower. Best to keep all long trades on a tight leash. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.