Here are four stocks with buy rank and strong value characteristics for investors to consider today, August 11th:

Party City Holdco Inc. (PRTY): This distributor of party supplies has a Zacks Rank #2 (Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 0.8% over the last 60 days.

Party City Holdco’s has a price-to-earnings ratio (P/E) of 11.76, compared with 17.80 for the industry. The company possesses a Value Score of A.

Gap, Inc. (GPS): This apparel retail companyhas a Zacks Rank #2 (Buy), and seen the Zacks Consensus Estimate for its current year earnings increasing 0.5% over the last 60 days.

Gap’s has a price-to-earnings ratio (P/E) of 11.91, compared with 13.00 for the industry. The company possesses a Value Score of A.

Summer Infant, Inc. (SUMR): This distributor of branded juvenile health and wellness productshas a Zacks Rank #1 (Strong Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 50% over the last 60 days.

Summer Infant’s has a price-to-earnings ratio (P/E) of 12.33, compared with 17.80 for the industry. The company possesses a Value Score of A.

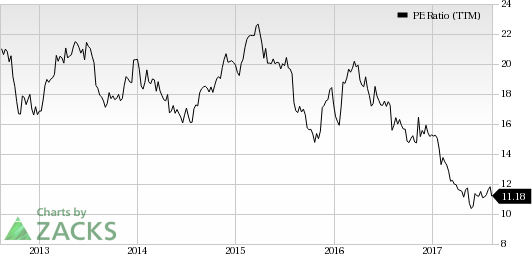

Sally Beauty Holdings, Inc. (SBH): This specialty retailer of professional beauty supplieshas a Zacks Rank #2 (Buy), and seen the Zacks Consensus Estimate for its current year earnings increasing 2.3% over the last 60 days.

Sally Beauty Holdings’ has a price-to-earnings ratio (P/E) of 11.36, compared with 15.00 for the industry. The company possesses a Value Score of A.

See the full list of top ranked stocks here

Learn more about the Value score and how it is calculated here.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020. Click here for the 6 trades >>

Summer Infant, Inc. (SUMR): Free Stock Analysis Report

Sally Beauty Holdings, Inc. (SBH): Free Stock Analysis Report

Party City Holdco Inc. (PRTY): Free Stock Analysis Report

Gap, Inc. (The) (GPS): Free Stock Analysis Report

Original post

Zacks Investment Research