Here are the Rest of the Top 10:

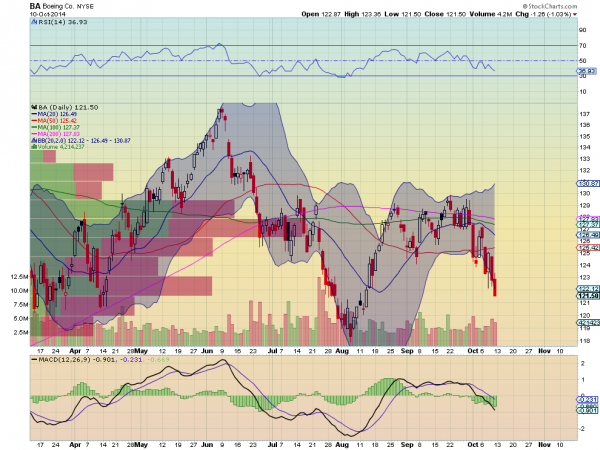

Boeing, Ticker: BA

Boeing (NYSE:BA) fell from a consolidation in the high 120′s last week. Ending on the low, the RSI moved into the bearish zone with the MACD falling. Both support more downside, and the Measured move suggest 110 as a possibility.

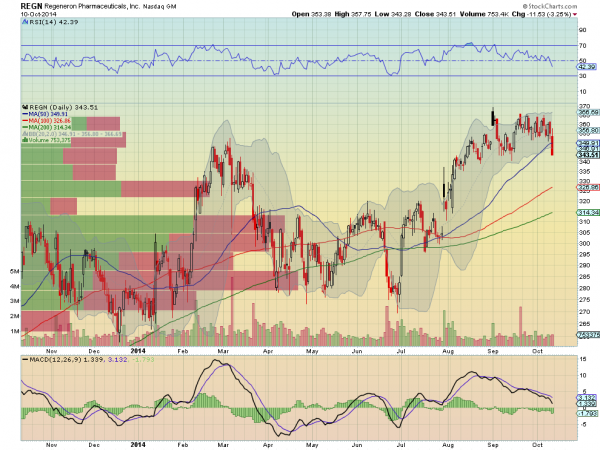

Regeneron Pharmaceuticals, Ticker: REGN

Regeneron Pharmaceuticals (NASDAQ:REGN) fell out of a consolidation at the end of last week and closed under the 50 day SMA for the first time since mid July. The RSI is falling and nearing the bearish zone while the MACD continues lower.

Royal Bank of Canada, Ticker: RY

Royal Bank of Canada (NYSE:RY) was a strong stock the first half of the year and then started to consolidate. The pullback in September looked to have found support but then broke lower again Friday, showing it may have just been a bear flag. The RSI is falling along with the MACD. This is a big week for banks reporting so it could be influenced although it does not report until early December.

Skechers USA, Ticker: SKX

Skechers USA (NYSE:SKX) had a 15 month run higher out of consolidation at 22.50. That ended in September when it started to pullback. It found support at the 100 day SMA but broke down out of that consolidation Friday. The RSI is falling and in the bearish zone with a MACD that is also falling, supporting a downside continuation.

Zoetis, Ticker: ZTS

Zoetis (NYSE:ZTS) has held up very well during the market pullback so far. Sitting on support, the RSI is holding over the mid line while the MACD is falling. There is a lot of room lower if it joins the pullback party but on a market reversal this strength is something you want to own.

Up Next: Bonus Idea

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which, heading into October Options Expiration sees the picture for the equity markets looking gloomy. Elsewhere look for Gold to bounce in its downtrend while Crude Oil continues lower. The US Dollar Index is strong and biased higher along with US Treasuries. The Shanghai Composite is also looking at heading higher while Emerging Markets are biased to the downside. Volatility is on the cusp of a break out higher putting equities at risk. The charts of the Index ETF’s, SPDR S&P 500 (ARCA:SPY), iShares Russell 2000 Index (ARCA:IWM) and PowerShares QQQ (NASDAQ:QQQ), show that as well, with the IWM starting a downtrend while the SPY and QQQ are also biased lower in the short run, but look stronger in the longer timeframe. This week could prove crucial for equities. Use this information as you prepare for the coming week and trad’em well.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.