Here is your Bonus Idea with links to the full Top Ten:

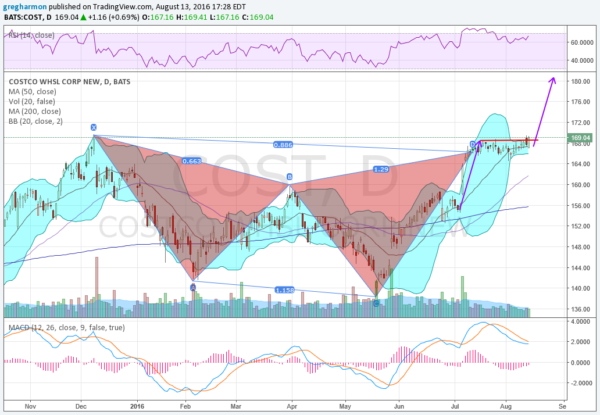

Costco (NASDAQ:COST), started a pullback in December that ran to a low in February. It bounced to a peak at the start of April and then fell back to a lower low. The move higher from there retraced the full initial drop by early July and has been consolidating since.

That full set of moves created a bearish Shark harmonic, reaching the Potential Reversal Zone (PRZ) in the beginning of July. But it refused to reverse. After a month it is looking to move higher with a strong candle Friday. There is a Measured Move to the upside that gives a target to about 180.60. With the Bollinger Bands® squeezing, it may be ready to move now.

The RSI is in the bullish zone and holding firm, with the MACD leveling and positive after a reset lower. Short interest is low at 2.1%. The company is expected to report on September 29th, and the stock went ex-dividend August 10th.

The options chain expiring this week sees very large open interest at the 165 Strike on the call side and then big at 170 as well. The put side is spread from 160 to 165 but smaller. September monthly options as largest on the call side as well, but at a higher 175 Strike. And the October options, the first beyond the reporting date, shows open interest on the call side spread from 160 to 170 and then the put side from 145 to 165.

Costco

Trade Idea 1: Buy the stock as it moves over 168.50 with a stop at 165.50.

Trade Idea 2: buy the stock as it moves over 168.50 with a August 26 Expiry 167.5/September 9 Expiry 172.5 collar.

Trade Idea 3: Buy the September 170 Calls ($2.29).

Trade Idea 4: Buy the August/September 170 Call Calendar ($1.70).

Trade Idea 5: Buy the August/September 170 Call Calendar and sell the September 160 Put ($1.10).

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which heading into August options expiration sees the Equity markets continuing to look strong but maybe in need of a short term pause.

Elsewhere look for Gold to consolidate in its uptrend while Crude Oil rises. The US Dollar Index seems content to move sideways in broad consolidation while US Treasuries consolidate near their high. The Shanghai Composite and Emerging Markets are both biased to the upside next week.

Volatility looks to remain at abnormally low levels keeping the bias higher for the equity index ETF’s SPY (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). Their charts show that the SPY and IWM may need a pause or retrenchment in the short term, while the QQQ continues to lead. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.