Here are the Rest of the Top 10:

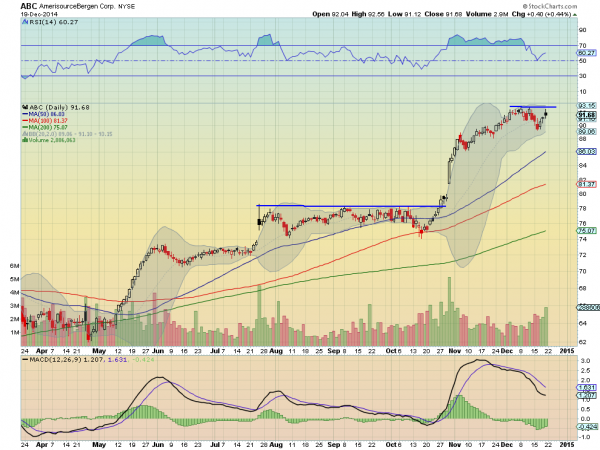

AmerisourceBergen, Ticker: ABC

AmerisourceBergen, ABC, went through a basing period from late July until mid October before launching higher. Now it is consolidating under new resistance after a small pullback. The RSI is moving back higher in the bullish zone after bouncing off the mid line while the MACD is flattening.

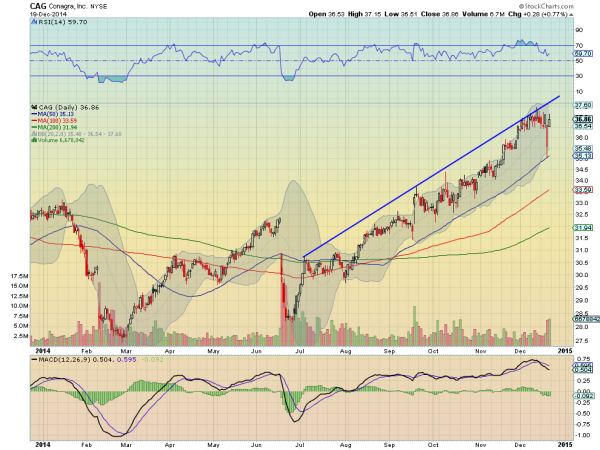

ConAgra Foods Inc (NYSE:CAG)

ConAgra, CAG, reported earnings last week and pulled back intraday to the 50 day SMA. A Hollow Red candle showed a quick rebound and it is now at resistance again. The MACD continues lower but the RSI is trying to rebound, while it has remained in the bullish zone.

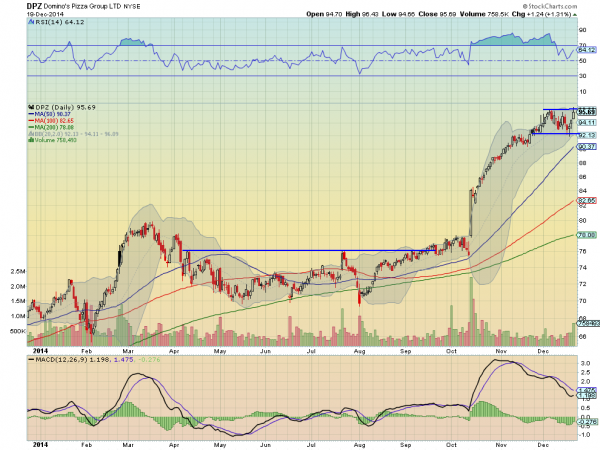

Domino’s Pizza (NYSE:DPZ)

Domino’s Pizza, DPZ, broke a long consolidation area higher in October, and has been absorbing the move since the beginning of December. The price is now approaching the top of the new consolidation range with a RSI that is running higher after a bounce, and in the bullish zone and a MACD that is turning back up.

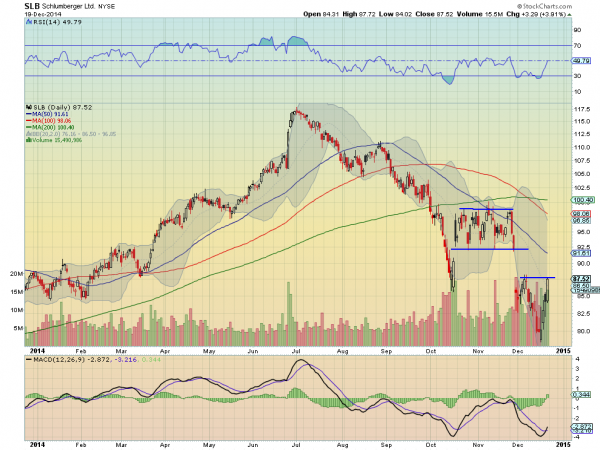

Schlumberger (NYSE:SLB)

Schlumberger, SLB, has been trending lower since July began. The recent ‘V’ bottom in December gives hope for a reversal, as it is back at the gap lower level Friday after printing a bullish Marubozu candle. The RSI is trying to crack the mid line while the MACD has crossed up and is rising.

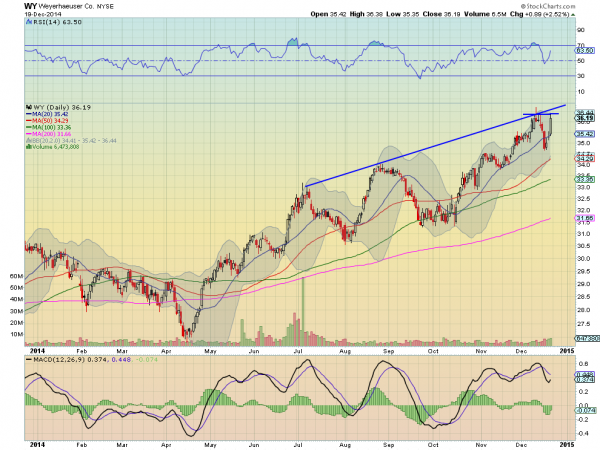

Weyerhaeuser (NYSE:WY)

Weyerhaeuser, WY, is moving higher is a strong trend since April. The pullback ending last week has reversed and is back at resistance with a rising and bullish RSI and a MACD turning up. The series of higher lows and higher highs continues. The RSI held at the mid line on the pullback, a strong bullish signal.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which, heading into the Holiday shortened week for Christmas, sees the Santa Claus Rally already in full swing for equities. Elsewhere look for Gold to continue to bounce in its downtrend while Crude Oil gains some footing. The US Dollar Index is making another leg higher while US Treasuries also look towards all-time highs. The Shanghai Composite continues its move higher but requires a cautious stance from a momentum perspective while Emerging Markets are reversing higher. Volatility looks to remain subdued again and may fall keeping the bias higher for the equity index ETF’s SPDR S&P 500 (ARCA:SPY), iShares Russell 2000 Index (ARCA:IWM) and PowerShares QQQ (NASDAQ:QQQ). Both the SPY and QQQ look to retest their prior highs and the IWM its all-time high. Use this information as you prepare for the coming week and trad’em well.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.