Here is your Bonus Idea with links to the full Top Ten:

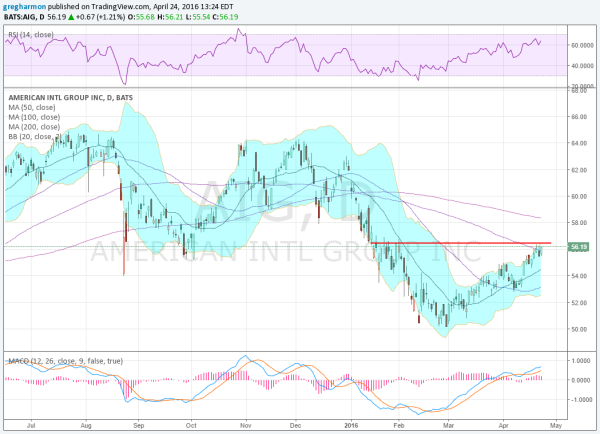

American International Group Inc (NYSE:AIG), pulled back from a double top in December, finding support at $50 at the end of February. Since then it has been riding higher and is now back at the resistance area from January before it dropped the final leg. The shorter SMA’s are turning higher now as the 20 and 50 day rise, and Friday saw the price move over the 100 day SMA for the first time since the first trading day of 2016.

Momentum is building as well. The RSI is into the bullish zone now and the MACD has crossed back higher and is positive. The Bollinger Bands® are also turned higher, to let the stock run up. Short interest is low in this stock at only 1.2%. There are a lot of shares outstanding.

There is resistance just above at 56.45 and then 57.50 followed by 59.15 and 60.65 before 62 and 62.75 then 64.25. These are based upon where prior price battles have occurred. Support lower may come at 55.25 and 54 before 53 and 51.25 then 50. The company is also expected to report earnings on May 2nd after the close.

Options expiring this week suggest a $1 range based on the at-the-money straddle and open interest favors that it is to the downside. There is large open interest at 53 on the put side and at 55 and 55.5 on the call side. Looking to the May 6th expiry, beyond earnings sees a $2.25 move implied in the straddle. Open interest is lighter, but biggest above at the 57 strike on the call side.

The May monthly options look more like this week with large open interest below at 52.5 on the put side and 55 on the call side, but with some size at 56 and 57.5 there too. Longer term in August also sees bigger open interest below on the put side, at 50 and 52.5, and spread from 52.5 to 65 on the call side.

The chart reads higher and options read lower. Hmmm.

AIG

Trade Idea 1: Buy the stock on a move over 56.45 with a stop at 55.25.

Trade Idea 2: Buy the May 6 Expiry 56.5 Calls ($1.03) on a move over 56.45 in the stock, with a stop at 55.25 in the stock price.

Trade Idea 3: Buy the May 6 Expiry 56/54.5 1×2 Put Spread (free).

Trade Idea 4: Buy the April 29 Expiry 56/May 6 Expiry 57 Call Diagonal (7 cent credit).

Trade Idea 5: Buy the May 6 Expiry/August 57.5 Call Calendar ($1.46) and sell May 52.5 Puts for $1.04.

The first is a straight stock trade for the short run into earnings. #2 is the same but only risking $1.03 no matter what happens. #3 is a trade for a pullback on the earnings report, and could give you entry to the stock at $53. #4 looks for a short term move higher this week and the options open interest to contain the stock next week. You would look to sell the April calls at the end of the week. #5 is a longer term trade, relying on the open interest for next week to contain the stock. Upon expiry of the May Calls you would look to sell June Calls to collect more premium. This also has potential to put you in the stock at 52.5 at may expiry.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which heading into the last week of April the Equity indexes are showing signs of rotation out of the PowerShares QQQ Trust Series 1 (NASDAQ:QQQ) and SPDR S&P 500 (NYSE:SPY) and into the iShares Russell 2000 (NYSE:IWM).

Elsewhere look for Gold to consolidate in a $30 range while Crude Oil continues higher. The US Dollar Index continues to test the bottom of a wide consolidation range while US Treasuries are biased lower. The Shanghai Composite and Emerging Markets are biased to the downside with risk of the Emerging Market longer term uptrend re-exerting itself. Volatility looks to remain subdued and with a bias lower keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ, despite the moves last week.

Their charts are mixed with the IWM just strong all around and the SPY strong on the weekly timeframe but with cracks on the daily. The QQQ is the weakest on the daily and shows consolidation on the weekly. Perhaps next week rotates back into the QQQ. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.