Here are four stocks with buy rank and strong value characteristics for investors to consider today, September 5th:

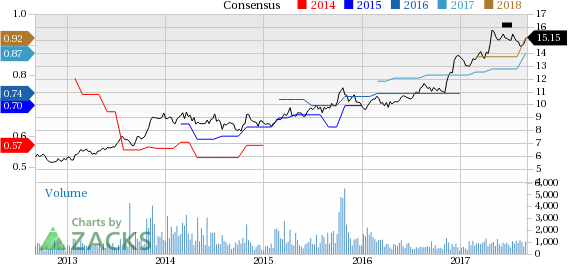

CBIZ, Inc. (CBZ): This professional business services provider has a Zacks Rank #1 (Strong Buy), and seen the Zacks Consensus Estimate for its current year earnings increasing 6.1% over the last 60 days.

CBIZ has a price-to-earnings ratio (P/E) of 17.41, compared with 17.50 for the industry. The company possesses a Value Score of A.

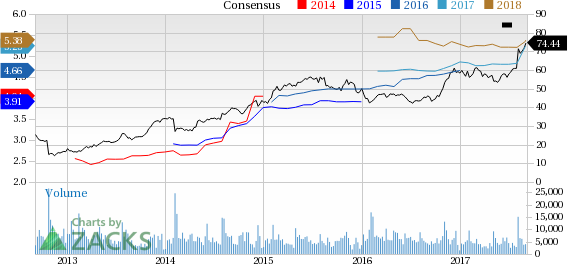

Spirit AeroSystems Holdings, Inc. (SPR): This commercial aero structures manufacturer has a Zacks Rank #2 (Buy), and seen the Zacks Consensus Estimate for its current year earnings advancing 8.7% over the last 60 days.

Spirit AeroSystems Holdings has a price-to-earnings ratio (P/E) of 14.24, compared with 54.50 for the industry. The company possesses a Value Score of A.

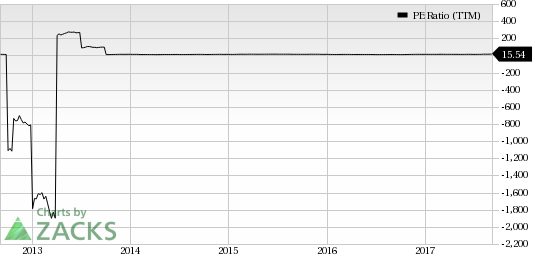

Atento S.A. (ATTO): This customer relationship management services provider has a Zacks Rank #2 (Buy), and seen the Zacks Consensus Estimate for its current year earnings increasing 13.9% over the last 60 days.

Atento has a price-to-earnings ratio (P/E) of 14.57, compared with 23.30 for the industry. The company possesses a Value Score of A.

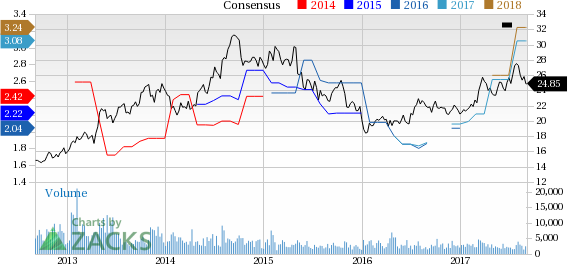

SK Telecom Co., Ltd. (SKM): This wireless telecom services provider has a Zacks Rank #1 (Strong Buy), and seen the Zacks Consensus Estimate for its current year earnings advancing 17.6% over the last 60 days.

SK Telecom has a price-to-earnings ratio (P/E) of 8.21, compared with 14.70 for the industry. The company possesses a Value Score of A.

See the full list of top ranked stocks here

Learn more about the Value score and how it is calculated here.

Zacks' 10-Minute Stock-Picking Secret

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

But here's something even more remarkable: You can master this proven system without going to a single class or seminar. And then you can apply it to your portfolio in as little as 10 minutes a month.

Spirit Aerosystems Holdings, Inc. (SPR): Free Stock Analysis Report

SK Telecom Co., Ltd. (SKM): Free Stock Analysis Report

CBIZ, Inc. (CBZ): Free Stock Analysis Report

Atento S.A. (ATTO): Free Stock Analysis Report

Original post

Zacks Investment Research