Here are four stocks with buy rank and strong momentum characteristics for investors to consider today, February 4th:

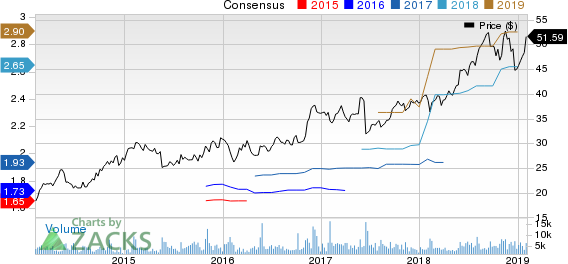

Booz Allen Hamilton Holding Corporation (BAH): This technology, engineering and management consulting company has a Zacks Rank #1 (Strong Buy) and witnessed the Zacks Consensus Estimate for its current year earnings increasing 0.4% over the last 60 days.

Booz Allen Hamilton’s shares gained 13.1% over the last one month against the S&P 500’s rise of 6.2%. The company possesses a Momentum Score of B.

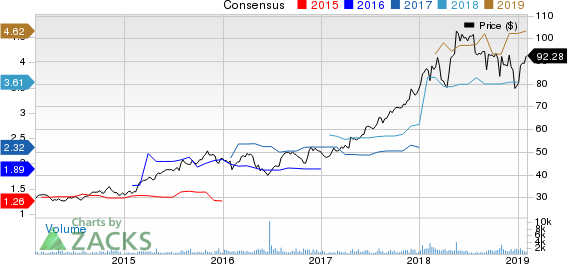

Churchill Downs Incorporated (CHDN): This gaming, racing and online entertainment company has a Zacks Rank #2 (Buy) and witnessed the Zacks Consensus Estimate for its current year earnings increasing 0.3% over the last 60 days.

Churchill Downs’ shares gained 10.9% over the last one month. The company possesses a Momentum Score of B.

Allegiant Travel Company (ALGT): This leisure travel company has a Zacks Rank #2 and witnessed the Zacks Consensus Estimate for its current year earnings increasing 10.9% over the last 60 days.

Allegiant Travel’s shares gained 24.2% over the last one month. The company possesses a Momentum Score of B.

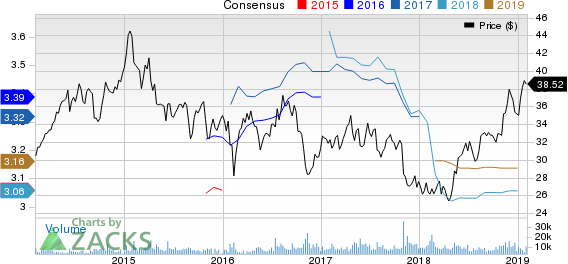

Omega Healthcare Investors, Inc. (OHI): This REIT that invests in long-term healthcare industry has a Zacks Rank #2 and witnessed the Zacks Consensus Estimate for its current year earnings increasing 0.3% over the last 60 days.

Omega Healthcare Investors’ shares gained 9.6% over the last one month. The company possesses a Momentum Score of A.

See the full list of top ranked stocks here.

Learn more about the Momentum score and how it is calculated here.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Omega Healthcare Investors, Inc. (OHI): Get Free Report

Churchill Downs, Incorporated (CHDN): Get Free Report

Booz Allen Hamilton Holding Corporation (BAH): Get Free Report

Allegiant Travel Company (ALGT): Free Stock Analysis Report

Original post

Zacks Investment Research