Here is your Bonus Idea with links to the full Top Ten:

Bristol-Myers Squibb (NYSE:BMY) is headquartered in the heart of midtown, on Park Avenue in New York City. Not exactly where you would expect to see a company that discovers, develops, licenses, manufactures, markets, distributes and sells biopharmaceuticals world wide. Or maybe it is with a market cap of over $100 billion.

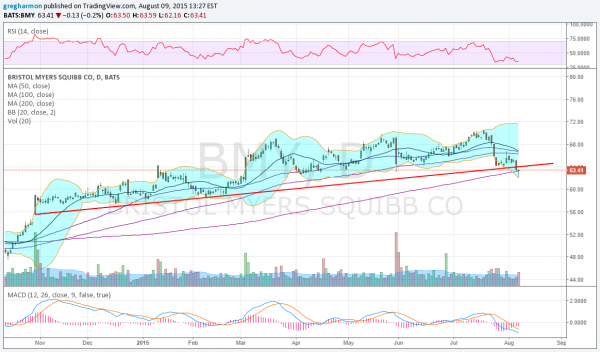

Over the last 9 months since the stock price up off of its moving averages, it has found rising trend support, moving the range higher. That is until last week. Thursday it broke down below that trend line and Friday continued. It comes into the week sitting on its 200 day SMA, where it has not been since that move up began in October.

It also printed a Hammer candlestick Friday though. This can be a sign of a reversal, when it is confirmed by a higher close the next day, in this case Monday. The RSI is now in the bearish zone and the MACD is falling. These support more downside price action.

Which way will it go, a continuation lower, or a reversal higher? I do not know, but there is resistance above at 64.25 and 66 followed by 69.25 and 70.50. Support lower may show up at 62.50 and 60.75 followed by 58.85 and 57.50.

The options chains show weekly contracts out to September 25th and then monthly contracts. The open interest on the weekly options is sizable at the 63 Put Strike, near the current price. But it is twice as big at the 71.5 Call Strike. The August monthly Expiry sees enormous open interest at the 70 Call Strike. The company is expected to report earnings next October 22nd and the short interest is low under 2%.

Trade Idea 1: Buy the stock on a move over 64 with a stop at 62.

A straight stock trade.

Trade Idea 2: Buy the August 64 Calls (offered at $1.00 late Friday).

A defined risk method of participating in the stock price move.

Trade Idea 3: Buy the August 63/64 bullish Risk Reversal (4 cents).

Adds leverage to the options trade.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad market macro picture reviewed Friday which, heading into next week sees the news and earnings dry up and Equities could use some quiet time to steady.

Elsewhere look for a possible bounce out of gold in its downtrend while crude oil continues lower. The US Dollar Index looks to continue to consolidate with an upward bias while US Treasuries continue higher. The Shanghai Composite remains in broad consolidation in the pullback while Emerging Markets look like they may break a 4 year range to the downside.

Volatility looks to remain subdued keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ, despite the moves lower. Their charts show further short term weakness possible but the Hammer candles could confirm a short term bottom. On the longer timeframe The IWM remains weakest with the SPY consolidating and the QQQ looking strong. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.