Here are four stocks with buy rank and strong momentum characteristics for investors to consider today, September 7th:

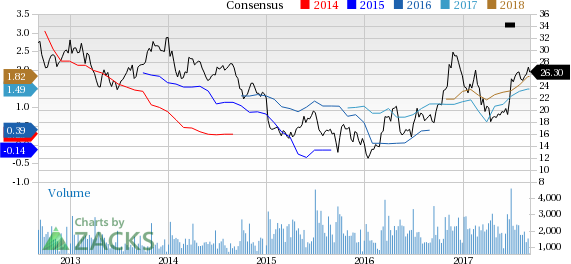

Schnitzer Steel Industries, Inc. (SCHN): This steel company has a Zacks Rank #1 (Strong Buy) and witnessed the Zacks Consensus Estimate for its current year earnings rising 14.6% over the last 60 days.

Schnitzer Steel Industries’ shares gained 4.5% over the last one month in contrast to S&P 500’s loss of 0.5%. The company possesses a Momentum Score of A.

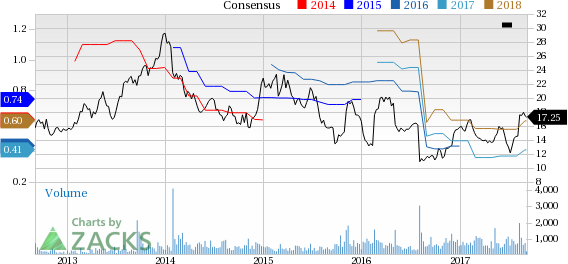

The Chefs' Warehouse, Inc. (CHEF): This specialty food products distributor has a Zacks Rank #2 (Buy) and witnessed the Zacks Consensus Estimate for its current year earnings increasing 10.8% over the last 60 days.

Chefs' Warehouse’s shares gained 18.6% over the last one month. The company possesses a Momentum Score of A.

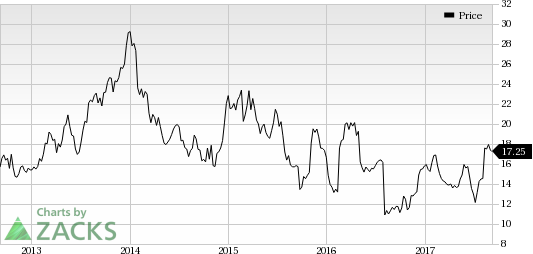

China Automotive Systems, Inc. (CAAS): This automobile company has a Zacks Rank #2 (Buy) and witnessed the Zacks Consensus Estimate for its current year earnings rising 19.4% over the last 60 days.

China Automotive Systems’ shares gained 16.5% over the last one month. The company possesses a Momentum Score of A.

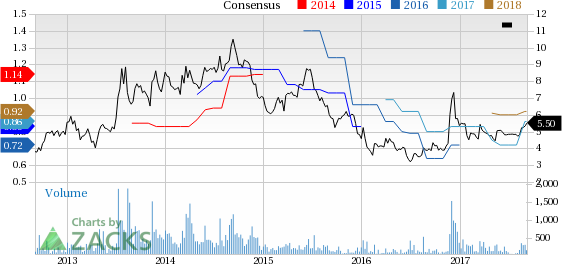

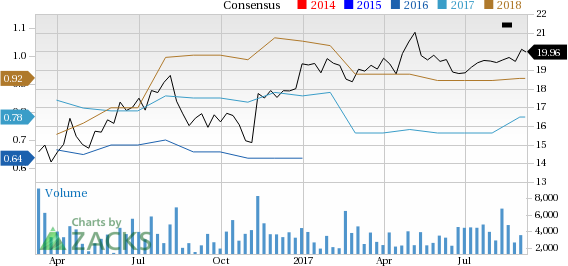

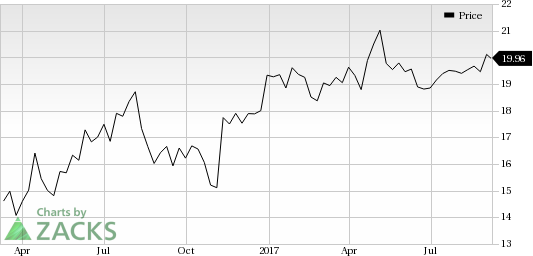

Welbilt, Inc. (WBT): This commercial foodservice equipment manufacturer has a Zacks Rank #2 (Buy) and witnessed the Zacks Consensus Estimate for its current year earnings increasing 6.9% over the last 60 days.

Welbilt’s shares gained 2.8% over the last one month. The company possesses a Momentum Score of A.

See the full list of top ranked stocks here

Learn more about the Momentum score and how it is calculated here.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today.

Manitowoc Food Service, Inc. (WBT): Free Stock Analysis Report

Schnitzer Steel Industries, Inc. (SCHN): Free Stock Analysis Report

The Chefs' Warehouse, Inc. (CHEF): Free Stock Analysis Report

China Automotive Systems, Inc. (CAAS): Free Stock Analysis Report

Original post