Here are three stocks with Zacks Rank #1 (Strong Buy) and strong value characteristics for investors to consider today, August 21st:

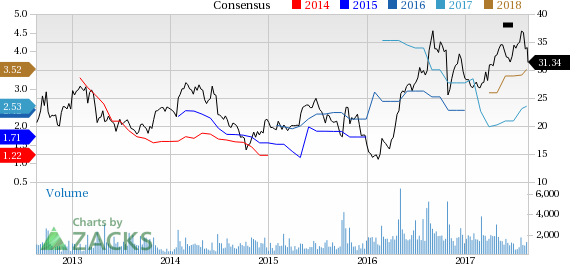

Kraton Corporation (KRA): This seller of styrenic block copolymers has seen the Zacks Consensus Estimate for its current year earnings increasing 16% over the last 60 days.

Kraton’s has a price-to-earnings ratio (P/E) of 13.62, compared with 26.30 for the industry. The company possesses a Value Score of A.

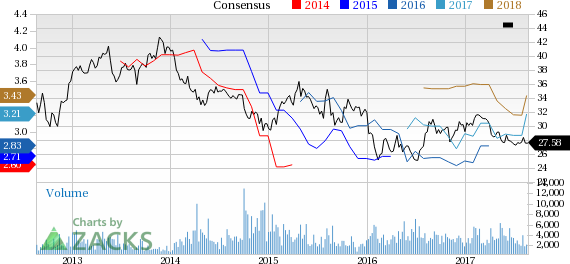

Honda Motor Co., Ltd. (HMC): This motorcycles and automobiles manufacturer has seen the Zacks Consensus Estimate for its current year earnings advancing 4.4% over the last 60 days.

Honda Motor’s has a price-to-earnings ratio (P/E) of 8.52, compared with 10.50 for the industry. The company possesses a Value Score of A.

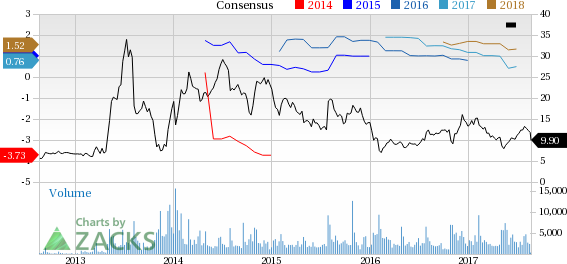

YRC Worldwide Inc. (YRCW): This various transportation services provider has seen the Zacks Consensus Estimate for its current year earnings increasing 38% over the last 60 days.

YRC Worldwide’s has a price-to-earnings ratio (P/E) of 17.16, compared with 20.10 for the industry. The company possesses a Value Score of A.

See the full list of top ranked stocks here

Learn more about the Value score and how it is calculated here.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020. Click here for the 6 trades >>

YRC Worldwide, Inc. (YRCW): Free Stock Analysis Report

Kraton Corporation (KRA): Free Stock Analysis Report

Honda Motor Company, Ltd. (HMC): Free Stock Analysis Report

Original post

Zacks Investment Research