Here are the Rest of the Top 10:

AOL, Ticker: AOL

AOL (NYSE:AOL) has been trending higher since a 20% drop following the May earnings report. Currently it is consolidating under resistance after it broke to 9 month highs. The RSI is in the bullish zone and the MACD is kinking back towards a cross.

NetApp, Ticker: NTAP

NetApp (NASDAQ:NTAP) is back touching resistance for the 4th time, the last 3 from higher lows. As it reaches this time the RSI is in the bullish zone and moving up while the MACD has just crossed higher. The dip in October violated the Cup and Handle by moving more than 50% from the lip but the series of higher lows is promising.

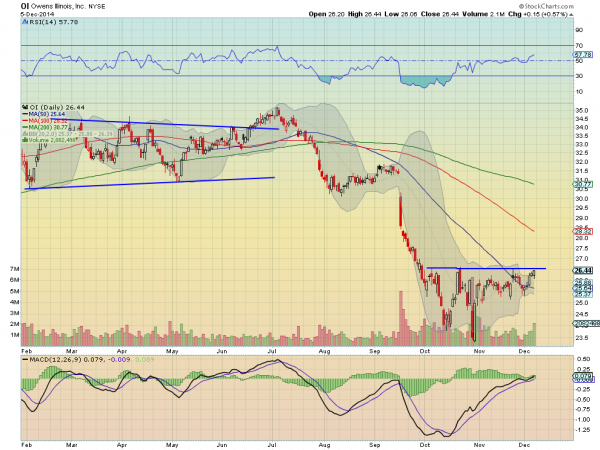

Owens-Illinois, Ticker: OI

Owens-Illinois (NYSE:OI) did a shake and bake move, breaking a symmetrical triangle higher then failing and crashing lower. Since then it has been consolidating under resistance and recently crossed back above the 50 day SMA for the first time in 4 months. The RSI is rising off of the mid line towards the bullish zone while the MACD is also rising. These support more upside.

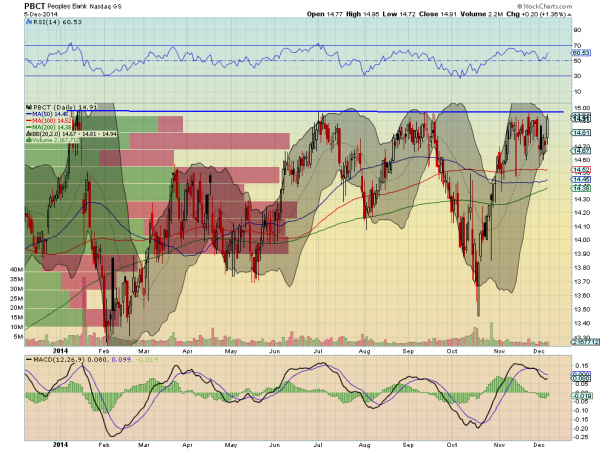

People’s United Financial, Ticker: PBCT

People’s United Financial (NASDAQ:PBCT) is back at resistance that has held it since the start of the year. This time the Bollinger bands are opening higher and it printed a long bullish candle Friday. These gain further support from the rising and bullish RSI and the MACD turning back up towards a bullish cross.

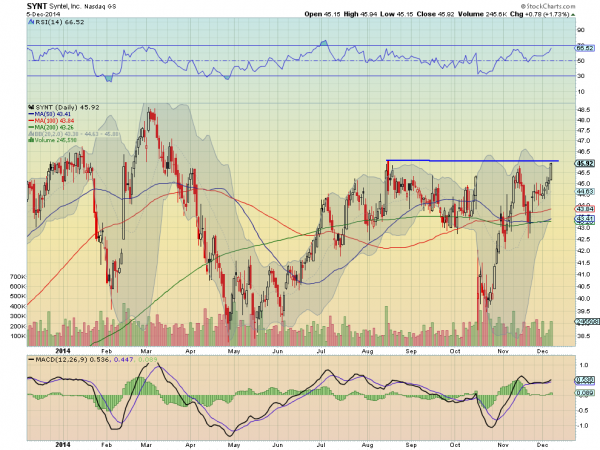

Syntel, Ticker: SYNT

Syntel (NASDAQ:SYNT) is approaching resistance from a higher low. The bullish Marubozu candle Friday combined with the rising and bullish RSI and rising MACD support a push through the resistance.

Up Next: Bonus Idea

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which, heading into next week sees equities broadly looking better higher, but signs of rotation are showing up. Elsewhere look for Gold to continue the short term channel higher in the downtrend while Crude Oil may be finding a bottom at last. The US Dollar Index continues to be strong as US Treasuries are biased lower in the uptrend. The Shanghai Composite looks to continue its uptrend, but perhaps with a short term pause while Emerging Markets are consolidating in a bear flag and biased to the downside. Volatility looks to remain subdued keeping the bias higher for the equity index ETF’s SPDR S&P 500 (ARCA:SPY), iShares Russell 2000 Index (ARCA:IWM) and PowerShares QQQ (NASDAQ:QQQ). The SPY looks good on the longer timeframe with the IWM starting to move out or a tight range higher. The QQQ looks a bit tired in the short run and money may be rotating out of it to the IWM now. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.