Here are four stocks with buy rank and strong momentum characteristics for investors to consider today, August 14th:

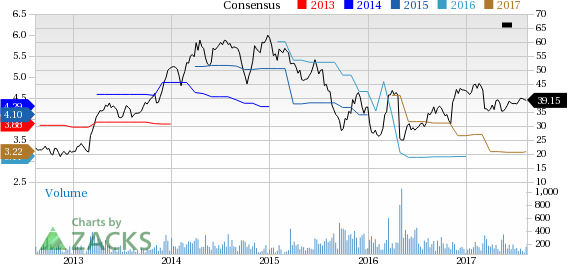

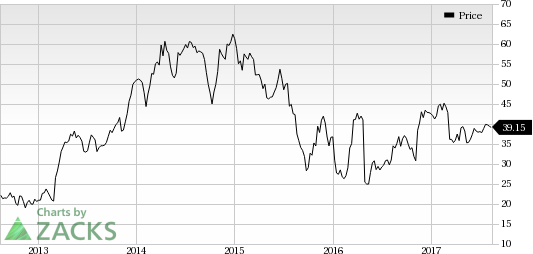

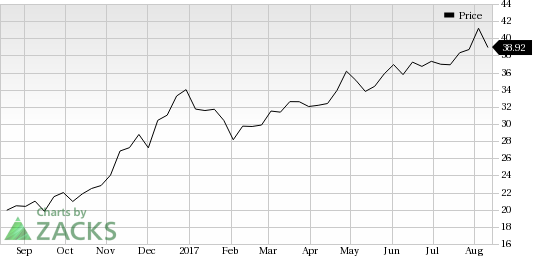

Park-Ohio Holdings Corp. (PKOH): This supply chain management services provider has a Zacks Rank #2 (Buy) and witnessed the Zacks Consensus Estimate for its current year earnings rising 0.3% over the last 60 days.

Park-Ohio Holdings’ shares gained 1.7% over the last one month in contrast to S&P 500’s loss of 0.3%. The company possesses a Momentum Score of A.

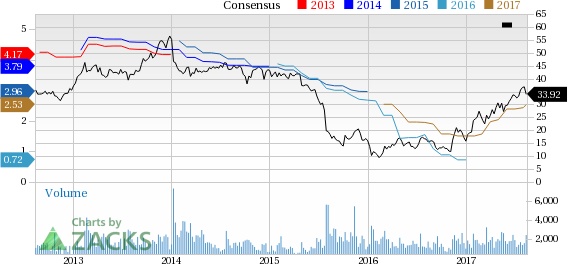

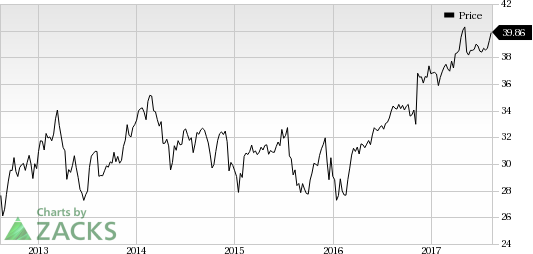

Triton International Limited (TRTN): This major container company has a Zacks Rank #1 (Strong Buy) and witnessed the Zacks Consensus Estimate for its current year earnings increasing 5.9% over the last 60 days.

Triton International’s shares gained 1.8% over the last one month. The company possesses a Momentum Score of A.

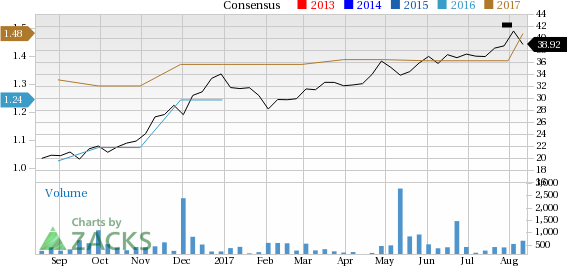

Kinsale Capital Group, Inc. (KNSL): This casualty and property insurance products provider has a Zacks Rank #2 (Buy) and witnessed the Zacks Consensus Estimate for its current year earnings rising 7.3% over the last 60 days.

Kinsale Capital Group’s shares gained 5.3% over the last one month. The company possesses a Momentum Score of A.

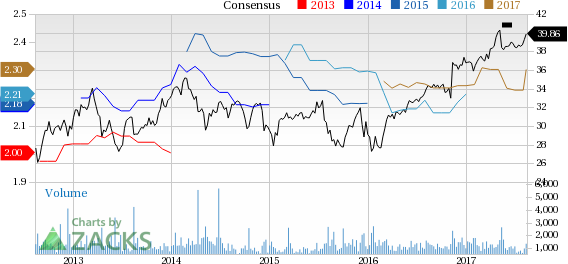

Main Street Capital Corporation (MAIN): This business development companyhas a Zacks Rank #2 (Buy) and witnessed the Zacks Consensus Estimate for its current year earnings increasing 3.1% over the last 60 days.

Main Street Capital’s shares gained 3.3% over the last one month. The company possesses a Momentum Score of A.

See the full list of top ranked stocks here

Learn more about the Momentum score and how it is calculated here.

Sell These Stocks. Now.

Just released, today's 220 Zacks Rank #5 Strong Sells demand urgent attention. If any are lurking in your portfolio or Watch List, they should be removed immediately. These sinister companies because many appear to be sound investments. However, from 1988 through 2016, stocks from our Strong Sell list have actually performed 6X worse than the S&P 500.

See today's Zacks "Strong Sells" absolutely free >>

Triton International Limited (TRTN): Free Stock Analysis Report

Park-Ohio Holdings Corp. (PKOH): Free Stock Analysis Report

Main Street Capital Corporation (MAIN): Free Stock Analysis Report

Kinsale Capital Group, Inc. (KNSL): Free Stock Analysis Report

Original post

Zacks Investment Research